- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA Survey: Property prices to tumble up to $60K by 2020

- Experts predict property price falls to continue across all but one capital city

- Positive sentiment for housing affordability reaches 13-month high

- Sydney houses set to see largest financial loss of $57,758

1 April 2019, Sydney, Australia - Property prices across the nation haven't hit rock bottom yet with further dips predicted, according to Finder, Australia's most visited comparison site.

In the latest Finder RBA Cash Rate Survey™, experts and economists were asked how much they expect house and unit prices to rise or fall from now until the end of the year across capital cities.

The panel predicts that property prices could fall by up to almost 8% by the year's end, with Sydney units (-7.71%) and Melbourne apartments (-7.62%), tipped to be worse off.

While the median for Sydney house prices currently sits at $930,000, a forecasted 6.21% decline would see the new median fall to $872,242, a drop of $57,758. Melbourne house prices are tipped to fall by almost $50,000 by 2020.

The only capital city with increasing property prices this year is expected to be Hobart, with houses set to rise in value by 1.42%, equivalent to a $6,559 uplift.

Graham Cooke, insights manager at Finder, said the cooling market could be just what some first-time buyers need to get on the property ladder.

"With the highest median house and unit price in the country, it's not surprising that Sydney is expected to be hit hardest by the property downturn.

"If the predictions hold true, Melbourne and Sydney property still have another 6–8% to drop this year. This means $60,000 more knocked off the average property price in Sydney.

| Location | Median sales price last 3 months | 2019 experts' prediction* | Prices by end of 2019 | 2019 change in prices |

|---|---|---|---|---|

| Sydney houses | $930,000 | -6.21% | $872,242 | ($57,758) |

| Sydney units | $705,000 | -7.71% | $650,614 | ($54,386) |

| Melbourne houses | $750,000 | -6.53% | $701,053 | ($48,947) |

| Melbourne units | $551,000 | -7.62% | $509,039 | ($41,961) |

| Brisbane houses | $560,000 | -2.29% | $547,153 | ($12,847) |

| Brisbane units | $386,500 | -5.30% | $366,016 | ($20,485) |

| Perth houses | $520,000 | -3.00% | $504,400 | ($15,600) |

| Perth units | $372,500 | -4.63% | $355,272 | ($17,228) |

| Adelaide houses | $487,500 | -0.82% | $483,511 | ($3,989) |

| Adelaide units | $339,000 | -2.17% | $331,655 | ($7,345) |

| Hobart houses | $463,000 | 1.42% | $469,559 | $6,559 |

| Hobart units | $361,000 | 0.20% | $361,722 | $722 |

Source: CoreLogic, Finder

*Average of predictions from 5–19 economists, depending on city. Canberra excluded due to small sample size. Inflation has not been taken into account.

"While this makes it harder for existing homeowners to build up equity, it could make Sydney an attractive market for first-time buyers with a deposit saved," Cooke said.

CoreLogic has stated that units in Melbourne have fallen 37.6% in the past 12 months. The Finder panel of experts expects a further 7.62% fall this year.

Cooke said those thinking of getting into the property market over the next few years may be wise to hold out until prices have dropped further.

"Right now, there's no need to jump on the first property you like. Use this time to save for your upfront costs.

"Look for value before you plunk down your deposit. Buying at the right time could potentially save you tens of thousands," he said.

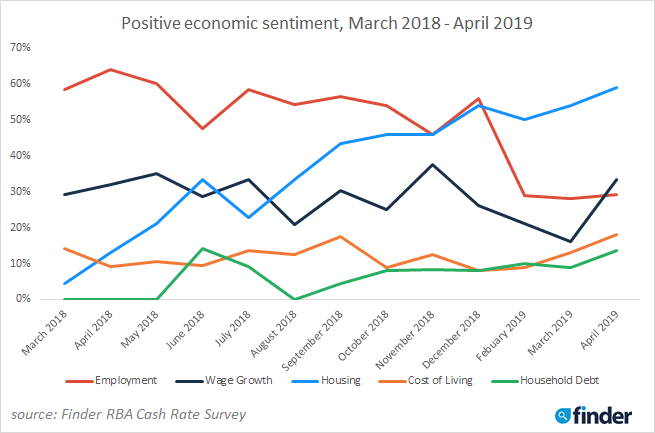

Results from Finder's Economic Sentiment Tracker, which gauges 5 key indicators – housing affordability, employment, wage growth, cost of living and household debt – have all tipped more positive this month, highlighted by housing affordability.

Introduced in March 2018, this month's tracker set an all-time mark for positive economic sentiment in housing affordability (58%) up from last month.

With positive sentiment trending upwards for employment and stronger numbers reported in March, Nerida Conisbee, chief economist of REA Group, said she sees a rate drop coming in the future, but not this month.

"While the likelihood of a cut is increasing, this month is still too early.

"If economic data continues to deteriorate, then we will likely see movement in the second half of the year," Conisbee said.

This feeling is shared by many on the panel with nearly all (35/36) experts and economists forecasting the cash rate to be held at 1.50% on Tuesday (2 April 2019) for the 29th consecutive meeting.

Economist Stephen Koukoulas from Market Economics, predicts the cut will come on Tuesday.

"The economy has slowed, with the per capita GDP recession in the second half of last year probably continuing into 2019.

"Inflation is low and with the household sector under pressure from falling house prices, some policy stimulus is needed," Koukoulas said.

76% of those surveyed expect the next rate change, whenever it does happen, to be a decrease. This belief is consistent with the 75% who held this prediction last month.

Here's what our experts had to say:

Mark Brimble, Griffith University, Hold: "Bias remains to decrease, however it is likely the RBA will hold this month."

Katrina Ell, Moody's Analytics, Hold: "There's no need to tap the easing just yet."

Matthew Peter, QIC, Hold: "The RBA will remain on the sidelines once again at their April meeting, but market pressure is building for a cut. If the RBA can withstand market pressure for a further six months, many of the current headwinds generating recession fears – trade wars, euro growth, Brexit, Australian housing market downturn – are likely to have receded and the RBA can avoid cutting rates. This is important as the RBA risks being trapped, along with the Fed, ECB, BOJ, in a low cash rate setting that limits the effectiveness of monetary policy."

Mark Crosby, Monash University, Hold: "Indications from the RBA are to hold for longer, labour market surprised on the strong side."

Alex Joiner, IFM Investors, Hold: "The RBA is cognizant of the recent weakening in the hard and higher frequency data flow, however there has not been enough weakness to serve as a catalyst for it to ease monetary policy in the short term. Importantly, labour market performance is so far holding up very well as while this is the case the RBA can see a path to better wages growth and higher rates of inflation"

David Bassanese, BetaShares Capital, Hold: "Unemployment is still low."

Stephen Koukoulas, Market Economics, Decrease: "The economy has slowed, with the per capita GDP recession in the second half of last year probably continuing into 2019. Inflation is low and with the household sector under pressure from falling house prices, some policy stimulus is needed."

Dr Andrew Wilson, My Housing Market, Hold: "Although momentum and expectations for a near-term rate cut has intensified, the latest labour market data would have bolstered the RBA clear resolve to leave rates on hold at least for April given the Bank's continued reference to employment data as the key measure for rate consideration."

Trent Wiltshire, Domain, Hold: "The RBA has shifted to a more dovish stance but are not willing to cut until they see a weaker labour market."

Jacqueline Dearle, Mortgage Choice, Hold: "Borrowers hoping for a rate cut on April 2nd will be disappointed, with the Reserve Bank of Australia unlikely to shift the official cash rate that's been anchored at 1.5% since 2016. Despite unemployment remaining low, wages remain low and there has been subdued growth in the Australian economy. In addition, we are now experiencing a "per-capita" recession for the first time in 13 years which may prolong soft household spending. These economic factors, plus a decline in dwelling investment driven by the tightened lending environment will also be weighing on RBA decision making."

David Robertson, Bendigo and Adelaide Bank, Hold: "Not enough evidence yet of the need to add monetary policy stimulus, however pressure for RBA rate cuts may increase in the H2 as the global economy slows."

Sean Langcake, BIS Oxford Economics, Hold: "Monetary policy remains very accommodative. Domestically, there has been very little new data in the last month, and none would cause the Bank to change its course."

Tim Nelson, Griffith University, Hold: "No material change in conditions since last meeting."

Malcolm Wood, Bank of America Merrill Lynch, Hold: "Growth indicators moderating and inflation below target band."

John Caelli, ME Bank, Hold: "The Reserve Bank is likely to hold rates for the near future. Despite slowing growth, a recent fall in unemployment numbers provides the RBA more time to assess the data before deciding if a rate cut is necessary."

Leanne Pilkington, Laing+Simmons, Hold: "There's still no trigger significant enough to warrant an adjustment to the cash rate at this time. Labor's proposed changes to negative gearing and CGT have the potential to impact the market considerably so we see the RBA leaving rates steady at least until the Federal election result is decided."

Brian Parker, Sunsuper, Hold: "RBA will probably wait for more labour market data before deciding whether to ease or not."

Nerida Conisbee, REA Group, Hold: "While the likelihood of a cut is increasing, this month is still too early. If economic data continues to deteriorate, then we will likely see movement in the second half of the year "

Michael Witts, ING, Hold: "Ahead of the Budget there is no need for the RBA to take action. In addition the labour market remains strong."

Janu Chan, St. George Bank, Hold: "The growth outlook is looking increasingly weaker than what the RBA had forecast. However, the labour market is a key focus for the RBA. While it continues to show strength, the RBA would seem reluctant to lower rates."

Tim Reardon, Housing Industry Association, Hold: "Unemployment – which the RBA has made clear is crucial to their decision-making – remains low."

Jonathan Chancellor, Property Observer, Hold: "The RBA won't be rushed into their next move."

Nicholas Gruen, Lateral Economics, Hold: "Because the economy has stalled, they really should cut, but they are flying by the seat of their pants so can't really decide what to do."

Shane Oliver, AMP Capital, Hold: "While the threat to growth and inflation from the housing downturn (via reduced construction activity and negative wealth effects) is such that the RBA should (and might) cut interest rates on Tuesday in order to get in before unemployment starts rising the most likely scenario is that they will continue to hold. The RBA probably needs to see more evidence that the slowdown seen in the second half last year is not just temporary, that consumer spending is under serious threat and that this will drive higher unemployment and lower for longer inflation. It will probably also want to see what sort of fiscal stimulus comes out of the budget and the Federal election outcome. So rate cuts are probably still several months off."

Noel Whittaker, QUT, Hold: "Because lowering rates would not solve anything."

Mathew Tiller, LJ Hooker, Hold: "Despite a slight softening, the economy is in relatively good shape, as evidenced by falling unemployment rates, this will see the RBA hold the cash rate steady this month."

Michael Yardney, Metropole Property Strategists, Hold: "While a drop in interest rates would help increase consumer confidence at a time when falling house prices is affecting confidence and spending, the Reserve Bank will be pleased that Australia's unemployment rate has hit an eight-year low, giving it more breathing room and the ability to hold off on cutting interest rates."

Alison Booth, ANU, Hold: "Economic fundamentals don't justify a change."

Alan Oster, NAB, Hold: "Still looking to sort out the different signals from the labour market and activity (e.g. GDP and NAB Survey)."

Peter Haller, Heritage Bank, Hold: "Employment growth is sufficient to offset fears the RBA may have related to falling property prices."

John Hewson, ANU, Hold: "Still waiting for more data on weakening economy against latest unemployment number."

Debra Landgrebe, Gateway Bank, Hold: "They have indicated a neutral bias, and we need to see further deterioration or slowing of growth to see them shift to an easing bias."

Andrew Reeve-Parker, NW Advice Pty Limited, Hold: "Economic data doesn't require immediate adjustment of rates."

Other participants: Bill Evans, Westpac; Ben Udy, Capital Economics.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel