RACQ Life Insurance Review

-

Bonus

- Maximum Cover

- $1,000,000

- Maximum Entry Age

- 65

- Terminal Illness Benefit

- $1,000,000

Our verdict

RACQ life insurance offers three core types of life cover to meet different needs. But its benefit limit of up to $1,000,000 isn't the most competitive on the market.

- This provider has a claims acceptance rate of 97% for death cover purchased through a financial advisor, which is higher than average (96.6%).

- You can get access to AIA Vitality discounts.

- With RACQ, you get a death benefit of up to $1,000,000. Insurers includingNobleOak, ahm and Suncorp all offer between $500,000 and $14,000,000 more.

Details

Key Details

| Product Name | RACQ Life Insurance |

| Maximum Cover | $1,000,000 |

| Terminal Illness Benefit | $1,000,000 |

| Funeral Benefit | $15,000 |

| Guaranteed Renewability | |

| Cooling-off (days) | 30 |

| Online Quote |

Eligibility

| Minimum Entry Age | 18 |

| Maximum Entry Age | 65 |

| Expiry Age | 75 |

Add-ons

| Total and Permanent Disability Option | |

| Child Benefit Option | |

| Trauma Option |

Must read: Important Information

Read a more detailed review on:

![]()

Life insurance

Key points of RACQ life insurance

- Life insurance: Pays out a lump sum of up to $1,000,000 in the event of death or terminal illness.

- AIA Vitality: Get access to this lifestyle rewards program with RACQ cover.

- Funeral advance: Up to $15,000 paid out ahead of the rest to help cover immediate expenses.

- Global coverage. You're covered worldwide 24/7 when you travel.

- Bonus cover on selected benefits. Bonus cover can increase the amount that you're insured for by 1% a year for the first 10 years of your cover.

Note: Be sure to check the Product Disclosure Statement (PDS) for terms and conditions.

![]()

Optional cover

Key points of RACQ optional cover

When you take out a Life insurance policy, you also have the option to add on the following:

- TPD insurance. Pays out a lump sum of up to $750,000, or your life insurance sum insured, in the event of total and permanent disability.

- Trauma insurance. It pays out a lump sum in the event of a specified medical event. The maximum trauma insurance cover is 50% of your life cover sum insured, up to $250,000.

- Children's trauma cover. You can apply for up to $50,000 Children's Trauma cover to support your family if your insured child gets seriously ill.

![]()

Eligibility

Key eligibility criteria

To apply, you must:

- Be an Australian citizen or permanent resident, or a New Zealand citizen.

- Permanently reside in Queensland or at a northern NSW address with an eligible postcode.

- Be 18-65 years of age (18-59 for Trauma & TPD cover).

- For TPD optional cover: Work a minimum of 20 hours per week (excludes heavy, manual occupations).

You need to also meet the underwriting requirements (health and lifestyle factors) during the application process to start receiving cover.

RACQ life insurance pros and cons

Still wondering if RACQ is right for you? Here are the main pros and cons summarised:

Pros

- It gives you access to AIA vitality.

- Wide range of linked cover options.

Cons

- Maximum sum insured of only $1,000,000

- Only available in QLD and northern NSW currently

How do I make a RACQ life insurance claim?

To make a claim you should inform RACQ as soon as reasonably possible after an insured event.

Call 1800 722 777 or email claims@lifeinsurance.racq.com.au to receive a claims form, and then mail it, completed, to the RACQ claims team.

You will need to include evidence to support your claim, which depends on the type of claim. The additional documentation required may include:

- Medical evidence provided by a practitioner

- Proof of earnings or work status

- Proof of age

- Proof of death

- Evidence of disability.

What are some of the key exclusions of RACQ life insurance?

You cannot make a claim for loss resulting from:

- Suicide or deliberately self-inflicted injury within 13 months of taking out or reinstating life cover, or at any time for trauma and TPD cover

- Criminal or unlawful acts, or legal imprisonment

- Engaging in any aerial activity, except as a fare-paying passenger with a licensed airline or charter company

- War of any kind

- Alcohol, illicit drugs or any kind of drug misuse, whether directly or indirectly

- Any motorised sports participation, in any capacity

- Hazardous occupational duties, including working underground, offshore, at heights, underwater, with explosives, in the armed forces or in professional sports

For children's trauma cover specifically, you cannot make claims within the first 90 days, for congenital conditions or for pre-existing health conditions.

Compare other direct life insurance policies below

Compare other products

We currently don't have that product, but here are others to consider:

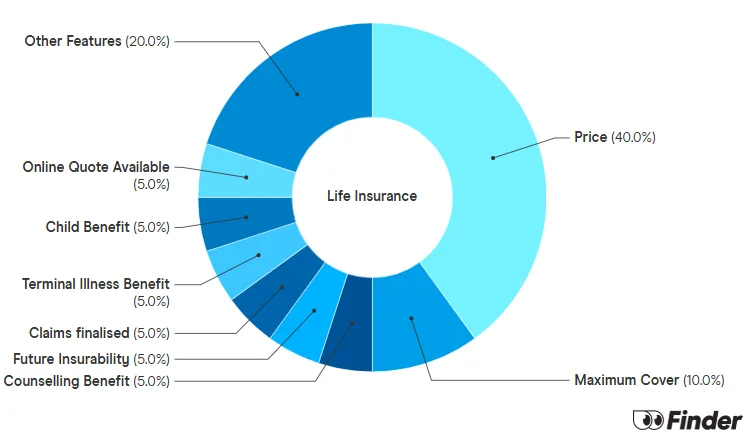

How we picked theseFinder Score - Life Insurance

Life Insurance is a little complicated and a lot overwhelming. That's why we made the Finder Score, to make it easier to compare Life Insurance products against each other. Our experts analysed over 30 products and gave each one a score between 1 and 10.

But a higher score doesn't always mean a product is better for you. Your situation is unique, so your policy choice will be too. Don't think of Finder Score as the final word, but as a good place to start your life insurance comparison.

Read full Finder Score methodology

Why compare life insurance with Finder?

-

You pay the same price as buying directly from the life insurer.

-

We're not owned by an insurer (unlike other comparison sites).

-

We've done 100+ hours of policy research to help you understand what you're comparing.

Speak to an insurance specialist to help you find personalised cover

Compare other products from RACQ

- RACQ home loans

- RACQ savings accounts

- RACQ term deposits

- RACQ personal loans

- RACQ car loans

- RACQ health insurance

- RACQ travel insurance

- RACQ home insurance

- RACQ car insurance

- RACQ motorcycle insurance

- RACQ caravan insurance

- RACQ pet insurance

Your reviews

James Finder

Journalist

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.