Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Scores explained

- 9+ Excellent - These cards are your ticket to sky-high points earning potential, hefty welcome bonuses, solid ongoing earn rates, and a premium selection of travel perks.

- 7+ Great - These cards might have slightly less impressive points earning or sign-up bonuses than the best cards on the market.

- 5+ Satisfactory - Reliable workhorses for frequent flyers who want decent points earning potential and some mix of perks and benefits.

- Less than 5 – Basic - the entry point in the frequent flyer market. Their sign-up bonuses and ongoing earn rates are lower.

How does the Finder Frequent Flyer Score work?

The Finder Score is an easy way you can figure out which frequent flyer credit cards are worth the trip, and which ones aren't worth getting out of bed for.

Here's how the score works:

- We analyse over 250 credit cards and assess 8 features, giving a score for each one.

- Then we combine these scores using a weighted methodology (because some features are more important than others).

- This gives us a final score out of 10: the Finder Score.

In the frequent flyer category we only consider credit cards that:

- Link to the Qantas Frequent Flyer or Virgin Australia Velocity Frequent Flyer program.

- Let you earn points directly based on spending.

- Are available to general consumers.

Scores are category-specific. So one credit card could receive a score of 9 in the balance transfer category but a score of 8 in the frequent flyer category.

The Finder Score methodology is designed by our insights and editorial team. Commercial partners carry no weight, and all products are reviewed objectively.

Remember that Finder Score is just one factor to consider. Look at other aspects like fees, features, benefits and risks to make sure a product is suitable for you. Double-check details that matter to you before applying or buying.

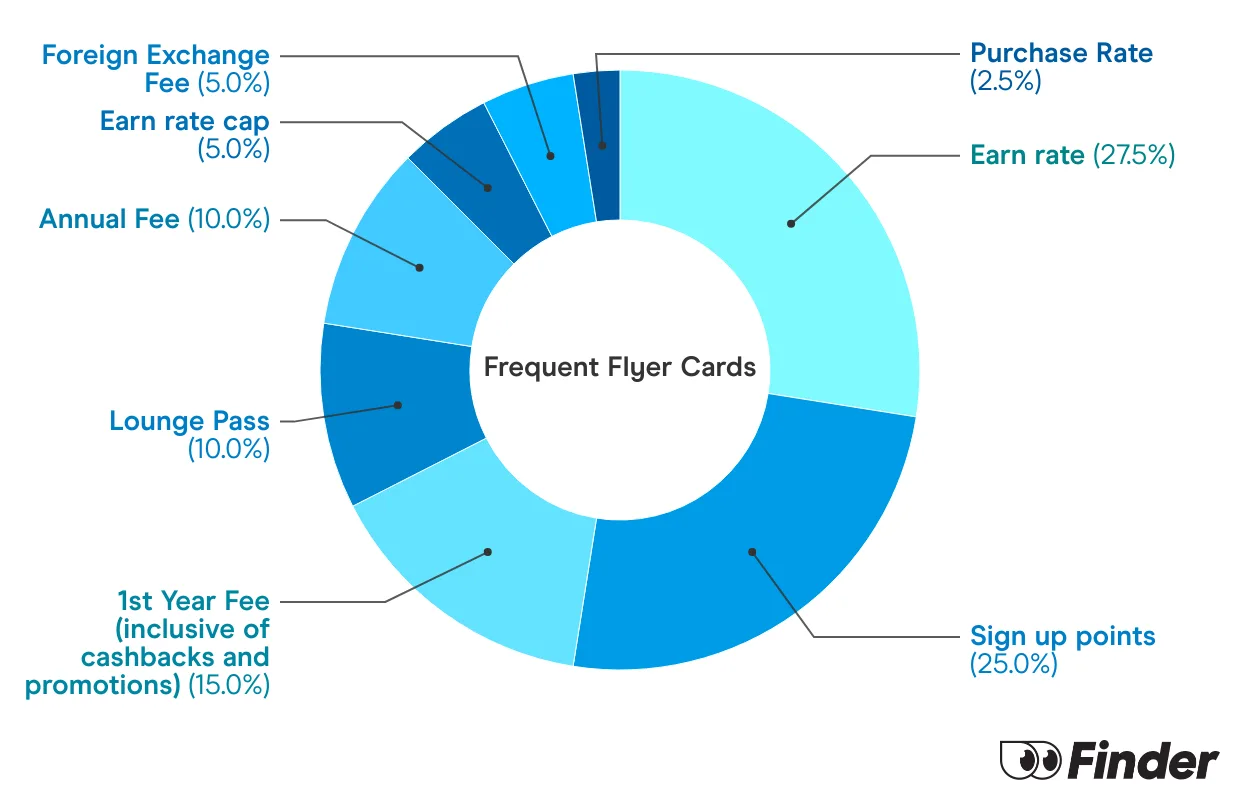

Frequent flyer credit cards - score weightings

| Feature | Definition | Assessment | Weight |

|---|---|---|---|

| Earn Rate | Points earned for every dollar spent on eligible purchases | Points awarded per dollar (up to 1.5) | 28% |

| Sign-Up Points | Bonus points earned for signing up and meeting spending requirements | Total bonus points offered (up to 150,000) | 25% |

| Purchase Rate | Interest rate on new purchases | Lower rates receive higher scores (up to 23.99% max) | 10% |

| Lounge Pass | Access to airport lounges | Complimentary annual passes receive full score | 10% |

| Foreign Exchange Fee | Fee on overseas transactions | Lower fees receive higher scores (0% fee scores highest) | 5% |

| Earn Rate Cap | Maximum points earned in a billing cycle before a lower earn rate applies | Higher caps or no cap receive higher scores (up to 10,000 points max) | 5% |

| First-Year Fee | Fee charged for the first year of card ownership | Lower fees receive higher scores ($0 fee scores highest) | 15% |

| Ongoing Annual Fee | Fee charged from the second year onwards | Lower fees receive higher scores ($0 fee scores highest) | 10% |