Key takeaways

- Chronic pain affects more than 3 million Aussies. The condition, which is more prevalent in women and older people, costs the economy more than $70 billion each year.

- In addition to physical symptoms, chronic pain can negatively affect mood, sleep and mental health.

- Both Medicare and private health insurance can play a role in helping you manage the affliction.

What is chronic pain?

Pain that lasts more than 3 months - or beyond the normal healing time of a condition following diagnosis, surgery or trauma - is considered chronic.

Common conditions linked to chronic pain include osteoporosis, arthritis and other musculoskeletal illnesses. But there are several uncommon chronic pain conditions as well. These can include kidney failure, heart disease and sleep apnoea.

Acute pain can become chronic pain if it is left untreated. This happens if a change occurs in the nervous system, which makes the body more sensitive to pain. The cause of chronic pain may also be unknown.

What treatment can I get for chronic pain?

Chronic pain treatment generally involves managing and alleviating pain as opposed to eliminating it entirely.

Depending on your condition, it can be treated in a number of ways. Doctors can administer different forms of pain management to alleviate chronic pain. Some may require devices, such as an infusion pump, while others don't, like treatment of nerve pain by injection of a nerve block.

Treatment for chronic pain can include:

- Medication. Such as nerve pain medication and nonsteroidal anti-inflammatory drugs

- Therapies. Including physical therapy, physiotherapy and acupuncture

- Specialists. GP consultations, occupational therapy, pain management and rehabilitation

- Self-care. Exercise, relaxation techniques and stress management.

How does Medicare support chronic pain treatment?

To get treatment for chronic pain with Medicare, you'll generally need to get a referral from your GP. Your doctor can prepare a Chronic Disease Management Plan for you. You are only eligible for this care if your GP feels you need it to deal with your chronic pain.

Depending on whether or not a provider accepts the Medicare benefit, you might have to pay the difference between the fee charged and the Medicare rebate. Otherwise, you should have no out-of-pocket expenses.

Management of chronic pain varies greatly. For example, you may receive non-pharmacotherapy (treatment focussed on concentration to better manage and reduce pain) care such as physiotherapy or acupuncture. Generally, Medicare does not cover most physiotherapy and occupational therapy or psychology services. It might cover acupuncture if it is part of your doctor's consultation.

If you want to ensure you're not out of pocket for these services, speak to your doctor to see if any specific items for health services are included as part of the Chronic Disease Management Plan.

How could private health insurance help with chronic pain?

If you want to access private hospital treatment - which can include choosing your own doctor and getting your own room - then bronze-level private health insurance is the minimum cover to consider. You'll find cover included under 'pain management'.

If you want comprehensive cover for chronic pain, you can consider gold-level hospital cover. Policies usually come with a 2-month waiting period, or 12 months if your chronic pain is a pre-existing condition.

Gold hospital health insurance provides benefits for a range of services related to chronic conditions. These may include:

- Dialysis for chronic kidney failure

- Insulin pumps

- Pain management with device

- Pain management

- Sleep studies

- Weight loss surgery.

With private health care, you might be able to receive care quicker as wait times for elective surgeries are often shorter than in the public system.

Find health insurance for chronic pain

All prices are based on a single individual with less than $101,000 income and living in Sydney.

Finder Score - Hospital cover health insurance

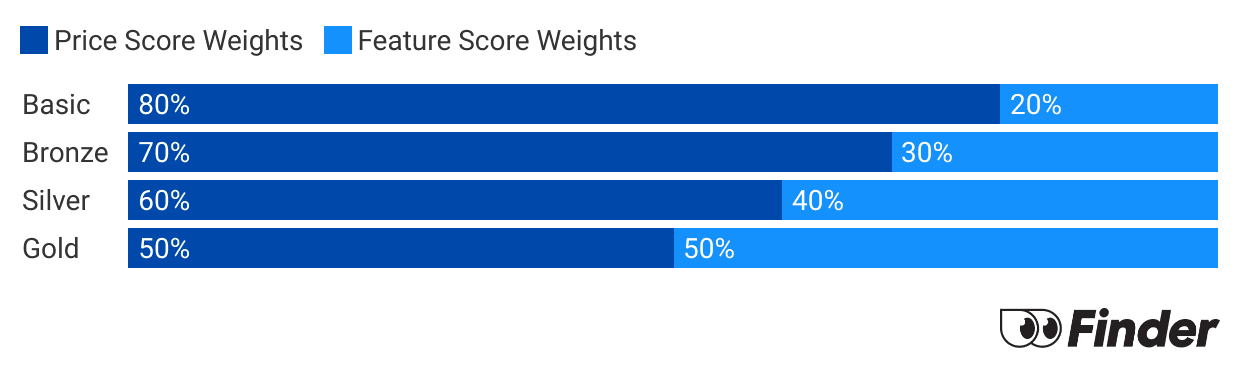

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

Other points to keep in mind about private health cover and chronic pain

Keep in mind that you'll probably need extras cover for chronic pain care done outside of hospital. While hospital cover helps pay for treatment and accommodation in a hospital during an illness or injury, extras cover helps cover the costs of ancillary health services you might need if you suffer from chronic pain.

Services like physiotherapy, remedial massage and natural therapies are included in extras cover and can be a really important part of chronic pain treatment.

Personal circumstances will dictate whether you feel you need extras on top of hospital cover. However, it's worth keeping in mind that if you don't have combined hospital and extras cover, you might be out of pocket for any care you receive outside of hospital.

- Extras only: $44

- Basic: $105

- Bronze: $152

- Silver: $179

- Gold: $260

Frequently asked questions

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.