What are the Finder Personal and Car Loan Awards?

Finder's Personal and Car Loan Awards recognise market-leading secured, unsecured and car loans, with a ratings methodology that compares features for 600 loans in our database.

Why you can trust our research

Selection criteria

Providers were included in the categories if their products were currently available, Finder had a full data set for the previous 12 months, and met the following criteria:

- Personal Loans - Secured: Not a car loan, requires security and has a valid interest rate.

- Personal Loans - Unsecured: Does not require security and has a valid interest rate.

- Car Loans - New: Car loan available for new vehicles.

- Car Loans - Used: Car loan available for used vehicles.

- Car Loans - Electric Vehicles: Car loan specifically for "green" or "electric" purposes.

Scoring

Metrics scored using either the tiered scores when dealing with categorical data points or a dynamic scoring when dealing with numeric data. Finder's dynamic scoring means a product's metric is scored in comparison to the data points of all the other competitor products.

| Features | Scoring method |

|---|---|

Interest rate | Dynamic scoring |

Monthly service fee | Dynamic scoring |

Application fee | Dynamic scoring |

Weights

| Features | Unsecured | Secured | New car | Used car | Electric car |

|---|---|---|---|---|---|

Interest rate | 70% | 70% | 80% | 80% | 80% |

Monthly service fee | 15% | 15% | 10% | 10% | 10% |

Application fee | 15% | 15% | 10% | 10% | 10% |

Final award score

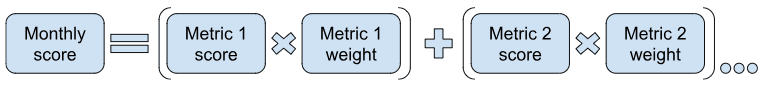

The final award score is calculated by first calculating a score for each of the previous 12 months. This evaluates each product against the competing products in those particular months. This score is calculated by multiplying the score for each metric by the weight percentage and summing the weighted scores:

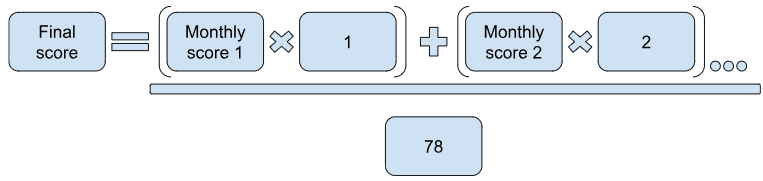

The final award score is calculated by taking a weighted average of the monthly scores with more recent months being weighted progressively more. This final award score is then ranked to determine the overall winners for each category.

Ties

In the event of a tie between two loans, Finder uses profile-based scoring to decide a winner.

More guides on Finder

-

Stratton Finance Used Car Loan

A used car loan with high borrowing amounts and both secured and unsecured options.

-

Great Southern Bank Fixed Rate Car Loan

If you’re in the market for a new car, the Great Southern Bank Fixed Rate Car Loan may be able to give you the funds you need. With the security of a fixed rate and flexible repayments, this loan might be what you need to own your new set of wheels.

-

Green Car Loans Australia

Some lenders offer a better deal if you get a loan for an eco-friendly car. See how they work and compare car loans here.

-

Stratton Finance New Car Loan

Stratton Finance might be able to help you finance your next car. Find out about all the rates and fees in this review.

-

Compare car loans for classic cars

Want to buy a classic car but don't have the ready money? There are still financing options available for classic vehicles. Find out what loans you have to choose one and which one will work best for you.

-

How to buy a car at auction

Get a bargain on the car you want at vehicle auctions – find out how to buy in this guide.

-

Tesla Superchargers Map: Where you can charge in Australia

Find out the extent of Australia's Tesla Supercharger network with our complete map of every charging station.

-

IMB New Car Loan

Read our review on the IMB offers a competitive fixed with its New Car Loan to help you finance a new car or one that's up to two years old, and find out if you're eligible to apply today.

-

Luxury car tax calculator Australia

Are you in the market for a luxury car? Calculate how much tax you'll have to pay and find the answer to your luxury car tax questions.

-

NAB Car Loan

This NAB secured car loan offers loans of up to $100,000 for new and used vehicles less than 12 years. It has a fixed interest rate with loans of 1 - 7 years, but no penalty if you repay the loan early.