Can I send money over WeChat?

We currently don't have this product on Finder

- Number of Currencies

- 4

- Minimum Transfer Amount

- 1

- Fees (Pay by Bank Transfer)

Summary

What started as an IM service now lets you pay for anything from your dry-cleaning bill to your groceries.

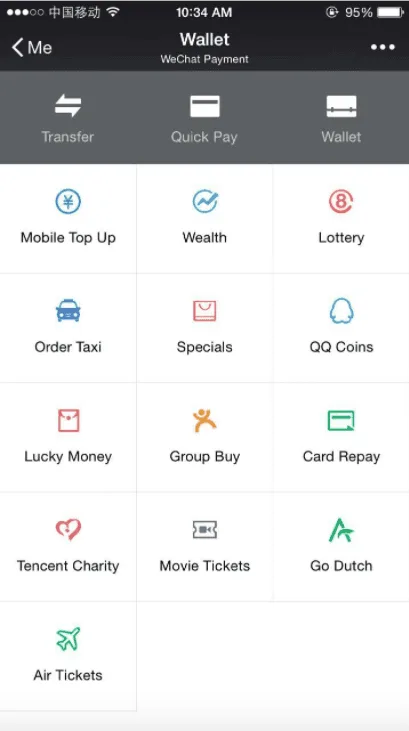

WeChat's wallet feature is a quick and easy way to split a dinner bill, pay a friend back or shop without a physical wallet. If you already use WeChat for messaging and you're registered in China, South Africa or Hong Kong, using it to send money is easy.

Pros

-

Service is free

-

Managing payments is quick and convenient

Cons

-

Service is limited to certain countries

-

No specified delivery time

Details

Product details

| Product Name | WeChat International Money Transfers |

| Customer Service | Phone, Email |

| Maximum Transfer Amount | 2000 |

| Number of Currencies | 4 |

What is WeChat?

WeChat – locally known as 微信 or Weixin – is a social media app that's become one of the most widely used in China. Because it's governed by China's strong censorship laws and messaging interception rules, the government can potentially review your messages and other data at any time. Given this, it's no surprise that WeChat's had a difficult time catching on internationally.

Why should I consider WeChat?

- Free service. Unlike PayPal, which makes money through a percentage of your transaction, WeChat's developer Tencent makes money selling other products. While WeChat Wallet is another way for Tencent to sell its products, the service is free to use.

What to be aware of

- Service limited to certain countries. To use WeChat Wallet, your account must be registered in mainland China, South Africa or Hong Kong.

- Potential for government prying. WeChat is governed by China's laws that allow the government to monitor your messages and personal info.

- No specified delivery. WeChat doesn't advertise how long it takes for transfers to complete, which means you may need to look elsewhere for emergencies.

Is WeChat Pay available in Australia?

While WeChat is available around the world, WeChat Pay is only available for those who have a bank account in China, Hong Kong, Malaysia or South Africa. If you do, you'll be able to use WeChat Pay in Australia.

At the start of 2018, WeChat Pay launched. This feature lets tourists, expats or international students pay at certain stores in Australia. You can see if your local grocery store offers it by looking for the logo.

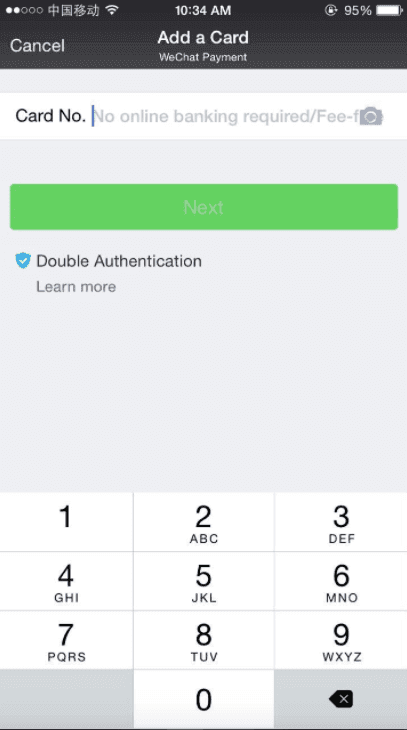

How do I request and send money with WeChat Pay?

What happens when someone sends me money?

The money you’re sent on WeChat is automatically transferred into your WeChat Wallet - meaning you don’t accept or deny payment. By reviewing your balance you can view and manage how much money is in your WeChat account.

Are there restrictions for sending money with WeChat?

Yes. WeChat is not legally allowed to process international money transfers. Be aware that only wallets specific to the areas supported by WeChat - China, Hong Kong, Malaysia and South Africa - can send accessible money between each other.

What this means is that if you're trying to send money from your wallet in China to someone in South Africa, the money will be sent, but now the recipient in South Africa will also have a Chinese wallet. Unless the user from South Africa heads to China, the money will be useless.

Is sending money over WeChat Wallet safe?

WeChat encrypts your personal information, financial details and monetary transactions. However, WeChat doesn't provide much information on other digital safeguards.

Because WeChat Wallet is based in China, it isn't required to comply with Australian security standards. Keep in mind that the Chinese government monitors all social media devices, including WeChat. So it’s safe from hackers, but no transaction is completely private.

WeChat and Remitly

Remitly now allows users to use WeChat to send money to loved ones in China. All you need to set up a transfer is your recipient's name and phone number associated with their WeChat account. However, make note that your recipient will need to have signed the kinship commitment letter (if they are receiving money for Family Support reasons) in order to be able to receive the money sent.

Are there other ways I can send money overseas?

While WeChat doesn't have the ability yet to make an international money transfer, there are other providers that can. Learn more about them below. If you'd like the convenience of a mobile app, check out our review on some of the most popular money transfer apps.

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Frequently asked questions

Sources

Your reviews

Adrienne Finder

Head of publishing and editorial

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.