Revolut international money transfer review

We currently don't have this product on Finder

- Number of Currencies

- 40+

- Minimum Transfer Amount

- $1

- Pay By

- Bank transfer, Debit card

- Fees (Pay by Bank Transfer)

- From 0.15%

Our verdict

Revolut offers easy money transfers at very competitive exchange rates, but make sure to check for fees and your plan’s limits.

Founded in 2015, UK-based Revolut has made a name for itself with its suite of money management services and travel money solutions. Arriving in Australia in 2020, Revolut offers international transfers in over 40 currencies.

You can send money from the Revolut app, and there are no exchange rate markups when you convert currencies during exchange market hours within your plan limits. But be aware that fees apply, and the plan you select affects how much money you can send.

Pros

-

Physical and virtual cards

-

Access 40+ currencies

-

Make payments in over 100 countries

Cons

-

Fees apply when you send an overseas currency transfer

Details

Product details

| Product Name | Revolut |

| Pay By | Bank transfer, Debit card |

| Receiving Options | Bank account, Mobile wallet |

| Customer Service | Live chat, 24/7 support |

| Maximum Transfer Amount | Unlimited |

| Number of Currencies | 40+ |

What do Australians think of Revolut international money transfer brand?

- 4.44/5 overall for Customer Satisfaction - higher than the average of 4.35

- 4.64/5 for Trust - lower than the average of 4.69

- 4.41/5 for Customer Service - higher than the average of 4.31

Based on Revolut international money transfer brand scores in Finder's 2024 & 2025 Customer Satisfaction Awards.

Why should I consider using Revolut

- Great user experience. The app is as user-friendly as they come. Exchanging currencies and sending international transfers is quick and easy through the Android or iOS app.

- Get a competitive exchange rate (most of the time). When you exchange currency during market hours, you can take advantage of close to the mid-market rate. However, a markup applies outside of these hours.

- No maximum limit on most currencies. There is no transfer limit on most major currencies but other limits may apply depending on your plan.

- Revolut card. When you sign up for any Revolut plan, you get a virtual debit card that's linked to your account. You can order a physical debit card too (there may be a delivery fee for this). The Revolut card lets you spend in over 150 countries around the world.

- Other money management services. Signing up for Revolut also allows you to access features such as share and crypto trading, bill splitting, budgeting tools, and more.

What to be aware of

- Exchange rate markups on weekends. Currency conversions made between Friday 5pm (Eastern time) and Sunday 6pm (Eastern time) attract a 1% fee. Note: Weekend fees don't apply on paid plans.

- Fees apply. As outlined in the costs section below, you'll need to pay a fee when you send an overseas currency transfer. The fee is calculated as a percentage of your transaction amount and varies depending on the plan you choose and the currency you send. The percentage is highest on the Standard plan, so Standard members will typically be best served using Revolut for smaller transfer amounts only.

- Plan limits apply. If you select a Standard plan, the maximum amount of currency you can convert with no fee during market hours is $2,000 a month.

- App only. You can contact Revolut customer support via in-app chat or an automated phone service. So if you're the type of person who likes to have the option of talking to a real person on the phone or visiting a branch, this is a drawback of Revolut's financial products.

"For someone who has family and friends living in different corners of the world, Revolut has made instant money transfers with competitive pricing easier. The app is easy to use and offers a host of features, making it a good everyday account as well. The in-app messaging service while transferring money gives a personalised touch."

Customer reviews and complaints

As of January 2025, Revolut has an average rating of 4.3/5 from over 178,200 reviews on Trustpilot. Those who left positive reviews praise Revolut for its ease of use and for offering fair exchange rates. However, customers who gave negative ratings sometimes complain about disappointing live chat customer service.

Is Revolut safe to use for international money transfers?

Revolut is headquartered in London. It serves over 200 countries and has more than 50 million customers around the world.

In terms of regulation here in Australia, Revolut holds an Australian Financial Services Licence and is authorised by the Australian Securities & Investments Commission. Revolut Australia is also regulated by Australian Transaction Reports and Analysis Centre (AUSTRAC) and is listed on the AUSTRAC Remittance Sector Register.

Revolut's plans and pricing

When you sign up for Revolut you have 4 pricing options:

| Standard | Plus | Premium | Metal | |

|---|---|---|---|---|

| Monthly fee | $0 / month | $5.99 / month | $11.99 / month | $28.99 / month |

*ATM providers may apply their own fees.

Standard

With the standard plan you pay no monthly fee. You can make no-fee ATM withdrawals up to $350 a month.

You can exchange money internationally up to $2,000 a month.

Plus

With the plus plan you pay $5.99 a month. You can make no-fee ATM withdrawals up to $350 a month.

You can exchange money internationally up to $6,000 a month.

Premium

With the premium plan you pay $11.99 a month. You can make no-fee ATM withdrawals up to $700 a month.

You can exchange money internationally up to $20,000 a month and get discounted airport lounge access.

You can also make 5 no-fee stock trades per month, get 24/7 customer support and a 60% discount on international fees.

Metal

With the premium plan you pay $28.99 a month. You can make no-fee ATM withdrawals up to $1,400 a month.

You can exchange money internationally with no limit and get discounted airport lounge access.

You can also make 10 no-fee stock trades per month, get 24/7 customer support and an 80% discount on international fees.

How to make an international transfer with Revolut

Follow these steps to send an overseas transfer with Revolut:

- Download the Revolut app on your Android smartphone or iPhone.

- Sign up for an account by providing your name, address, email address, proof of ID and a selfie.

- Use your card or bank account to add money to your Revolut account.

- In the Revolut app, choose the wallet you want to transfer from and tap "Transfer".

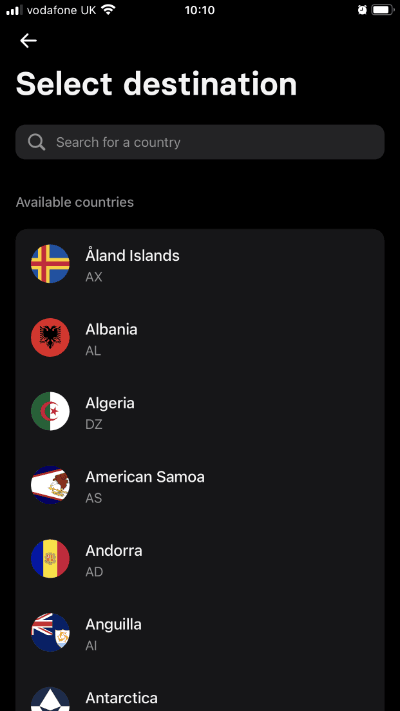

- Choose "Send International".

- Choose your destination country and currency.

- Enter your transfer amount and then review the exchange rate and any fees that will apply. If you're happy with what you see, tap "Continue".

- Enter your recipient's details. You'll usually need to provide their name, bank account number and bank code. Confirm your transfer.

How much does Revolut charge for international transfers?

You can get the mid-market exchange rate on currency exchanges during exchange market hours - roughly Monday to Friday. However, exchanges made outside market hours, which means between Friday 5pm (Eastern time) and Sunday 6pm (Eastern time), attract a 1% fee.

The next thing you need to consider when calculating the cost of Revolut money transfers is the provider's monthly membership fee. There's no fee if you're on a Standard plan, but you're limited to transferring $2,000 per month without exchange fees. Above this $2,000 limit, a 0.5% fee applies. You get a higher monthly transfer limit with Premium and Metal plans, but you'll need to pay a monthly fee.

| Standard | Plus | Premium | Metal | |

|---|---|---|---|---|

| Monthly fee | $0 | $5.99 / month | $11.99 / month | $28.99 / month |

| Currency exchange limit | $2,000 / month | $6,000 / month | $20,000 / month | Unlimited |

Finally, you'll also need to consider Revolut's currency transfer fee. When you're sending an international transfer in the recipient's local currency - for example, if you're sending GBP to the UK - a percentage fee applies. The fee amount varies depending on the currency being sent and the plan you select, so check the table below for examples.

| Recipient currency | Standard plan fee (minimum and maximum limits) | Plus plan fee (minimum and maximum limits) | Premium plan fee (minimum and maximum limits) | Metal plan fee (minimum and maximum limits) |

|---|---|---|---|---|

| EUR | 0.15% ($0.90-$500) | 0.15% ($0.90-$500) | 0.06% ($0.36-$200) | 0.03% ($0.18-$100) |

| GBP | 0.15% ($1-$500) | 0.15% ($1-$500) | 0.06% ($0.40-$200) | 0.03% ($0.20-$100) |

| INR | 0.15% ($1.20-$500) | 0.15% ($1.20-$500) | 0.06% ($0.48-$200) | 0.03% ($0.24-$100) |

| NZD | 0.15% ($1.50-$500) | 0.15% ($1.50-$500) | 0.06% ($0.60-$200) | 0.03% ($0.30-$100) |

| PHP | 0.15% ($1.50-$500) | 0.15% ($1.50-$500) | 0.06% ($0.60-$200) | 0.03% ($0.30-$100) |

| THB | 0.15% ($2-$500) | 0.15% ($2-$500) | 0.06% ($0.80-$200) | 0.03% ($0.40-$100) |

| USD | 0.15% ($1.80-$500) | 0.15% ($1.80-$500) | 0.06% ($0.72-$200) | 0.03% ($0.36-$100) |

Alternatives

There are several other alternatives money transfer providers you should consider before deciding if Revolut is right for you.

One popular company is Wise, which offers transfers to over 75 countries around the world. Like Revolut, Wise offers the mid-market rate, while its fees vary depending on the currency you send (starting from 0.41%).

So, which is better? It depends - on the size of your transfer, where you're sending money, and what Revolut plan you select. Revolut's fees are generally lower, but Wise has much higher transfer limits and it's free to open an account.

For example, assuming you have a Standard Revolut plan, sending $1,000 to the UK, your recipient will get £2.32 more. But if you want to send a large transfer, Revolut's no-fee transfer limits on Standard plans could make Wise a more cost-effective option. Calculate the cost of your transfer with each company to find the best deal.

How does Revolut compare to other money transfer services?

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Verdict

If you're searching for simple and affordable money transfers, Revolut is well worth a look. It's easy to use and offers very competitive rates and fees. However, the different membership tiers and fee structures it offers can be a bit confusing, so make sure the limits of your Revolut plan suit your needs.

Ultimately, be sure to compare Revolut with a range of other money transfer companies to find the right money transfer service that's right for you.

Frequently asked questions

Sources

Your reviews

Tim Finder

Writer

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.