Key takeaways

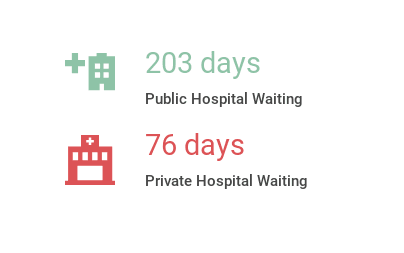

- Public waiting lists for knee surgery are longer than private waiting lists.

- The average public hospital waiting time was 203 days during the period we looked at.

- You can get covered with private health insurance for around $161 a month.

What is the cost of knee surgery/replacement?

For a knee replacement, the average cost can range from $17,00 to $30,000, whilst a knee cruciate ligament repair can cost between $5,000 and $14,000 so it's worth shopping around for the most affordable option.

It's important that you confirm the costs ahead of time, as there can be up to $5,000 in out-of-pocket expenses if you don't do your research. There are a number of things you can do to work out the total cost:

- Call your surgeon to get a cost estimate.

- Find out if your surgeon is in your private health insurer's preferred list.

- Get an estimate on extras and make sure there are no out-of-pocket expenses; extras can include paying for X-rays and an anaesthetist.

- Get a Medicare code. Call your private health insurer and give them your code.

- Find out your doctor's estimated rebate.

Finder survey: How many Australians in different states made a hospital claim for any of these conditions?

| Response | WA | VIC | SA | QLD | NSW |

|---|---|---|---|---|---|

| Bone joint and muscle | 1.89% | 2.59% | 1.33% | 6.09% | 3.19% |

Data for ACT, NT, TAS not shown due to insufficient sample size. Some other states may also be excluded for this reason.

How does private health insurance cover knee surgery?

If you decide to get private health insurance, there will be some out-of-pocket expenses for knee surgery. However, the amount really depends on your excess, as well as things like the hospital and doctor you use. One of the perks of going private is that you get to decide where you have the surgery and your surgeon, so you have more control over expenses.

Below are some examples from Finder Partners that cover joint replacement surgery. All quotes are based on a single hospital policy in Sydney.

All prices are based on a single individual with less than $101,000 income and living in Sydney.

How does Medicare cover knee surgery?

With Medicare, there are little out-of-pocket expenses for knee replacement surgery if you are a registered public patient and have surgery in a public hospital. However, people wait for months to receive surgery, which could worsen your condition and health as it prolongs the period you're forced to live with chronic pain and poor mobility. You are also unable to choose your own doctor, or the amount and time of consultations you have prior to your operation under Medicare.

You can claim your Medicare rebate using your Medicare online account. This can be accessed through myGov or by speaking to your doctor. It's vital you do this, as surgery is expensive. Whilst Medicare will cover 75% of costs, there can still be out-of-pocket expenses, so do your research beforehand.

Public vs private waiting list for knee surgery

The average waiting lists for knee surgery vary between the public and private health system. Average wait times for knee surgery in the public system can be up to 203 days, while private wait times are closer to 76 days.

Source: Australian Institute of Health and Welfare (AIHW) Private health insurance use in Australian hospitals 2006–07 to 2016–17

When might you need knee surgery?

If your doctor has recommended knee surgery, it's likely you've tried everything else to alleviate the pain. A bad knee can affect your every move, and pain can be excruciating even while lying down. You may need knee replacement surgery if:

- Medication is not improving pain, including injections into the knee

- Weight loss and exercise haven't stopped the pain

- Your knee has become weaker

- Your quality of life is worsened by your inability to move around

FAQs about knee surgery

Sources

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.