CommSec review: CommSec share trading account

We currently don't have this product on Finder

- Standard brokerage fee

- $5.00

- Available markets

- ASX, NASDAQ, NYSE, LSE, Euronext

- Support

- Phone, Email

Our verdict

While CommSec has top tier research and trading tools, the fees are higher than others when it comes to global stock trades.

CommSec is Australia's largest and best-known broker for good reason. Its platform is relatively easy to use, has excellent research tools and offers a decent range of educational content, making it a solid choice for most investors.

It's also one of Australia's oldest brokers. With over 20 years of share trading experience, it's the most widely used platform in Australia.

But while it's one of the better brokers around, investors are paying for the service. CommSec has higher fees, especially for US and global stock trades, compared with some of the lower-cost options. Since the brokerage fees are tiered for Australian shares, you'll also find yourself paying more if you prefer to trade higher amounts.

Pros

-

No inactivity fee

-

Great research tools

-

Data and monitoring tools

-

Can easily switch from CommBank app

-

Quality trading tools including conditional orders

-

CHESS-Sponsored shares

-

Stock and ETF screeners

Cons

-

Not price competitive on all global stocks

-

WebIRESS charting isn't free

-

No live chat support

-

Brokerage fees higher than others for trades over $1,000

Details

Platform details

| Type of broker | Full service, Online |

| Asset Class | ASX shares, Global shares, Options trading, US shares, ETFs |

| Available markets | ASX, NASDAQ, NYSE, LSE, Euronext |

| Standard brokerage fee | $5.00 |

| Support | Phone, Email |

What do Australians think of CommSec share trading platform?

- 4.1/5 overall for Customer Satisfaction - lower than the average of 4.18

- 4.55/5 for Trust - equal to the average of 4.55

- 3.95/5 for Customer Service - lower than the average of 4.11

Based on CommSec share trading platform scores in Finder's 2024 & 2025 Customer Satisfaction Awards.

Hands-on review of CommSec

Company background

Launched in 1995, CommSec is one of Australia's oldest share trading platforms for retail investors.

Today, it's among the country's largest and best-known online brokerages, offering Australian and international shares, exchange traded funds (ETFs) and self managed super fund (SMSF) accounts.

You don't need to be a banking customer of Commonwealth Bank to open a CommSec share trading account, although it can be advantageous to open a CommBank everyday account.

What are the key features of a CommSec share trading account?

The CommSec share trading account offers useful features for both novice and advanced investors. However, the platform is simple enough to use that new investors won't be too overwhelmed.

While its brokerage fees aren't the lowest on the market for trades of more than $1,000, there's no minimum number of trades required on your standard Australian shares account. This means you won't be charged an inactivity fee or any other monthly fee.

Plus, one of the platform's biggest drawcards is the free high-quality data feeds and research on all listed securities.

| Fees |

★★★★★ 3.8/5 |

Brokerage fees are low for small trade sizes but increases the higher the trade. On the plus side, there is no inactivity fee. |

| Trading tools |

★★★★★ 4.3/5 |

CommSec offers a long list of conditional orders plus margin trading and charting tools. |

| Research and education |

★★★★★ 4.8/5 |

CommSec offers broker analysis on stocks, company announcements plus regular markets updates. |

| Available securities |

★★★★★ 3.5/5 |

CommSec offers shares, ETFs, warrants and options. |

| Customer support |

★★★★★ 3/5 |

There is no live chat but you can phone or email from 8am to 7pm, Monday to Friday. |

| Available countries |

★★★★★ 4.5/5 |

CommSec offers shares from 13 global markets. |

Single Commonwealth Bank login

Current clients of Commonwealth Bank can use a single login to easily switch between both CommSec and NetBank, which helps to keep all finances in 1 place. If you choose to go down this path, it pays to set up a Commonwealth direct investment account (CDIA). A CDIA is the same as a regular transaction account. However, it can also be used as a trade settlement account, which is viewable right next to your current bank balances within NetBank. Plus, it gives you the option of having a debit Mastercard attached to the account.

ASX CHESS-sponsored shares

CHESS sponsorship is automatically applied to all newly opened CommSec share trading accounts. The Clearing House Electronic Subregister System (CHESS) is a management system used by the Australian Securities Exchange (ASX).

If your account is CHESS-sponsored, it will have a unique holder identification number (HIN).

Think about it like insurance. Under a CHESS model, the shares are in your name and you can update key details. Should anything happen to the broker, you have access to shares.

Trade international shares and ETFs

CommSec allows you to invest in overseas markets by opening a CommSec International account. Clients have the ability to buy shares in US companies such as Apple and Google along with global stocks and ETFs listed in 12 other overseas markets.

Real-time prices, news and research

All CommSec share trading accounts provide clients with up-to-date market prices and data.

With a CommSec share trading account, you're updated with the latest news and releases as they happen. You can access reports, videos and analyses from CommSec analysts directly within the platform.

Create personalised watch lists

One of the key benefits of CommSec is it allows investors to create personalised lists that view live pricing, research and data points.

CommSec Pocket

The company has diversified into an app called CommSec Pocket, which allows investors to start trading with as little as $50.

This helps newer investors get started, with traditional brokers setting minimums of $500 before they can begin trading.

With CommSec Pocket, you can't buy and sell shares, but you will gain access to 10 themed ETFs and pay just $2 per trade.

Browser and app account access

CommSec share trading account holders can log in and place trades through a number of portals. Trades can be placed online via a web browser, through the CommSec mobile app for iPhone and Android or simply by calling and placing an order over the phone. Even without internet access, you have the peace of mind that comes with having phone access to the CommSec office.

Advanced trading tools

One of the key features of CommSec is its trading tools, which include the following:

- Advanced charting

- Create personalised watchlists

- Live prices, research and market data

- Research tools

- Portfolio health checks

- Margin and trading tools

- Weekly stock recommendations from experts

What markets can I trade in with a CommSec share trading account?

Depending on which CommSec trading account you choose, you'll be able to trade in the following markets:

- Australian shares. Buy shares in Australian companies listed on the ASX.

- International shares. Buy shares in international companies listed on 13 global stock exchanges by opening an international account. Exchanges include the NYSE, NASDAQ, LSE and the TYO.

- Options trading. Trade Australian exchange traded options by opening a margin account.

- ETFs. Buy and sell listed funds such as ETFs and other exchange-traded products traded on the ASX.

Additional trading options

Aside from trading in various markets, CommSec allows you to trade the following:

- Warrants

- Fixed income securities

Who is CommSec designed for?

CommSec is designed for pretty much anyone, but its ease of use and beginner features can help those newer to the market.

Some of the more advanced trading features are probably more suited to those who have traded before. But this all depends on what account you choose to start with.

The majority of clients can trade a range of assets through a basic CommSec account, although signing up for direct investment has some advantages.

For total novices looking to start investing small amounts of money, there is CommSec Pocket. For serious traders, there is CommSec One, option accounts and margin loan accounts.

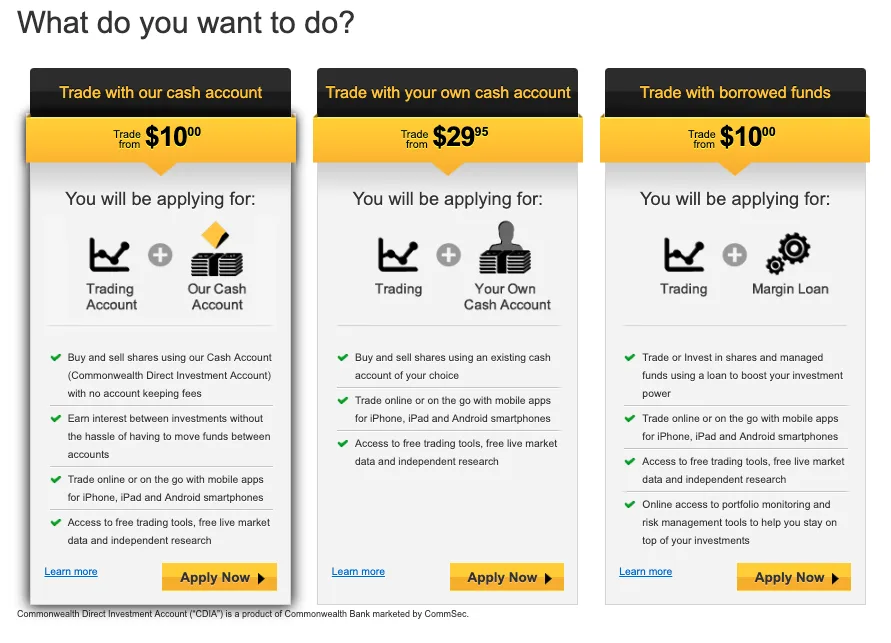

What account types are available with a CommSec share trading account?

Through CommSec, you can open an Australian share trading account and a CommSec International share trading account. Separately, you can also open an account through the CommSec Pocket App if you want to invest in a select range of ETFs.

In terms of trade settlement, you can use either a CommSec CDIA, your own account or you can trade through margin loans.

Trading with the CommSec CDIA

If you choose to conduct trades using the CDIA, you'll benefit from lower brokerage fees and no account-keeping fees. Plus, you can earn tiered interest on funds in your account and have access to all free live trading tools and market research.

- Trade shares from $5.00.

- No account-keeping fees.

- Earn interest on funds over $10,000.

Trading using your own cash account

If you choose to trade with CommSec using your own cash account, you'll still have access to all the same tools. However, you'll be charged a higher brokerage fee (starting at $29.95).

- Trade shares from $29.95.

- Access free live trading tools.

Margin trading

If you choose to trade using a margin loan, you get access to the same benefits such as free trading tools and live market data. You'll also get access to risk management tools and portfolio monitoring.

- Trade shares from $5

- Trade shares and invest in managed funds using borrowed funds.

- Access risk management and portfolio monitoring tools.

CommSec International

If you choose to trade global stocks, you have 2 account options you can select from - International Shares (standard account) or International Shares Plus.

If you choose the International Shares Plus account, your brokerage fees are higher, however you have the option of managing your own currency conversions.

What customer support options are available from CommSec?

A broker the size of CommSec is naturally expected to have a high level of customer support access. If you have queries or problems, there are a number of choices:

- Frequently asked questions (FAQ). The CommSec FAQ page is fairly in-depth. You can also download product disclosure statements and information guides throughout the site.

- Phone support. CommSec has 2 English-speaking numbers for clients located both within Australia and overseas. It also has a Cantonese/Mandarin number for use within Australia.

- Email support. The support email address allows clients to articulate their problems via text. Questions are usually answered within 1 business day.

- Questionnaire form. Unfortunately, this form doesn't lead to a live chat session. The questionnaire form on its support page feels a little redundant, especially because attaching any supporting screenshots or documentation will open up an email window anyway.

- Twitter support. CommSec has now opened a @CommSecSupport Twitter handle and it goes some way to supplementing the broker's lack of a live chat feature.

Overall, CommSec customers can expect a reasonably high level of customer support for an online broker. The only disappointing feature about CommSec's customer service is its lack of a live chat option. The live form on its website isn't actually live and it can take 1–2 days for a response to come through via email. That's frustrating for clients who have short questions that could easily be answered on the spot by a live chat representative.

What are the fees I can expect from a CommSec share trading account?

There are a few basic fees and brokerage charges you need to be aware of when using CommSec:

- Brokerage fees. These vary depending on the amount you're trading and the cash settlement method you choose:

- Trades placed through a CDIA cash settlement account. If you're a CHESS-sponsored customer and settle through either your CDIA or CommSec margin loan account, you'll pay $5.00 brokerage for trades of Australian shares up to $1,000. For trades between $1,000 and $3,000, you'll incur a $10 brokerage fee. This fee rises to $19.95 for trades between $3,000 and $10,000, $29.95 for trades between $10,000 to $25,000 and 0.12% for trades over $25,000.

- Trades placed through a non-CDIA cash settlement account. If you choose to settle your trades through a different cash settlement account, then trades up to $10,000 will incur a $29.95 brokerage fee. This fee rises to 0.31% for trades over $10,000 and $59.95 for trades over $10,000 that are placed over the phone.

- International equities. Brokerage fees vary depending on which country the shares you want to buy are listed. Fees for US shares start from US$5.00 while shares listed on the London Stock Exchange are GBP£12.00 or 0.40%, whichever is greater.

- Phone fees. Trades settled over the phone charge much higher brokerage fees. Transactions up to and including $10,000 charge $59.95.

- Ongoing account fees. You pay nothing when you first open a CommSec share trading account. There are also no monthly account-keeping or inactivity fees for your Australian account.

Is CommSec worth the fees?

While it is true that reducing fees is a great way to improve your investment returns, for a lot of investors, using CommSec could be worth the additional expense.

CommSec is more expensive than some discount online brokers even though they do not have a management or inactivity fee.

The reason why it might be worth the additional money is its tools, features and ease of use. This can be especially useful for newer investors.

How do I pay for shares on a CommSec share trading account?

You have a few options when paying for your share trades through CommSec. When you buy shares, settlement must occur within 2 business days – this is called "T+2". This means your funds will need to be available by this date or you'll incur a fee. Options include the following:

- Automatic direct debit. CommSec can automatically direct debit funds from your nominated bank account. This is the simplest and most common way to pay for your share trades.

- BPAY. The alternative to automatic direct debit for Australians is through BPAY. Your BPAY details can be found within your CommSec share trading account profile page and can be used as an alternative.

How do I open a CommSec share trading account?

When you're ready to open a CommSec share trading account, click the Open Account button on the CommSec website. You'll see the following screen asking whether you'd like to trade with a CommSec cash account or your own cash account:

Selecting the first option to trade using CommSec's cash account will give you a new CDIA, which means you get cheaper brokerage fees. You can choose to trade from an account outside of CommBank, but you'll be hit with higher fees. You can read more about what these options mean in our CDIA guide. Once you've selected the account you'd prefer to use, follow this 4-step process:

- Complete residency and ID check.

- Provide personal details.

- Register interest.

- Download trading platform and mobile app.

To complete the account opening process, you must be 18 years or older and have the following documentation handy:

- Name.

- Address and contact details.

- Valid email address.

- Mobile phone number.

- Tax file number.

Frequently asked questions

Sources

Your reviews

Kylie Finder

Investments Analyst

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Elizabeth Barry Finder

March 26, 2024

Hi Sally,

We have a detailed guide on how to buy shares for someone as a gift which you can find here.

Unfortunately to make the final transfer to them they do have to sign a form, so to keep it a surprise you may want to consider keeping the shares in your CommSec account and transferring after his birthday. In the guide there are examples from CommSec to show you the process.

Hope this helps,

Elizabeth

Show more Show less

Trevor

September 28, 2023

I have 30 FOXA shares on the NASDAQ exchange which I wish to sell. Please advise me the best/easiest method to complete the trade.

Regards,

Trevor

Kylie Purcell Finder

September 29, 2023

Hi Trevor, unfortunately the answer to this is quite complicated. How you sell the shares will depend on how and where they were purchased and how your ownership is recorded. Did you buy them through an Australian broker or were they purchased overseas? If you didn’t purchase them directly, were they transferred to you from a relative?

If you purchased the shares through a local broker, you should also be able to sell your shares with them. If the situation is anything else, you may need to contact the share register – in this case that appears to be Computershare. This list of contacts may help: https://investor.foxcorporation.com/investor-resources/contact-us

Good luck.

Show more Show less

Loraine

July 15, 2019

Please advise me of my Commsec no. I have changed address several times but my address still says the same.

Nikki Angco

July 16, 2019

Hi Loraine,

Thanks for getting in touch!

It would be best to reach out to Commsec directly to obtain your Commsec number. Kindly note that we do not work with Commsec and the information such as account numbers are not visible to us.

Hope this clarifies!

Best,

Nikki

Show more Show less

Shane

February 19, 2019

I am thinking of opening a commsec account and wondering if I can transfer my shares I have already from a previous company share program?

Cheers shane

Nikki Angco

February 19, 2019

Hi Shane,

Thanks for getting in touch! You can find information on how to open a Commsec account on the page above that says “How do I open a CommSec share trading account?” and you should be able to transfer shares from a previous company share program to this account unless the other company prohibits it. Hope this helps!

Best,

Nikki

Show more Show less

jeremy

March 15, 2018

Is it possible to set up and purchase shares in an ITF (in trust for) my young 15 year old daughter with commsec?

Joshua Finder

March 22, 2018

Hi Jeremy,

Thanks for getting in touch with Finder.

One of the requirements to use the CommSec platform is for the user to be 18 years old and above. CommSec’s website mentioned this:

“CommSec cannot trade on behalf of a minor. You can however open an account in the name of an adult who will act as trustee until the minor turns 18. Once the minor has turned 18, the shares can be transferred into an account in their name.”

Just in case you want to explore other share trading platforms, you can use our comparison table to help you find the right platform for you. When you are ready, you may then click on the “Go to site” button and you will be redirected to the provider’s website where you can sign up or get in touch with their representatives for further inquiries you may have.

I hope this helps. Should you have further questions, please don’t hesitate to reach out again.

Have a wonderful day!

Cheers,

Joshua

Show more Show less

Sally

March 13, 2024

Hi, can I buy shares for my son, who is turning 21 years, in my CommSec account, in my name and then change them to his name on his birthday? I would prefer it to be a surprise which is why I don’t want to buy them in his name in the first instance, as it will require setting up his own CommSec account.

Show more Show less