What is crypto Dollar-Cost Averaging? DCA explained

Learn how to apply one of the most simple and effective investment strategies to Bitcoin and cryptocurrencies.

Sponsored by Swyftx - Trade 300+ cryptocurrencies with AUD deposits and setup auto recurring orders for dollar cost averaging. All with a feature-packed app, two factor security and downloadable tax reports.

Sponsored by Swyftx - Trade 300+ cryptocurrencies with AUD deposits and setup auto recurring orders for dollar cost averaging. All with a feature-packed app, two factor security and downloadable tax reports.

Sponsored by Swyftx - Trade 300+ cryptocurrencies with AUD deposits and setup auto recurring orders for dollar cost averaging. All with a feature-packed app, two factor security and downloadable tax reports.

One of the most common questions people ask before they invest in cryptocurrency is 'When should I buy?'.

The problem is, there's no one, easy way to time the market. Attempting to do so can be a time-consuming, expensive process that may result in a substantial loss.

You might invest too early, too late, or become stricken with analysis paralysis and not invest at all.

A simple solution to this is dollar-cost averaging – a tried and tested method that applies to many aspects of investing, beyond just cryptocurrency.

How does dollar-cost averaging work?

Dollar-cost averaging is a popular strategy used to mitigate the risk of market volatility. It involves purchasing a set amount of an asset at a regular interval, regardless of the price or market conditions. An example of this would be if you set up a recurring order that purchased $100 worth of Bitcoin at the start of every month.

This investment strategy essentially averages out the purchase price of an asset over an extended period of time. It can help avoid purchasing too much of a cryptocurrency when it's expensive, or too little when it's cheaper.

Dollar-cost averaging is particularly effective in extremely volatile markets, like cryptocurrency. By setting up a recurring buy order, you are able to ignore the day-to-day swings of the market, where the value of a single trade can shift by thousands of dollars in a manner of hours.

There's no specific formula for success with dollar-cost averaging. You can do it manually, or use an exchange like Swyftx which automates the process for you. You can make a purchase every week, fortnight or month, with whatever level of funds you're comfortable investing. The most important thing to remember is that DCAing is a long-term strategy. As long as you repeat the purchase process repeatedly over a period of time, you are employing the strategy correctly.

An overlooked benefit of dollar-cost averaging is that you can get started straight away. Lump sum investments may take a while to save up, whereas DCAing can be effective no matter your finances.

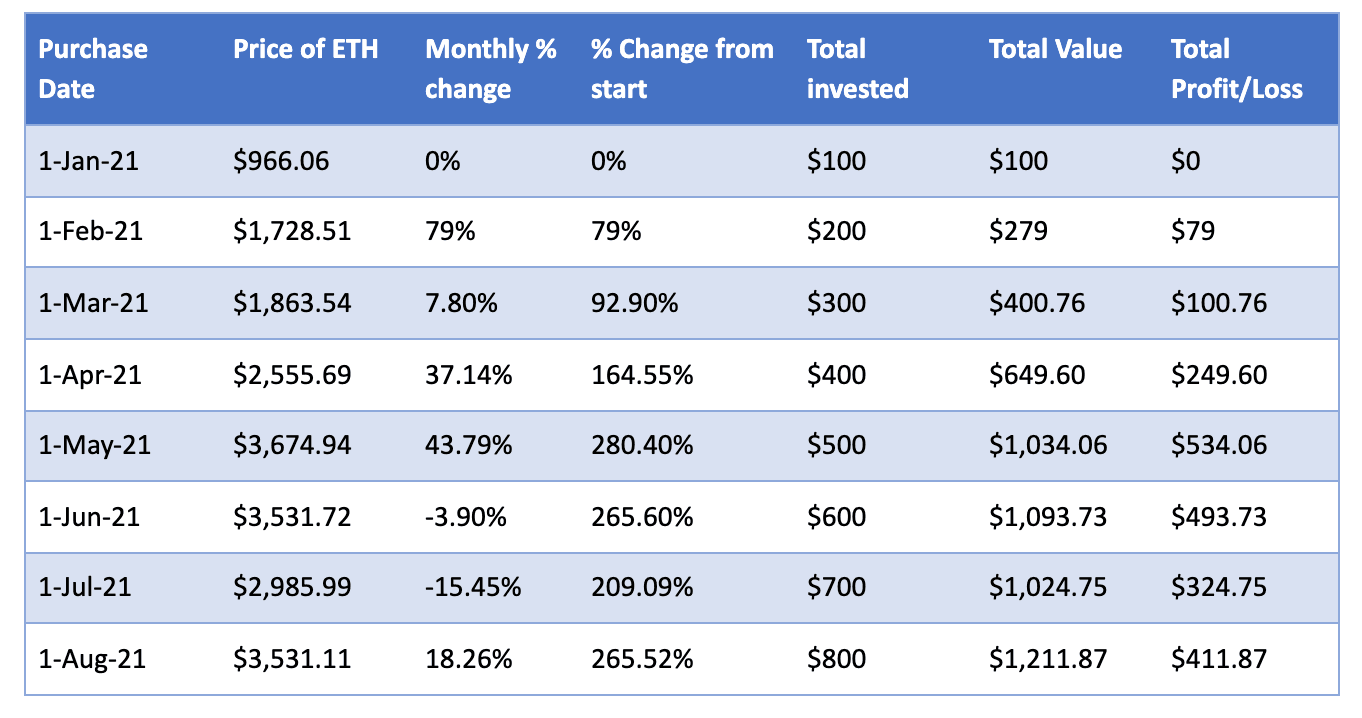

Example: Buying Ethereum using DCA vs a lump sum investment

To get a better understanding of how dollar-cost averaging works, lets walk through an example of investing via a DCA strategy, as well as with a lump sum. In this instance, we will explore buying $100 worth of Ethereum (ETH) each month over the course of eight months in 2021.

If you used a DCA strategy and invested $100 into Ethereum on the first of each month, starting in January and continuing through to August, your $800 of ETH would be worth $1,211 on the 1st of August 2021.

Let's compare that to the worst-case scenario. If you had invested a lump sum on the 12th May, when ETH was worth $5,483 and hype was at its peak, your investment would only be worth $496 as of August.

And if you somehow had the fortune and foresight to time the market's bottom, you would have invested on 1 January when ETH was worth $966.06. That would leave you with an investment worth $2,000 by August.

Using DCA leaves you with a gain of 144% compared to the worst-case scenario, but only a loss of 40% compared to the best-case scenario.

While DCA can't beat investing at the bottom, timing the market correctly is an incredibly risky and difficult feat to pull off. This scenario clearly highlights the strengths of dollar-cost averaging over the long term, reducing your risk considerably.

Here's a closer look at exactly how that DCA strategy would have played out.

How to dollar-cost average with cryptocurrency

Setting up an automated investment strategy is typically a straightforward process, and can be done on several major Australian exchanges.

There are a number of ways you can go about implementing a DCA strategy. The simplest way to figure out the frequency and value of the recurring investment is to align it with your pay cycle. You could dedicate a predetermined portion of your wage to cryptocurrency, and follow your normal pay schedule for deposit frequency (be it weekly, fortnightly, or monthly).

Whatever you choose, your next step will be to decide on a cryptocurrency platform that offers recurring investments, such as Swyftx.

Once you have created an account on your selected exchange, navigate to the 'recurring orders' section of the website.

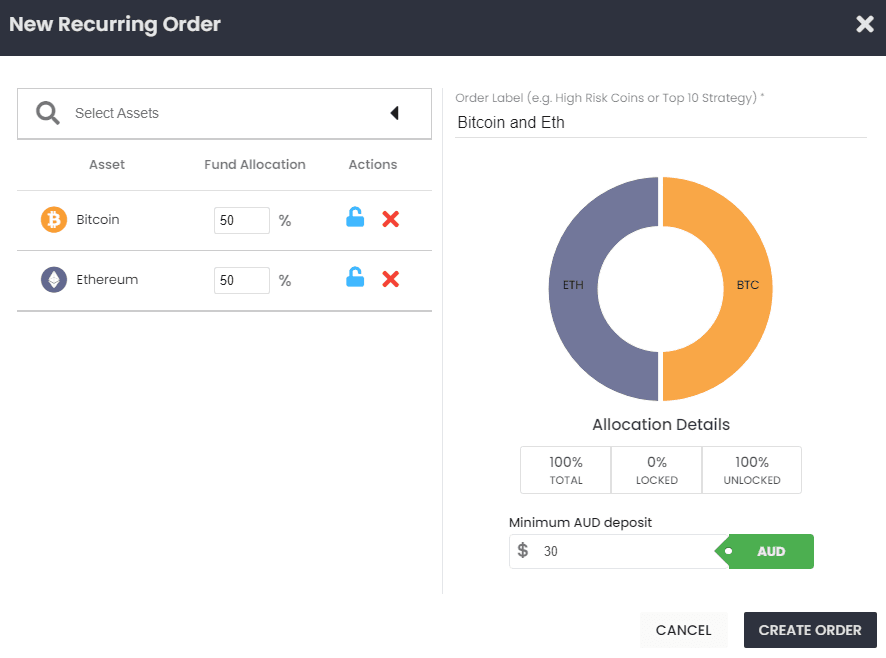

From this point, you get to decide the parameters of your automated investment. This will include choosing an investment timeframe, value and the asset you wish to purchase. For instance on Swyftx you can set up a DCA strategy for multiple cryptocurrencies, meaning you can allocate a portion of your repeated investment among different assets.

Some exchanges such as Swyftx (pictured) allow for a nuanced DCA strategy, including multiple currencies.

How the funds are processed from this point will vary from exchange to exchange. For example, Swyftx users will need to access their online banking portal and create a recurring payment from their account to a specific Swyftx bank account, along with a reference number.

Other exchanges will draw the money from users' deposited funds, meaning the recurring trade will not be executed if the money is not already in their account.

Bottom line

Perhaps the most appealing element of a dollar-cost average investment strategy is how stress-free it is. You don't have to spend your time poring over complex crypto charts and watching your portfolio rise and fall on a daily basis (although you certainly can still do this). Instead, you may be a bit more comfortable with your investments, knowing that the process is automated.

It's important to remember that dollar-cost averaging does not completely absolve you of investment risks. Even with a DCA strategy in place, cryptocurrency projects can plummet in value, become abandoned or possibly exploited.

The normal rules for investing apply: never risk more money than you can afford to lose, and perform ample research on the cryptocurrency prior to buying.

That said, setting up a recurring order may be a good way for you to mitigate some of the issues that come alongside investing in cryptocurrency.

Disclosure: The author owns a range of cryptocurrencies at the time of writing

Trade with Swyftx

Compare cryptocurrency exchanges here

Compare other products

We currently don't have that product, but here are others to consider:

How we picked these