How can I keep my credit score going up?

What makes your credit score rise, and what can you do to help?

First, let's quickly revisit the basics. Your credit score is used by banks and other financial institutions to help decide whether you're eligible for loans and credit cards.

A healthy credit score makes it more likely you'll be approved, though it isn't the sole factor in that decision. Finder consumer surveys found that 21% of Australians who applied for a credit card were rejected because of a bad credit score.

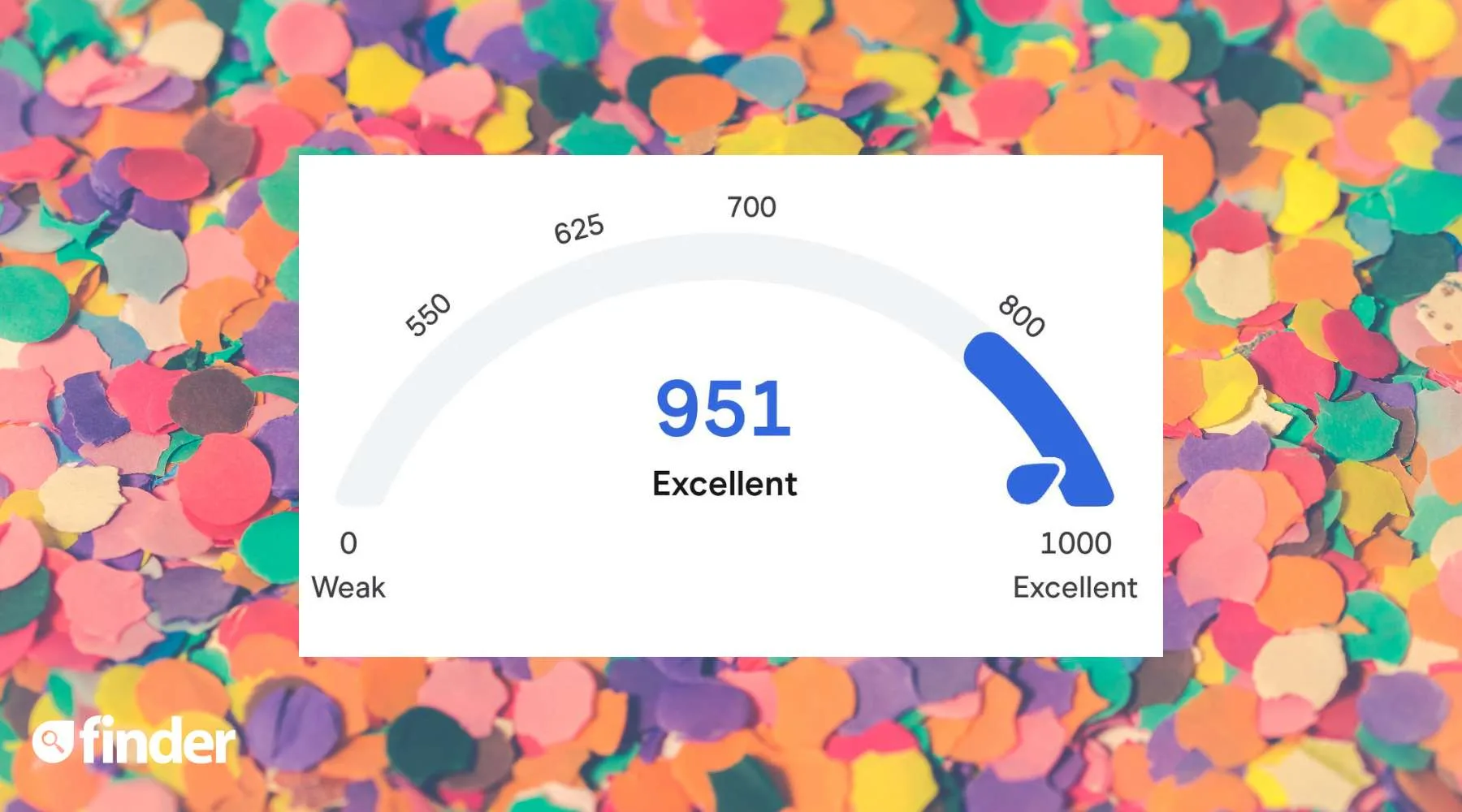

Here's the percentage of folks in each of the Experian credit score ranges:

| Score rating | Score range | % of people |

|---|---|---|

| Excellent | 800-1000 | 15% |

| Very good | 700-799 | 46% |

| Good | 625-699 | 18% |

| Average | 550-624 | 6% |

| Below average | 0-549 | 15% |

What makes your credit score go up?

As our detailed Finder guide to credit scores in Australia explains, there are a number of different activities which can result in your credit score increasing:

- Making timely repayments. Your credit report tracks 2 years of repayments. So if you missed a repayment two years ago (but it was paid eventually), your score may go up once that two-year period has passed.

- Taking out a credit card or loan. This provides an uptick to your score, as the fact you've been approved is a positive signal. However, that doesn't mean applying for multiple cards will improve your score, as we'll explain shortly.

- Repaying a default. If a defaulted payment is cleared (most likely because you've finally paid it), that can increase your score.

- Defaults and other negative data being removed from your credit report. Inaccurate information can sometimes end up on your credit report. If that information is removed, your score can go up.

A key principle to absorb here. If you're paying your bills, credit card debts and loans on time, it's likely you'll have a good credit score, but it won't be changing very often.

Paying all bills on time, clearing your credit card balance and checking your credit report for errors can all potentially make your score go up.

However, that doesn't mean you'll see a new score every single month. Your credit score tracks long-term behaviour and can take time to adjust to changes in your behaviour.

One common mistake? Thinking that applying for multiple credit cards or loans will improve your score. The reverse is true. Multiple card applications can raise a red flag, since they increase your total pool of potential debt. And if you're rejected for a card, that isn't a positive signal either.

A good credit score comes from solid basic money habits: not spending more than you have and paying your bills promptly. Over time, that will lift your score, but you won't necessarily see changes every month.

Should I be trying to get my credit score higher?

If your credit score is under 700, then increasing it can improve your chances of being approved for loans or credit cards. In that case, paying off all existing debts and living within your means, thus demonstrating you're potentially a responsible borrower, makes sense.

However, if you're above 700 (the "Very good" range) and especially above 800 (the "Excellent" range), the difference may be less evident. If you already have a very good or excellent credit score, you're likely to be eligible for most loans and cards.

Remember that a credit score isn't a one-stop score that sums up your financial health. It's a calculation lenders use to try and minimise their own risk.

Good money habits have real benefits, but you shouldn't treat your credit score as a complete for how well your finances are going.

In short? Your credit score isn't like your ranking in Duolingo or Pokémon. It won't change constantly, and there aren't easy ways to game the system to increase it.

But managing your money sensibly ensures your credit score will stay high and grow over time, and helps position you for a more prosperous future.

Note: We updated this guide in January 2024 with additional data on credit scores.