Cryptocurrency trends in 2020: From DeFi to COVID crisis

What are the trends that look set to define cryptocurrency in 2020?

This guide is sponsored by Binance. Join the world's largest cryptocurrency exchange and enjoy zero fee AUD deposits and withdrawals. Trade with Binance anywhere, any time. Learn more.

This guide is sponsored by Binance. Join the world's largest cryptocurrency exchange and enjoy zero fee AUD deposits and withdrawals. Trade with Binance anywhere, any time. Learn more. This guide is sponsored by Binance. Join the world's largest cryptocurrency exchange and enjoy zero fee AUD deposits and withdrawals. Trade with Binance anywhere, any time. Learn more.

This guide is sponsored by Binance. Join the world's largest cryptocurrency exchange and enjoy zero fee AUD deposits and withdrawals. Trade with Binance anywhere, any time. Learn more.

As you’ve probably heard, these are unprecedented times.

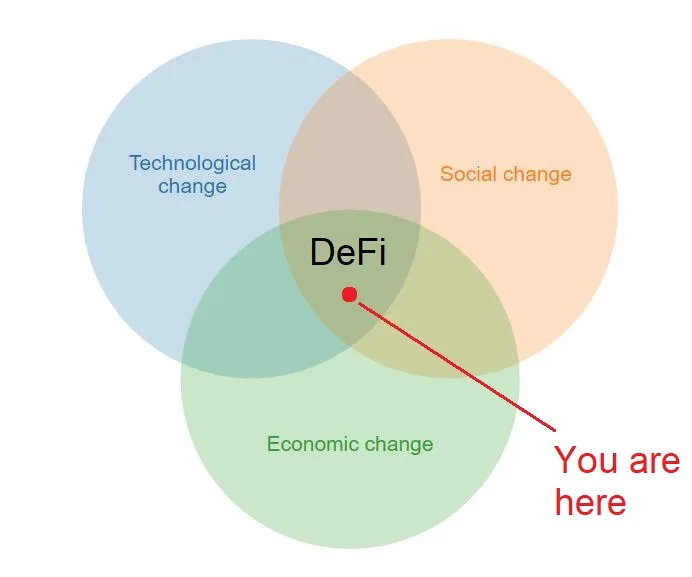

Pandemic aside, they’ve been unprecedented for a long time now as the world keeps rolling through a period of immense technological, social and economic changes.

The number of Internet users around the world has more than doubled over the last decade, society is increasingly shaped by people’s ability to connect with each other and find information online and there are growing questions about the sustainability of the global economy as we know it.

These factors came together to create Bitcoin during the 2008 economic crisis, by giving people the means and motivation to connect around the world’s first cryptocurrency.

It’s happening again now. The same ingredients are coming together in 2020, building on Bitcoin’s foundations in a much more sophisticated way than before, with potentially much more potent results. It’s called decentralised finance, or DeFi for short, and it’s at the epicentre of this year’s biggest trends in cryptocurrency.

Unlike Bitcoin, DeFi isn’t just something people are buying. It’s something people are doing to surf the waves of change and get in on the ground floor of cryptocurrency 2.0, and it’s the foundation of this year’s five unmissable cryptocurrency trends.

Decentralised finance (DeFi)

Decentralised finance (DeFi) is the idea of breaking financial services into separate, interconnected pieces that work together in an open, permissionless ecosystem on the Internet.

It’s exemplified by a few overarching design principles.

- Openness and permissionlessness: Anyone, anywhere should be able to access it if they want without needing to go through middlemen or get approval from intermediaries.

- Composability: Different DeFi apps should be able to seamlessly interact with each other, fitting together like Lego blocks to create a sophisticated Internet financial system.

- Security, transparency and trustlessness. DeFi apps should be open source and their internal workings publicly visible. Where possible and practical, dependence on third parties should be minimised, and apps should be largely automated.

It’s a sharp contrast to traditional centralised finance (CeFi), where everything is done through opaque central entities and intermediaries. For example, central banks create the money, while commercial banks hold the money and via intermediaries provide many of the financial services that keep the world turning.

Bitcoin started the DeFi shift by taking the process of money creation away from central banks and putting it online where anyone could do it, in the form of Bitcoin mining. Cryptocurrency wallets, meanwhile, allowed anyone to take personal custody of their money and send it anywhere they wanted without needing to rely on banks.

DeFi goes a step further though. It aims to do the same thing to all other financial services, such as payments, loans, insurance, savings accounts, managed investments and so on, making them openly available on the Internet and able to connect to each other.

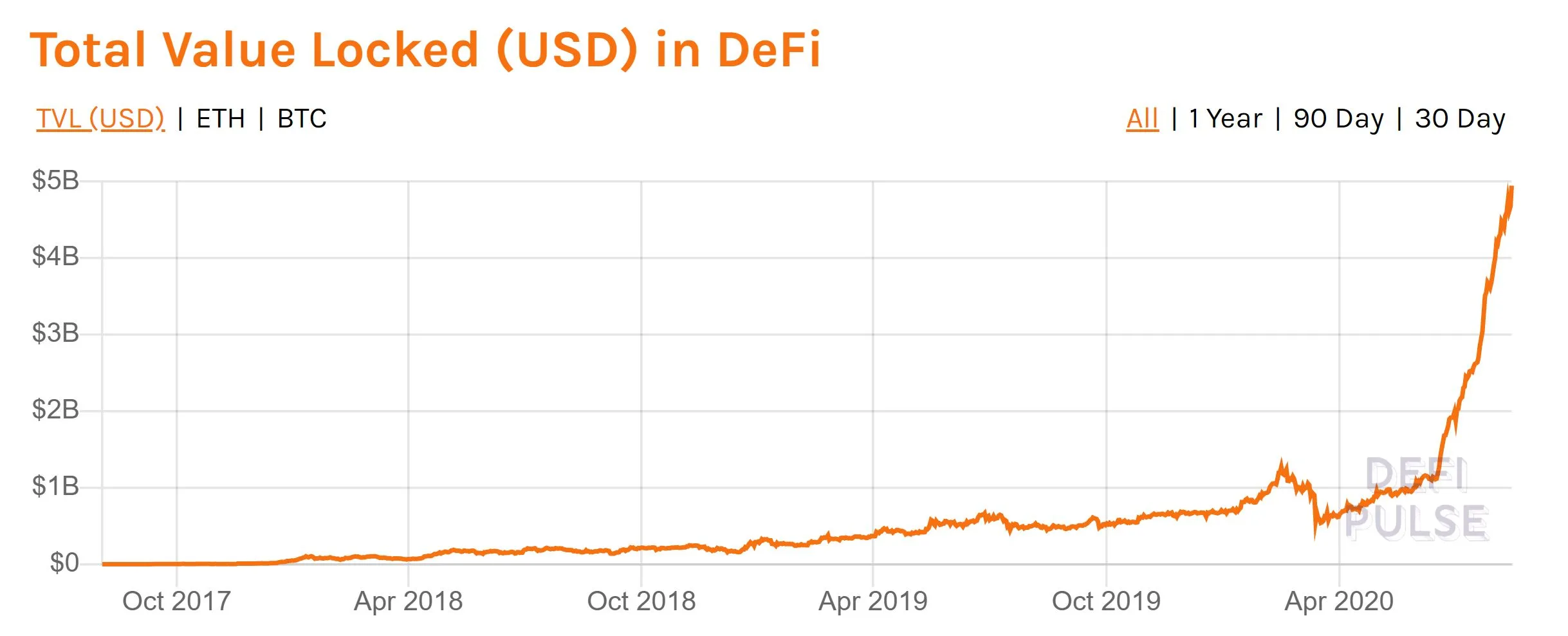

That’s what started happening in a big way this year. Specifically, we’ve seen many of these applications become usable, start linking up with each other and attracting users. The result is an exploding DeFi ecosystem that wasn’t there a year ago.

At the start of June 2020 there was around US$1 billion locked in DeFi. A month later that number doubled to $2 billion. And another month after that, by the start of August, it doubled again to $4 billion.

Imagine how much it could be by the end of the year.

This sum is driven by the people participating in DeFi in different ways, and many of the trends that will define cryptocurrency in 2020 can be viewed as subsets of the wider DeFi movement.

Stablecoins and synthetic assets

Stablecoins and synthetic assets are a key component of DeFi.

These cryptocurrencies are designed to follow the prices of other assets, which helps bring stable real world values to the space, such as the value of a US dollar. It also greatly broadens the horizon of possibilities in the DeFi space.

Different stablecoins and synthetic assets accomplish this in different ways, each of which is good for different things.

| Type | How it works | What it’s good for |

|---|---|---|

| Guaranteed redemption Examples include Binance USD (BUSD), Tether USD (USDT) and Pax Gold (PAXG). | Companies issue these stablecoins and guarantee that they can be redeemed at face value for money in the bank. | It’s a simple and effective way of issuing stablecoins, presenting an opportunity for businesses that want to enter the DeFi space themselves, or that want to help their customers enter the space. |

| Algorithmically stable Examples include MakerDAO + Dai (MKR + DAI) and Terra + TerraKRW (LUNA + KRT). | These cryptocurrencies attempt fully automated price stabilisation, typically using a paired token system where one token acts as governance and collateral, and the other is pegged to a stable asset such as the USD. | It’s a more trustless, permissionless and open form of price-stable cryptocurrency, which may better mesh with the long term development of the DeFi space. |

| Synthetic assets Examples include Synthetix (SNX) and Universal Market Access (UMA). | These complex platforms enable the creation of “synthetic assets” intended to reliably track the price of almost anything, from cryptocurrency to stocks to derivatives, and even to abstractions such as tokens that represent the average price of real estate in a specific neighbourhood. | It’s a more trustless, permissionless and open way of bringing almost any kind of asset into the DeFi ecosystem, and even creating entirely novel assets and indexes. |

While stablecoins have been around for a long time, by cryptocurrency standards, the DeFi explosion has shown all of them to be an integral part of the future of the industry and one of the trends to watch in 2020.

Some potential developments you may want to keep an eye out for in coming months, based on stablecoins and synthetic assets, include the following.

Banks issuing collateralised stablecoins

As the lines between DeFi and “the real economy” blur, it’s likely that more of the real economy will move online. Collateralised guaranteed redemption stablecoins present an easy avenue for banks, and even central banks, to safely enter the DeFi space.

In the long run, we might look back on collateralised stablecoins as the catalyst for world changing events such as the decline of the US dollar as a global standard.

Expansion of algorithmic stablecoins

With some creativity, algorithmic stablecoins can enjoy impressive competitive advantages over other forms of money, which could prove to be game-changing.

MakerDAO, for example, is looking to allow the use of more assets, including real world assets, as collateral. Down the line you might be able to start using a fraction of your home equity, or other real world assets, to collateralise a stablecoin loan. The effect is to unlock the value of real world assets and let them beneficially interface with DeFi technology. In the process, MakerDAO can evolve from an algorithmic stablecoin into a full-fledged synthetic asset platform.

Meanwhile, Terra has devised a system where seigniorage profits are reinvested as cashback-style rewards for users, with the aim of creating a new ultra-competitive payment network.

Seignorage refers to the profit made from minting new currencies. It’s technically the difference between the cost of creating money and the face value of the created money. This revenue source has typically been the domain of central banks, but algorithmic stablecoins can put it to use elsewhere.

Novel synthetic assets

Synthetic assets are one of the newest and most complex types of cryptocurrency, so it’s difficult to gauge their potential impacts. But this also means it stands to be one of the most surprising.

One trend to watch in particular is the emergence of entirely new types of assets.

A simple example is the cDAI stablecoin, which directly earns interest to the currency itself. It’s kind of like if a pile of cash under the mattress was able to grow over time by earning the same interest as the money in a bank savings account.

A more complex example is the freshly-invented yToken, which is intended to track the yield curves of interest-earning assets. It’s roughly similar to an “all inclusive” currency whose market value includes predicted future interest earnings. As envisioned, it expires at set dates like futures contracts do, and presents a way for people to further unlock the value of their assets, while also presenting an interesting system for the collective wisdom of the markets to place bets on how much interest an asset will earn in the near future.

Unlocking the full potential of synthetic assets could well be a never ending journey, but this might be the year it begins in earnest, so lots of eyes will undoubtedly be watching this space in 2020.

Passive income and yield farming

As you can imagine, stablecoins and synthetic assets present many more ways to unlock the value of assets, while the interconnected and already-thriving nature of the DeFi ecosystem means there’s always demand for the right assets in the right place at the right time.

As a result of this, yield farming, which is simply the practice of putting your money to work in the DeFi ecosystem in the most profitable way possible, can be extremely rewarding.

One popular form of yield farming is liquidity mining, in which people can provide market making services for decentralised exchanges to get paid with new tokens, a cut of the exchange transaction fees or whatever other sustainable incentive scheme can be programmed into an application.

The Balancer protocol, for example, rewards people for providing liquidity to trading pairs in order to reduce the cost of slippage for its users. Here, liquidity providers have been known to earn returns in excess of 100% per annum equivalent.

Elsewhere, returns equivalent to more than 1,000% per year, for brief periods at least, are not unheard of.

In addition to yield farming, cryptocurrency staking provides a more accessible, and still very rewarding, way of earning returns on cryptocurrency. Certain cryptocurrencies are designed to naturally reward stakeholders (the token holders) with a slice of the network profits, and combined with any price appreciation these cryptocurrencies may experience, it can similarly be extremely profitable for those who buy and hold.

Ethereum, once it updates to Ethereum 2.0, will be the best-known example of a stakable cryptocurrency.

The best part of staking and yield farming, other than how wildly profitable it can be, is that it performs an essential service for the DeFi ecosystem, so there’s a lot of work being done to make it as easy as possible for everyone.

For those who just want generous returns without any techno-financial know-how, centralised exchanges provide an easy way of picking up some of the generous returns circulating in the DeFi ecosystem.

Of these, Binance has by far the largest selection of interest-earning cryptocurrencies available.

Cryptocurrency as an ecosystem

Composability, the ability to fit all these different parts of the DeFi ecosystem together in a useful way, has been essential for its growth this year.

Liquidity mining and other yield farming techniques directly contribute to the usability of other elements of the DeFi ecosystem; synthetic assets present new ways of unlocking value and using novel assets across all DeFi applications; stablecoins bring the reassurance of dollar benchmarks to the ecosystem and allow for profit taking, and they all come together to create a whole that’s much greater than the sum of its parts.

The rapid growth of DeFi this year is largely because these applications have started coming together and driving value to each other as part of a holistic ecosystem, rather than just being separate cryptocurrencies.

This is also key to realising the benefits of DeFi relative to traditional siloed finance, such as:

- Better security. Decentralising the financial system helps reduce the impact of weak points, such as an over-leveraged bank, and introduces multiple redundancies in case something goes wrong.

- Cost-effectiveness. Many DeFi applications are intended to operate as autonomous community organisations, feeding value back to users rather than siphoning it off to pay for big executive salaries. The seamless connections between applications and the programmable nature of cryptocurrency, meanwhile, can drastically reduce intermediary expenses. Plus, as an open ecosystem all participants are forced to compete on actual value delivered.

- Coopetition. Blockchain is a team sport, and applications can drive a lot of value and utility to each other. By embracing more cooperative paradigms through data sharing agreements and interconnections with other applications, businesses may be able to reduce the resources they spend on competing and find new mutually beneficial ways of cooperating.

As such, this trend – the shift from individual cryptocurrencies to connected ecosystems – may end up being a key catalyst for the entry of more traditional institutions into the DeFi space, making it an important trend to watch.

Economic crisis

Of course, when discussing alternative finance, it’s impossible to ignore the current economic crisis or to understate its potential impact on cryptocurrency.

Like gold, Bitcoin is often perceived as a hedge against currency devaluation, and in the growing DeFi space both Bitcoin and gold can start earning interest along with other assets, potentially making them much more attractive than they used to be.

While it’s beyond the scope of this article to say whether or not more traditional investments are overvalued, it’s well within the scope of this article to gently point out that the S&P500 briefly hit a new all time high on 13 August 2020, and to wonder aloud whether this might be a bit premature given the still-staggering unemployment rate in the United States and the likely downturn in consumer spending.

It’s similarly within scope to point out US treasury bond yields are creeping along around record lows, as people run out of places to safely put their money.

2020 is a year marked by uncertainty, a shortage of sound investments and shrinking economies. And in that sense DeFi, with its high returns and exploding value, is presenting the polar opposite at exactly the right time.

The high chance of today’s economic uncertainty kicking off a DeFi bullrush later this year means the COVID economic crisis is definitely a trend to watch.

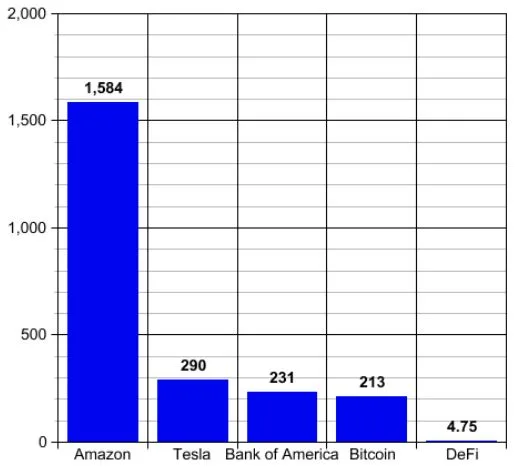

As of mid August though, when this article was written, DeFi is still tiny. If the merits of cryptocurrency are finance’s best kept secret, then DeFi must be cryptocurrency’s best kept secret.

It’s quite eye opening to compare the current value locked in DeFi (US$4.75 billion) with the market cap of Bitcoin ($213 billion) and other giants.

Comparative market caps (US$ billions)

DeFi is the heart of the biggest cryptocurrency trends of 2020, and it’s only just beginning.

So if you’re reading this, that probably means you’ve arrived early. Welcome!

If you’re interested in getting into DeFi, but aren’t sure where to begin, you may want to consider entering via Binance.

Firstly, because the only thing you really need to get started in DeFi is some cryptocurrency (Ethereum rather than Bitcoin is a better choice for DeFi), and if you compare prices among different exchanges there’s a good chance you’ll find Binance to be the most cost-effective option.

Secondly, because Binance has one of the biggest cryptocurrency selections in the world, including DeFi picks like SNX, KAVA and YFI.

And thirdly, because you can stake and lend cryptocurrencies directly through Binance to start earning returns without needing to worry about gas costs, private key management and other headaches before you’re ready to.

With these key cryptocurrency trends emerging, 2020 promises to be a big year for cryptocurrency.

Trade with Binance

Compare cryptocurrency exchanges here

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseAlso watch

Disclosure: The author holds cryptocurrencies including LINK at the time of writing.

Latest cryptocurrency news

-

The Coinstash Cryptocurrency Hub

30 May 2024 |

-

Ordinals and runes – the new crypto craze?

24 Apr 2024 |

-

Join the party: Finder’s giving away $200K worth of Bitcoin

23 Feb 2022 |

-

Australians have spent $50.9 million on crypto trading fees

31 Jan 2022 |

-

Stablecoins vs Bitcoin: What’s the difference?

3 Nov 2021 |

Picture: Shutterstock

Ask a question