Review: SingX international money transfers

We currently don't have this product on Finder

- Number of Currencies

- 21

- Minimum Transfer Amount

- $1

- Pay By

- Bank transfer

- Fees (Pay by Bank Transfer)

- From 0.5%

Our verdict

Get the interbank exchange rate and same-day processing on your next overseas transfer.

You won't find better than the mid-market exchange rate and that's exactly what SingX offers when it comes to money transfers in popular currencies. But this isn't the case for volatile currencies as a markup is likely, along with other fees. By using the handy online calculator, you'll always see the fees upfront. Delivery is quick too, with recipients receiving funds within 1 or 2 days.

SingX is a solid option, providing you and your recipient both have bank accounts. Where SingX really falls short is by not accepting cash and card payments and its lack of cash pick-ups and mobile wallet transfers. Plus, if you need to send a larger transfer, the percentage-based transfer fee can escalate compared to a fixed fee.

Pros

-

Good for fast transfers, mid-market exchange rates and fees declared upfront

Cons

-

Not so great for larger transfers. SingX also doesn't support cash transfers.

Details

Product details

| Product Name | SingX For Large Transfers |

| Pay By | Bank transfer |

| Receiving Options | Cash pickup location, Bank account |

| Customer Service | Phone, Email |

| Maximum Transfer Amount | Unlimited |

| Number of Currencies | 21 |

SingX exchange rates and fees

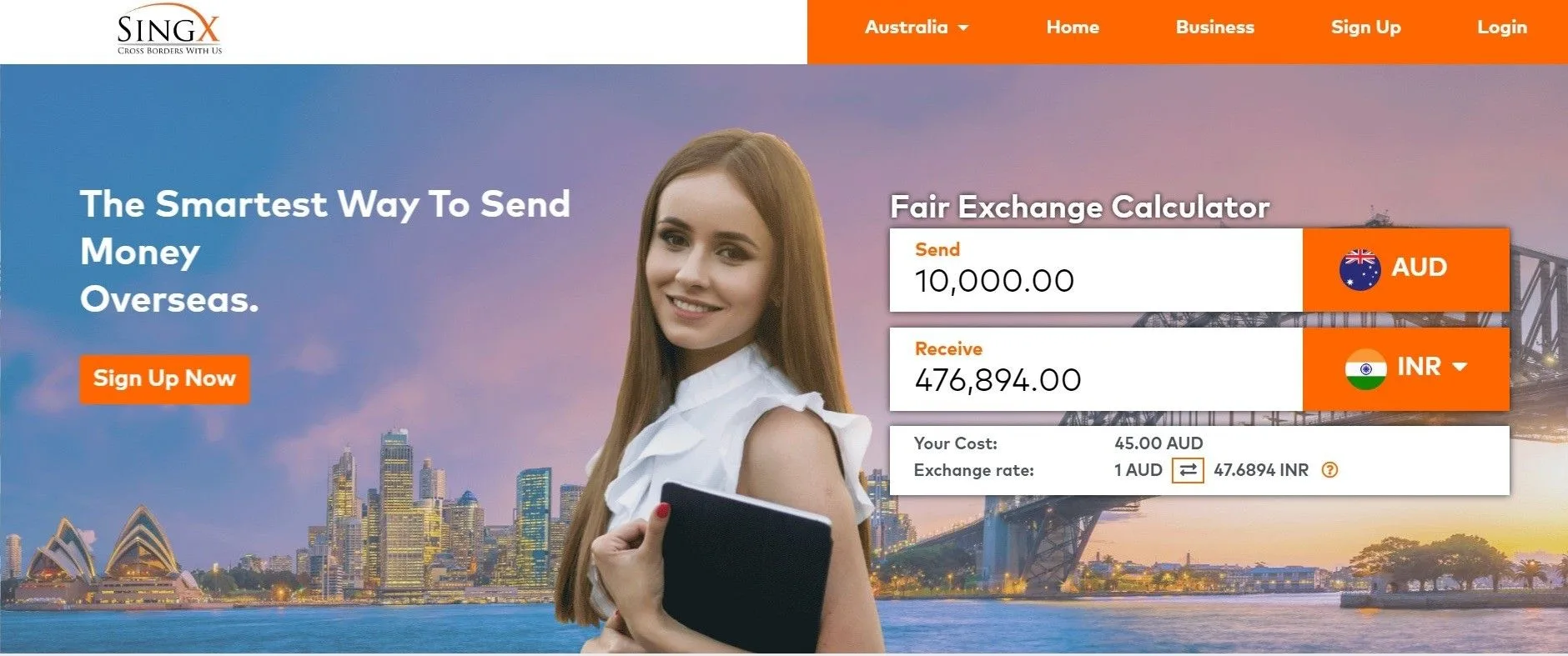

SingX offers an online calculator that allows you to see the fees and exchange rates that will apply to your transaction upfront.

In most cases, you'll receive the mid-market rate for your transaction. This is the rate you see listed on Google and is also known as the interbank rate. However, a fee of up to 0.5% will apply to your transaction.

Additional charges may apply if you want to send a volatile or less frequently traded currency. In these situations, SingX may apply an exchange rate mark-up or a flat fee.

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Check if there are any SingX promo codes available

Available currencies

SingX supports transfers from AUD to more than 15 currencies, including:

- CNY Chinese yuan

- EUR Euro

- GBP British pound

- INR Indian rupee

- JPY Japanese yen

- NZD New Zealand dollar

- PHP Philippine peso

- USD US dollar

You can check out a full list of supported currencies above.

What types of transfers can you make with SingX?

SingX only supports bank account transfers. Other options, such as cash pick-up or mobile wallet transfers, are not available.

SingX also offers a cross-border payments service for business customers.

How long does a transfer with SingX take?

Before your transfer can be sent, you'll need to allow time for your deposit to arrive with SingX. This usually takes 1-2 working days.

The time it takes for your transfer to be sent will then depend on where you are sending money. In most cases, it will take 1-2 working days for your transfer to be completed.

Transfers typically take![]()

Within minutes

What payment methods does SingX accept?

You can send money to SingX using the following payment methods:

- Online bank transfer

Is SingX safe to use?

- Security and regulation: Licensed in Australia by ASIC

- Established: 2014

- Awards: MAS Global FinTech Award Winner 2017

- Reviews: Googles Reviews gives SingX a score of 4.5* out of 5, based on over 1,652 reviews.

*According to SingX and Trustpilot on 3 March 2023.

SingX is registered in Singapore and works with licensed remittance operators in the countries where it does business. In Australia, it is regulated by ASIC and is listed on AUSTRAC's Remittance Sector Register.

SingX claims to have a range of security measures in place to ensure the safety of your personal details. These include two-factor authentication on your account, keeping client funds in a segregated account and storing all account information in a secure facility.

How does SingX make money?

SingX makes money by charging a transfer fee on all transactions.

If you're sending a transfer in a rare currency, SingX may also apply an exchange rate mark-up to your transaction.

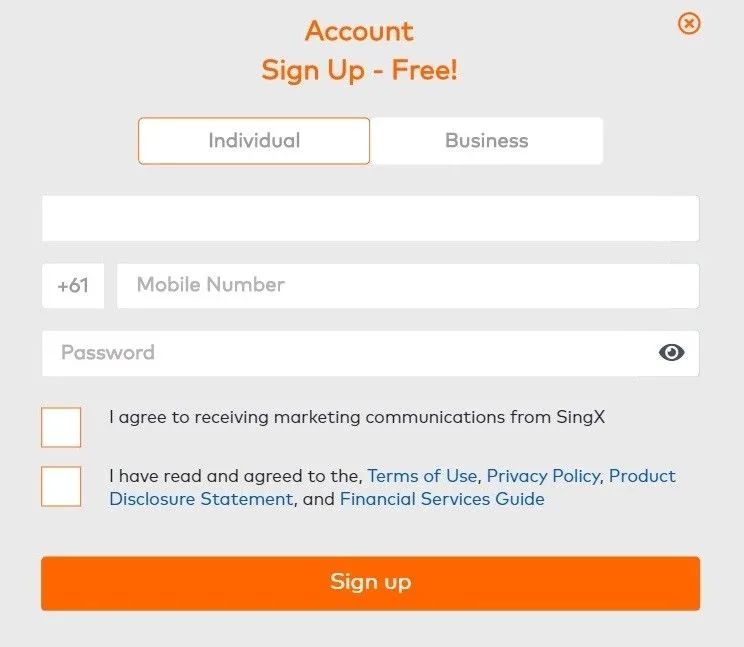

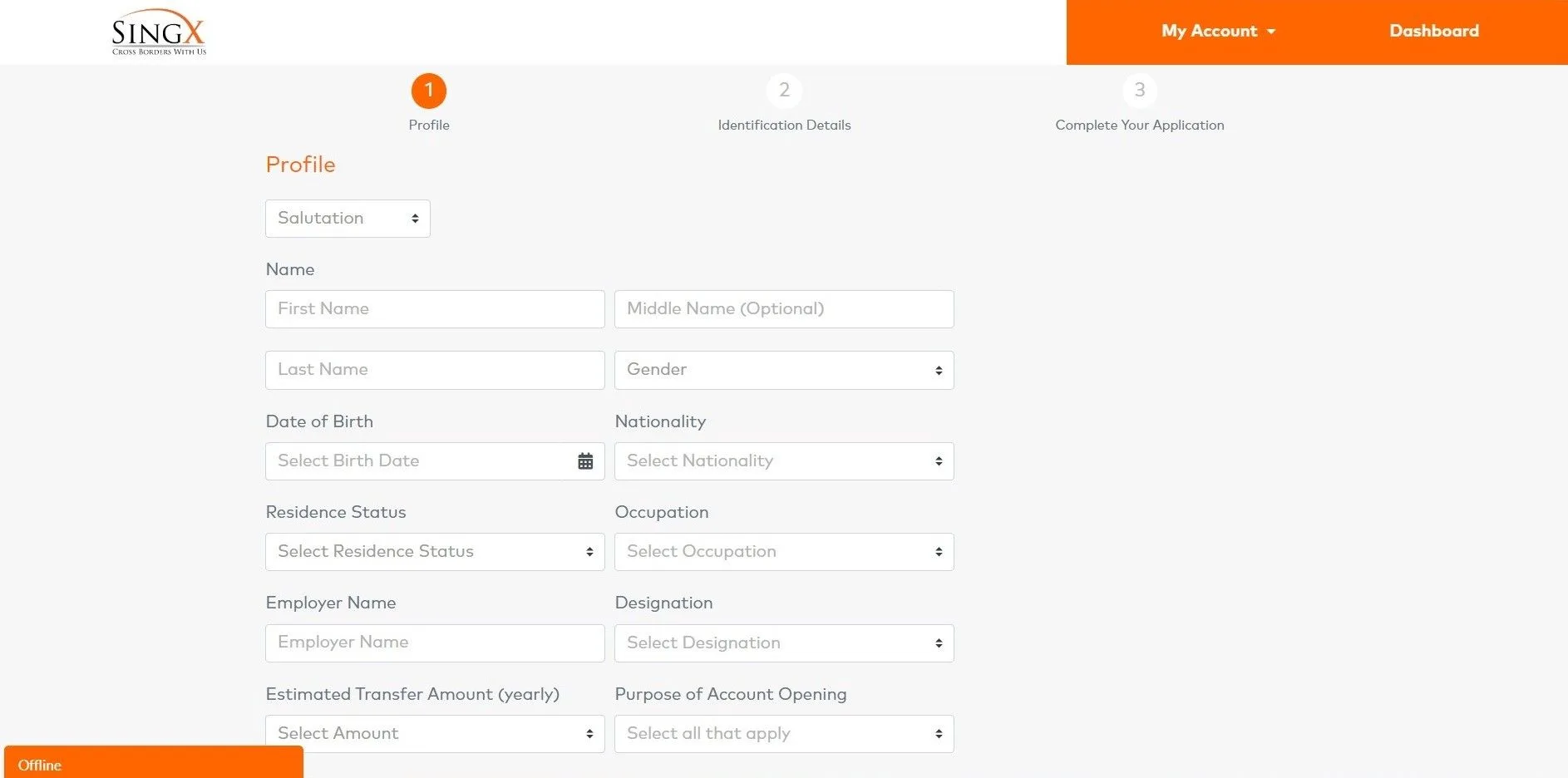

How to register an account

You can register for a SingX account by completing the following steps:

How do I make an international money transfer with SingX?

You can complete a transfer by following these steps:

- Log in to your SingX account.

- Click "Start your transfer".

- Confirm the amount and currency you'd like to send.

- Review the details of your transaction, including the transfer fee.

- Enter your recipient's bank account details.

- Pay for your transfer via online banking.

What is SingX?

SingX is a global remittance service based in Singapore. Established in 2014 by former American Express banker Atul Garg, SingX has since expanded its operations to Australia and Hong Kong.

In Australia, it offers money transfer services through its wholly owned subsidiary, SingX Australia Pty Ltd. The company's Australian headquarters are located in Brisbane.

In a nutshell

Pros

- Get the mid-market rate. When you send money overseas with SingX, there'll be no margin added to the mid-market exchange rate.

- Transparent fees. All fees that apply to your transaction are revealed upfront, so there are no nasty surprises.

- Quick transfers. In many cases, it only takes SingX one working day to complete a transaction after receiving your funds.

Cons

- Doesn't offer cash transfers. If you want to send a cash pick-up transfer to an overseas recipient, you'll need to consider other transfer providers.

- Limited payment methods supported. The only way to pay for your transfer is from your bank account – credit card and cash payments are not supported.

- Fees on large transfers. Since the transaction fee with SingX is a percentage-based fee, it can be quite expensive to send larger transfer amounts.

How does SingX compare to other services?

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Frequently asked questions

Sources

Your reviews

Tim Finder

Writer

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.