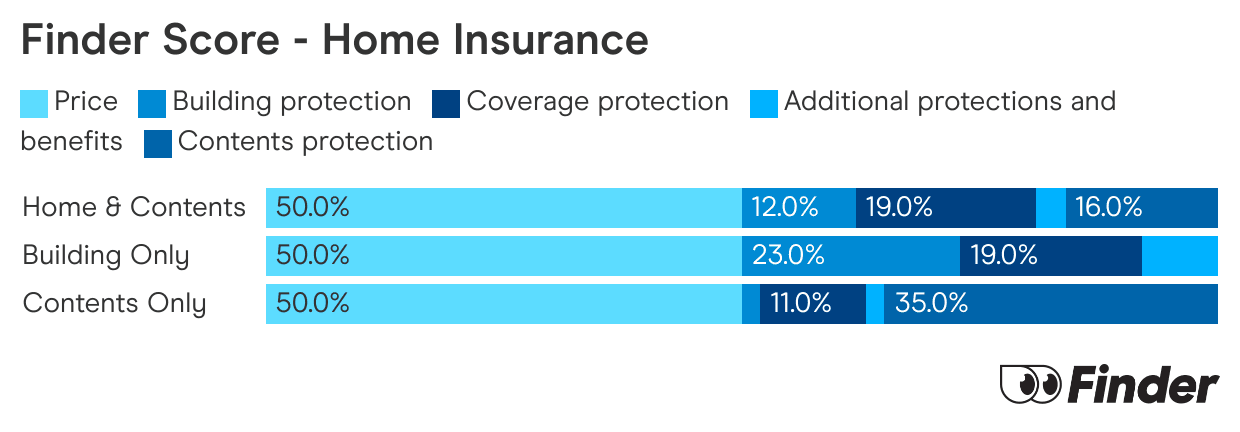

Finder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

How do I make a leaking roof insurance claim?

Find out if you can make a claim

You can make a leaking roof insurance claim if it's due to circumstances beyond your control, such as a storm or natural disaster. If your roof has been leaking for years and is only now becoming a problem, you won't be covered. Your insurer will likely send someone out to assess whether the leak was due to negligence or was accidental.

Prepare your claim

Let your insurer know that you need to make a claim. Take pictures and videos of the leak if possible. Stop further damage from occurring but try not to fix it yourself or you risk jeopardising your claim.

Submit your claim

Submit your claim by email or mail and wait to hear back. Insurers can take up to 10 days to respond to your claim. In these circumstances, they should be able to help stop the leak quicker.

Will I be covered for a leaking roof?

It depends on whether or not the leak was due to an accident or your own negligence. They will send an assessor to inspect your roof.

- If the assessor believes the cause of the leak was accidental, such as damage from hail or storm-related debris, the insurer will usually approve your claim.

- However, if the assessor sees no evidence of accidental damage or finds evidence that the roof has been leaking for some time, they will likely classify the leak as being caused by inadequate roof maintenance. The insurer will deny your claim.

How to avoid your claim from being rejected

- Keep up-to-date with roof maintenance. There are several roof maintenance tasks that you can do to ensure your claim isn't rejected for poor roof maintenance.This can include clearing blocked gutters, flashings and debris from the roof.

- Have a roofing contractor check for repairs. They can ensure your roof is up to scratch and you won't have a claim rejected for wear and tear, continuous seepage or other installation and design problems.

How to spot a potential leak

There are 3 signs that your roof may be leaking:

- Missing shingles or tiles. You should regularly inspect your roof for missing or broken shingles and tiles, which can allow water to enter.

- Stains on the ceiling. If there is a damp spot on your ceiling, this can indicate that water is already leaking into your home.

- Choked gutters and downpipes. You should clear these regularly and install gutter guards to prevent debris build-up.

So what's the answer?

In the light of all this doom and gloom, you may well be asking yourself why bother to have home insurance. It's because it will cover you if disaster strikes your home, which is many people's largest asset in life, after all.

As for gradual water damage to your roof, the trick is to make sure it doesn't happen. Regular roof maintenance and hiring a roofing expert to rectify any design or installation problems can help prevent any issues.

Sources

Ask a question

2 Responses

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.

I had a new tiles put on my garage roof after a couple of years it’s got a small leak which was repaired can I claim for the damage it made

Hi Wayne,

Thanks for your inquiry.

Your home insurance will cover your house and contents for water damage caused by an insured event such as a storm. But if the damage is the result of a leak in your roof that the insurer deems to be a maintenance issue (and thus not covered), the water damage to your home and contents will usually not be covered.

Hope this was helpful. Don’t hesitate to message us back if you have more questions.

With care,

Nikki