What are the Finder Home Loan Awards?

Finder's Home Loan Awards are part of the annual Finder Awards program. We evaluate home loans from across the market by looking at interest rates, loan fees and features to find our award winners.

Why you can trust our research

Selection criteria

The products were included in the categories if they were currently available and met the following criteria:

- All categories: An interest rate of 7.5% or under.

- Owner Occupier Home Loan - Variable: Variable interest rate, 80% max LVR or higher, principal-and-interest repayment type.

- Owner Occupier Home Loan - 1-3 Year Fixed: Fixed interest rate, 1- to 3-year fixed rate length, 80% max LVR or higher, principal-and-interest repayment type.

- Investor Home Loan - P&I - Variable: Variable interest rate, investor home loan, 80% max LVR or higher, principal-and-interest repayment type.

- Investor Home Loan - Interest only - Variable: Variable interest rate, investor home loan, 80% max LVR or higher, interest-only repayment type.

- Investor Home Loan - Interest only - 1-3 Year Fixed: Fixed interest rate, 1- to 3-year fixed rate length, investor home loan, 80% max LVR or higher, interest-only repayment type.

- First Home Buyer Home Loan: Variable interest rate, first home buyer loan, 90% max LVR or higher, principal-and-interest repayment type.

- Owner Occupier Home Loan - Refinance Variable: Variable interest rate, 70% max LVR or higher, principal-and-interest repayment type, less than $200,000 min loan amount, more than $500,000 max loan amount.

- Owner Occupier Home Loan - Refinance Fixed: Fixed interest rate, 70% max LVR or higher, principal-and-interest repayment type, less than $200,000 min loan amount, more than $500,000 max loan amount.

- Home Loan Provider of the Year: 80% LVR or higher, investor and owner-occupier, any repayment type, same weighting as owner-occupier variable.

- Big Four Home Loan Provider of the Year: 80% LVR or higher (also investor and OO), any repayment, same weighting as owner-occupier variable.

Scoring

Metrics scored using either the tired scores when dealing with categorical data points or a dynamic scoring when dealing with numeric data. Finder's dynamic scoring means a product's metric is scored in comparison to the data points of all the other competitor products.

| Metrics | Scoring |

|---|---|

| Offset facility | 10 if offset account available, 0 if not |

| Interest rate | Inverse percentile rank |

| Total fees | Inverse percentile rank |

Weights

Final award score

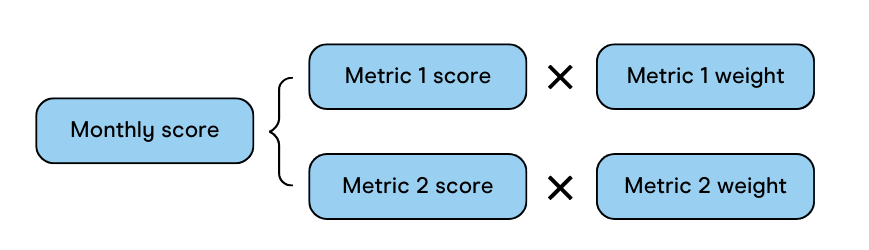

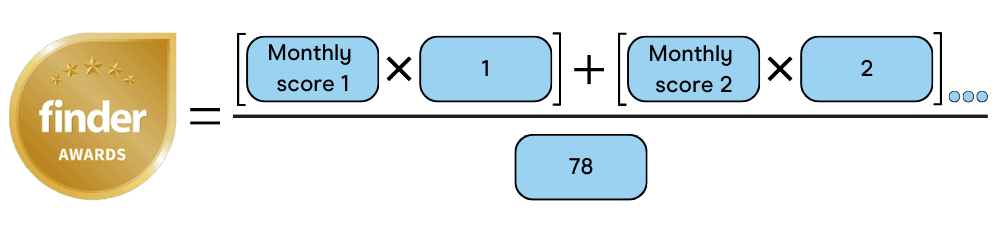

The final award score is calculated by first calculating a score for each of the previous 12 months. This evaluates each product against the competing products in those particular months. This score is calculated by multiplying the score for each metric by the weight percentage and summing the weighted scores:

The final award score is calculated by taking a weighted average of the monthly scores with more recent months being weighted progressively heavier. This final award score is then ranked to determine the overall winners for each category.

Why you can trust our awards

Expert analysis

Our Home Loan Awards winners are based on 100+ hours of research by our expert authors and insights team.

They're comprehensive

We researched hundreds of Australia's most popular home loans from the biggest banks to the smallest online lenders.

They're independent

Some winners may be partners but this never influences our decisions. All loans are based on a clear methodology and must meet editorial standards.

Meet our experts

Richard Whitten

Editor for money

Richard Whitten is a money editor at Finder. He has been covering home loans, property and personal finance for the last 6 years.

Saranga Sudarshan

Insights analyst, Finder Awards

Saranga is responsible for gathering the data that fuels the Finder Awards. He ensures our winners are based on facts, not biases.

Rebecca Pike

Senior writer, home loans

Rebecca is a senior writer at Finder covering all things home loans. She has been writing about the home loan market in Australia for almost 6 years.

More guides on Finder

-

Finder Home Insurance Awards 2026

Find out which home insurance brands came out on top in the 2026 Finder Awards.

-

Finder Pet Insurance Awards 2026

Find out which pet insurance brands came out on top in the 2026 Finder Awards.

-

Finder Personal and Car Loan Awards 2026

Find out which loan providers came out on top in the 2026 Finder Awards.

-

Finder Mobile Awards 2026

Find out which mobile providers came out on top in the 2026 Finder Awards.

-

Finder Banking Awards 2026

Find out which banking providers came out on top in the 2026 Finder Awards.

-

Finder Income Protection Awards 2026

Find out which income protection brands came out on top in the 2026 Finder Awards.

-

Finder Life Insurance Awards 2026

Find out which life insurance brands came out on top in the 2026 Finder Awards.

-

Finder Credit Card Awards 2026

Find out which credit card providers came out on top in the 2026 Finder Awards.

-

Finder Car Insurance Awards 2026

Find out which car insurance brands came out on top in the 2026 Finder Awards.

-

Finder Home Loans Awards 2026

Find out which home loan providers came out on top in the 2026 Finder Awards.