5 common investing mistakes and what you can learn from them

Everyone makes mistakes while investing, but here is how you can avoid the 5 most common ones.

Sponsored by Pearler – the app helping everyday Australians invest in ASX shares on your own HIN, add US shares or micro-invest in 8 simple funds tracking popular ETFs. Set & forget with round-ups and regular deposits. Pearler Investments Pty Ltd is a Corporate Authorised Representative (No. 1281540) of Sanlam Private Wealth (AFSL 337927).

Sponsored by Pearler – the app helping everyday Australians invest in ASX shares on your own HIN, add US shares or micro-invest in 8 simple funds tracking popular ETFs. Set & forget with round-ups and regular deposits. Pearler Investments Pty Ltd is a Corporate Authorised Representative (No. 1281540) of Sanlam Private Wealth (AFSL 337927).

Sponsored by Pearler – the app helping everyday Australians invest in ASX shares on your own HIN, add US shares or micro-invest in 8 simple funds tracking popular ETFs. Set & forget with round-ups and regular deposits. Pearler Investments Pty Ltd is a Corporate Authorised Representative (No. 1281540) of Sanlam Private Wealth (AFSL 337927).

Investing can be one of the most rewarding financial decisions anyone can make. But there's no such thing as the perfect investor, with even the very best making mistakes from time to time.

Instead, investing should be seen as a journey, as you continue to build your knowledge you'll hopefully make fewer mistakes.

And while some lessons you'll have to learn on your own, Finder, with the help of Australian investment platform Pearler, has come up with 5 common mistakes and how to avoid them, to help kickstart your investing journey.

Your neighbour/friend told you it's a hot stock

We've all been there.

You're at the pub with one of your friends and they are telling you about some hot stock that you've probably never heard of.

Worse still, you follow the advice, only for the share to consistently fall.

While speaking about investing with your friends and family is a great way to get ahead, unfortunately nobody cares as much about your money as you do. As such, you should always do your own research before purchasing any share.

Assuming investing is not for you

It's often thought that investing is only for rich, boring and old people, but this stereotype is changing.

In fact, younger people, especially women are now entering the market.

New research from Pearler shows that millennial women are picking up share investing at the same rate as men, despite having to overcome a 36% wage gap based on the earnings data for its 50,000+ accounts.

This is especially true for millennials and gen Z, who have joined financial independence, retire early (FIRE), looking to take control of their finances and leave the workforce should they choose to do so.

"We've seen financial independence blow up as a theme for young people, particularly women, who are becoming more proactive in dealing with historical hurdles like lower wages, minimum cheque sizes, access to education and support," Pearler's head of product Ana Kresina said.

Investing also doesn't mean you need to buy assets that will do harm to the world. These younger investors are particularly favouring ESG funds, with women especially looking to align their values with their dollars.

"What we are hearing and then seeing in the data is that younger investors, especially women, want to make more ethical investment choices when considering their future – it's something certain investors feel very strongly about," she said.

Falling in love with a company

It's no secret that choosing to buy equity in a company is a personal process that involves weighing up the business's share price, its future outlook and your own personal risk appetite.

This process of identifying the right opportunities can be time-consuming.

But just because you've put in the work doesn't mean you should fall in love with the company. In fact, this is one of the most common mistakes investors will make.

Too often, when we see a company we've invested in do well, it's easy to fall in love with it and forget that we bought the stock as an investment.

While constantly buying and selling shares can be a losing strategy, holding onto businesses that have peaked just because they have performed in the past is an easy way to limit your upside.

Attempting to time the market

There's an old investing saying, "time in the market beats timing the market".

The concept is closely related to the idea of dollar-cost averaging, meaning you consistently add to the market based on time instead of share price.

Unfortunately, nobody knows exactly when a market will bottom out. As such, trying to time it can be incredibly difficult.

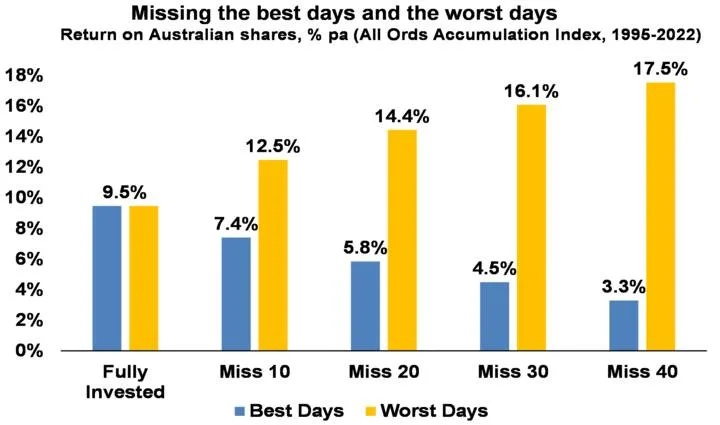

Worse still, a study by AMP shows missing the best 40 days on the market between 1995 and 2022 will see your returns fall to 3.3% per annum compared with the market average of 9.5%. It's also worth noting, the opposite is also true, miss the worst 40 days and your returns increase to 17.5%

To facilitate positive investing habits, some brokers have tools like round-ups and auto-invest schedules plus fractional investing (all available in the Pearler app).

Source: Bloomberg, AMP

Putting all your eggs in one basket

Another unfortunate mistake many investors make is being overconfident in a single investment and putting all their eggs in one basket.

When times are good for the investment, you'll likely outperform, but when things fall, only having shares in a single company becomes incredibly risky.

And while having conviction in a share will serve you well during times of volatility, it's important to diversify as even the best investors get a single share wrong.

Instead of putting the majority of your money into a single investment, you could take a basket approach, meaning you would own a number of shares and exchange-traded funds (ETFs). Or platform-based themed funds that track ETFs, like Pearler Micro.

If nothing else, ETFs can protect you from yourself. During times of volatility, not only will it help protect your assets but it will make you less likely to sell after a price drop, which is often the worst possible time.

Get started with Pearler

Sponsored by Pearler – the app helping everyday Australians invest in ASX shares on your own HIN, add US shares or micro-invest in 8 simple funds tracking popular ETFs. Set & forget with round-ups and regular deposits. Pearler Investments Pty Ltd is a Corporate Authorised Representative (No. 1281540) of Sanlam Private Wealth (AFSL 337927).

Sponsored by Pearler – the app helping everyday Australians invest in ASX shares on your own HIN, add US shares or micro-invest in 8 simple funds tracking popular ETFs. Set & forget with round-ups and regular deposits. Pearler Investments Pty Ltd is a Corporate Authorised Representative (No. 1281540) of Sanlam Private Wealth (AFSL 337927).

Sponsored by Pearler – the app helping everyday Australians invest in ASX shares on your own HIN, add US shares or micro-invest in 8 simple funds tracking popular ETFs. Set & forget with round-ups and regular deposits. Pearler Investments Pty Ltd is a Corporate Authorised Representative (No. 1281540) of Sanlam Private Wealth (AFSL 337927).

Compare other micro investing apps here