Important Note: In most cases, homeowners aren't covered if work on the project is abandoned for more than 30 days. A builder's insurance policy may not cover any claims for damage caused by the abandonment of the renovation work exceeding 30 consecutive days, which could leave some owners in a sticky situation, particularly if you've hired someone who has too many jobs on the go or if your project takes place during the rainy season.

Important Note: In most cases, homeowners aren't covered if work on the project is abandoned for more than 30 days. A builder's insurance policy may not cover any claims for damage caused by the abandonment of the renovation work exceeding 30 consecutive days, which could leave some owners in a sticky situation, particularly if you've hired someone who has too many jobs on the go or if your project takes place during the rainy season.Key takeaways

- If you plan to renovate, check to see if your home insurance will cover you.

- If your home insurance does not cover you for renovations, builders insurance often can.

- Remember, builders insurance covers the renovation itself; you will need to increase your sum insured to cover your newly renovated home.

Does home insurance cover me for renovations?

In most cases, there are two types of policies needed to adequately cover your project:

Builders insurance

Check that your builder has builders insurance. This can ensure that your home is covered for loss or damage due to the renovation work. It can also cover legal fees if someone is hurt or killed while on your property.

Home and contents insurance

Some home and contents insurance policies will exclude cover for any renovation work, others will charge an additional premium and some will not cover you if the renovation project is valued above a set amount – for example, around $50,000 or $100,000. If your current provider refuses to cover you, you can change providers. Once your home has been renovated, you'll likely need to increase the amount it's insured for (sum insured).

Compare home and contents insurance side-by-side

Compare other products

We currently don't have that product, but here are others to consider:

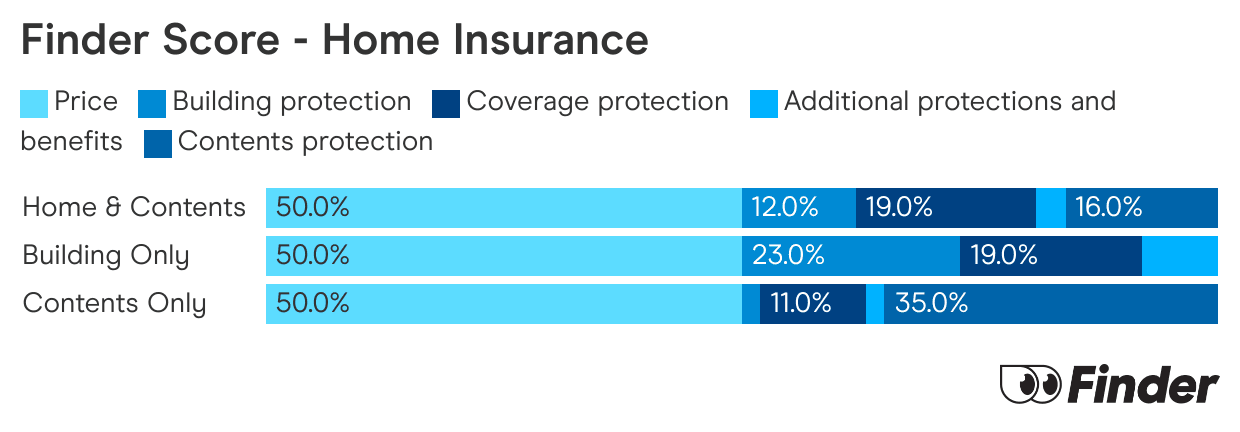

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Insurance for small renovations

You might still be covered with standard home insurance for renovations that are minor. For example, if you're changing a partition wall in a room or fixing a bathroom, you're not substantially changing or altering the structure of your house.

Aside from the $50,000 cap, a good rule of thumb when considering home insurance and renovations is if the alterations aren't making your house less secure (i.e. more vulnerable to theft and structural damage), then your current policy is more likely to cover you.

To be sure you are covered, always read your product disclosure statement (PDS) beforehand as exclusions regularly apply. For example, many do not cover any construction, alteration or renovation work. Most also require you to inform them when any construction, alteration or renovation work will start or finish.

Also be aware that no matter the size of a renovation, most insurers have exclusions for water damage that occurs during or as a result of any renovation job.

Insurance for big renovations

Home and contents insurance while renovating gets more complicated the bigger the job gets. Here are some key facts you need to be aware of:

- Vacancy can void your policy. Some policies will be voided if your home is empty for a specific amount of time. If you're thinking about moving out while you renovate, you might need to think again. Some policies can lapse after just 60 days.

- Tell your insurer you're renovating. If you don't notify your insurer of your renovation plans, your policy may become void – meaning if something goes wrong during the renovation, you won't be able to claim. Many insurers require you to inform them of any changes you're making to your property.

- You might need builders insurance. DIY renovators need extra cover as most policies won't cover homeowners undertaking their own renovations. If you're doing any part of the renovation yourself, then you may need builder's insurance on top of your home and contents cover. If you aren't doing any work yourself, you need to make sure your contractor has builders insurance.

- Renovation insurance might fill the gap in your home and contents insurance policy. If you're having difficulty finding a home and contents insurance policy while renovating, then renovation insurance could be a viable option. This is a type of specialist insurance tailored to those having difficulty getting cover. However, because it's relatively new, it's hard to say if it's good value yet.

Will insurance cover me for damage that contractors cause?

If your home insurer agrees to cover you for renovations, then you should be covered for damage or loss that contractors cause. Make sure to ask if this also includes cover for stolen goods and items. One of the main reasons insurers are reluctant to provide home insurance during renovations is that your home is often unsecured for long periods of time.

In most cases though, you will have to rely on builders insurance. If this is the case, make sure that your builder has insurance cover in case your home is damaged due to renovation work.

Speak to your contractor and their insurer as well, as it's often the case that builders insurance will only cover the portion of the home they are working on. To extend the builder's coverage temporarily to a third party, you will probably need to pay an additional fee.

Important Note: In most cases, homeowners aren't covered if work on the project is abandoned for more than 30 days. A builder's insurance policy may not cover any claims for damage caused by the abandonment of the renovation work exceeding 30 consecutive days, which could leave some owners in a sticky situation, particularly if you've hired someone who has too many jobs on the go or if your project takes place during the rainy season.

Important Note: In most cases, homeowners aren't covered if work on the project is abandoned for more than 30 days. A builder's insurance policy may not cover any claims for damage caused by the abandonment of the renovation work exceeding 30 consecutive days, which could leave some owners in a sticky situation, particularly if you've hired someone who has too many jobs on the go or if your project takes place during the rainy season.Don't leave your home unoccupied for too long

Some home insurance policies will not cover you for any claims if your home has been left unoccupied for a specific amount of time – usually between 60 and 90 days. If you plan to move out during the renovation, contact your insurer and let them know about the situation.

Don't forget to update your home insurance after a renovation

Once your home renovation project is complete, the value of your property is likely to have risen – so you'll need to update your home and contents insurance policy to reflect the new value of your home. If your home is underinsured and an insured event like a fire, storm or theft occurs, you could be hit with a large out of pocket bill.

To avoid this, you'll need to update your sum insured based on the new valuation of your home and contents.

Frequently Asked Questions

Sources

Ask a question

6 Responses

More guides on Finder

-

National Seniors home insurance review

If you're over the age of 50 and are looking for the right home insurance policy, National Seniors could be one to consider.

-

RACV home insurance

Find out what you will be covered for with RACV Home Insurance.

-

Bank of Melbourne home insurance

Review of Bank of Melbourne Home Insurance.

-

BankSA Home Insurance

Get cover for things like storms, lightning, theft and malicious acts. Choose from 3 levels of cover: essential, quality and premier care.

-

NAB home insurance review

A review of NAB's home and contents insurance policies. Find out how NAB can cover your house and possessions, giving you peace of mind and protection against the worst.

-

St.George Home Insurance review

Compare 3 home and contents insurance policies with St.George. Get a 10% discount for the first year if buying online.

-

Bendigo Bank home insurance review

Here's a detailed review of Bendigo Bank home insurance with information on 3 cover options.

-

Bupa home insurance review

Bupa Health Members may want to consider taking out a Bupa Home Insurance policy – you can get up to 15% off.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

AAMI Home & Contents Insurance Review

Compare home insurance policies from AAMI and find the right cover.

I’m trying to find home and contents insurance for a renovation job priced at over $100000 – any recommendations please?

Hi Sarah, We can’t provide specific recommendations as everyone’s needs vary. However, a good place to start is checking out the winners of Finder’s 20204 Home Insurance Awards.

Hi i am looking for renovation owner builder insurance?

Hi Jenny, we have a detailed guide to owner builder insurance which should help you out.

I’m trying to find an insurance company that will insure my house incomplete under renovation

Hi Leanne,

A home and contents insurance may offer coverage for renovation work. However, most insurers will only offer a limited level of coverage for reno works – usually up to a maximum of around $50,000. Be aware that not all policies offer this type of cover.

It’s a good idea to notify the insurer of your renovation project and obtain written confirmation of exactly what they will and won’t cover.

If you’re looking for a new policy, always review the Product Disclosure Statement (PDS) before deciding if it’s right for you.

Regards,

James