Key takeaways

- There are a range of private cover options for the common sterilisation and sterilisation reversal procedures.

- Simple procedures like vasectomies are covered under many Bronze health policies.

- More complex procedures like hysterectomies may require a top-tier plan.

Health insurance policies for sterilisation

Below you'll find a selection of Finder partners that cover sterilisation, and the minimum policy tier that covers the treatment. All have a two-month waiting period. All prices are based on a single individual with less than $101,000 income and living in Sydney.

Finder survey: What are the main reasons Australians have hospital insurance?

| Response | |

|---|---|

| To avoid public surgery waiting lists | 44.76% |

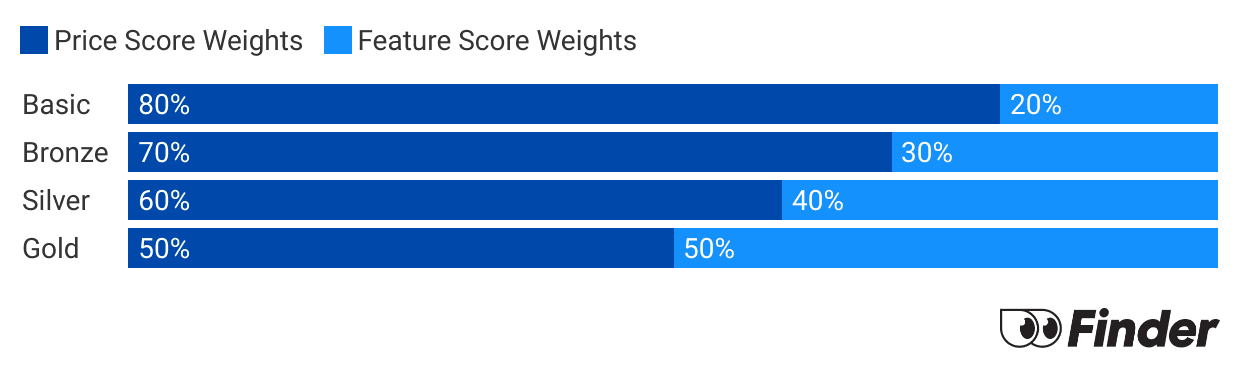

Finder Score - Hospital cover health insurance

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

What are the main types of sterilisation available?

In general, if someone never wants to have children then sterilisation can be an effective option. The two most widely-used methods of voluntary sterilisation are:

Vasectomy

A vasectomy involves a man having his vas deferens severed or sealed. This prevents him from impregnating women with no major impact on sexual functioning. The procedure does not require hospitalisation and can usually be performed in 30 minutes or less.

Tubal ligation

This procedure involves the surgical severing and/or blocking of a woman's fallopian tubes. This prevents the passage of eggs to the uterus and renders pregnancy near impossible.

In Australia, it is illegal to undertake either of these procedures on persons under the age of 18 unless it is a clear medical necessity. Needless to say, no health insurance will cover illegal procedures.

Must read

If you think you might want to undo your vasectomy or tubal ligation in the future, then do not get it at all.

Reversal surgery does not guarantee that you will recover full functionality, and in some cases will be completely ineffective. The high costs and indeterminate success rates of sterilisation reversal procedures mean that private health funds will typically only cover them as on more comprehensive policies.

How does health insurance handle contraceptive surgery?

Private health funds will cover vasectomies, tubal ligation and hysterectomies in varying ways, depending on the level of cover you have purchased and the conditions of the policy. Things to consider are:

- Your level of cover. Because sterilisation is an elective procedure, vasectomies and tubal ligation are typically covered under higher-tier hospital policies. Check your health insurance policy's Product Disclosure Statement (PDS) or contact your fund to find out if your policy covers it.

- Your hospital cover. Vasectomies do not usually require hospitalisation, but tubal ligation does and hysterectomies in particular require spending several days in hospital. Hospital stays will incur additional costs. To find out how a private health fund covers these and the limits which may apply, look at the hospital cover section of the policy. It is possible that your health fund will cover the surgery itself, but won't cover the hospital stay and related costs.

- What sterilisation covers. Sterilisation typically refers to tubal ligation and vasectomies. Sterilisation is the term to look for if you want a private health fund to cover your contraceptive surgery, and it is a good idea to familiarise yourself with the terms and conditions surrounding it.

- What gynaecological services covers. In both the hospital and general cover sections you may find that a policy includes gynaecological services. Typically this refers only to medically necessary services, like emergency hysterectomy, and not elective ones like tubal ligation.

- What fertility and infertility services mean. Fertility and infertility services, although related to sterilisation, are not connected to the contraceptive surgeries on offer and do not cover vasectomies or tubal ligation (which are sterilisation) or hysterectomies (which is a gynaecological service). However they do refer to vasectomy or tubal ligation reversal surgery, which is a procedure to undo sterilisation.

Can't I just get these types of medical service under Medicare?

You can. Because vasectomies and tubal ligation are not emergencies and Medicare offers relatively good benefits for them.

So, it's not usually worth choosing a fund on the basis of whether or not they cover these. However, going private may still be worth considering if:

- You only want to see a particular practitioner for your vasectomy or tubal ligation.

- You don't want to wait for a bulk-biller to fit you in.

- You are considering an elective hysterectomy for reasons such as a family history of cervical cancer.

How do I claim sterilisation services on health insurance?

To claim a vasectomy or tubal ligation with a private health fund:

- Make sure your chosen doctor is approved by the health fund.

- Book an appointment and confirm that they work with your fund.

- Pay them in a way approved by the insurance plan. This may be by simply swiping a health fund membership card, giving them your details, or paying up-front and then claiming it back later.

Claiming a hysterectomy can be more complicated as it depends on your reason for having the procedure and the methods used by the surgeon.

Bottom line

Having a vasectomy or tubal ligation procedure is easy and relatively inexpensive, but it should also be considered very carefully first. Covering sterilisation with public or private health insurance is simple, but undoing it can be much more complex and expensive.

- Extras only: $44

- Basic: $105

- Bronze: $152

- Silver: $179

- Gold: $260

Frequently asked questions

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.