Polygon is a Layer-2 (L2) scaling solution designed to improve the adoption of the Ethereum blockchain.

Ethereum has quickly become the go-to blockchain for decentralised application development. It has facilitated the creation of much of the cryptocurrency industry we see today. However, due to its current proof-of-work consensus mechanism, Ethereum suffers from network congestion, slow transaction speeds and low throughput. This has often led to high transaction fees (gas fees) for users.

Polygon, originally known as Matic, solves these issues by offering a platform where developers and consumers benefit from L2 scaling solutions.

In this guide we will look at what Polygon is, how it works and how to use it for DeFi applications (including step-by-step instructions). If you just want to buy the Polygon token (MATIC) instead, then jump to the table to compare your options.

How to use Polygon for DeFi

Polygon has quickly become a prominent feature of several DeFi protocols, and more platforms are adopting it each day. As such, Ethereum users who want to get the most out of their DeFi experience (such as low fees and fast transaction times) will need to learn how to use Polygon.

This requires moving existing funds from Ethereum over to the Polygon network.

To do this, you will need a Web 3.0 digital wallet and about 15 minutes of spare time like the MetaMask browser wallet.

How to move funds on to Polygon (step-by-step)

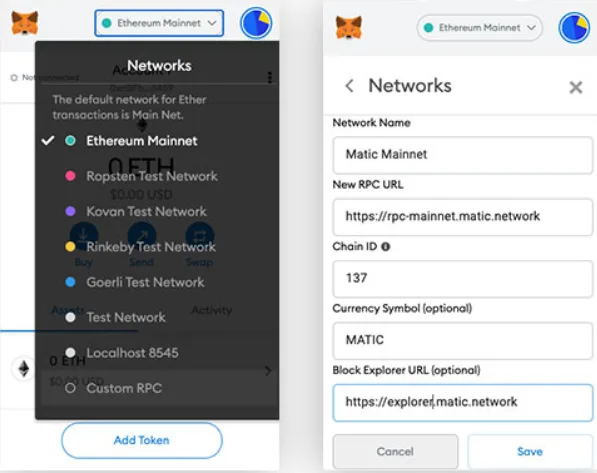

Step 1. Connect MetaMask to Polygon. To transfer funds from the Ethereum blockchain to the Polygon blockchain you must first make MetaMask compatible with the Polygon blockchain. In your MetaMask wallet click the "Ethereum Mainnet" symbol at the top centre of the page. In the dropdown list, choose the Custom RPC option.

Enter the details as shown in the screenshot below and click "Save".

This is also a text copy of the details:

- Network Name: Matic Mainnet

- New RPC URL: https://rpc-mainnet.maticvigil.com/

- Chain ID: 137

- Currency Symbol (optional): MATIC

- Block Explorer URL (optional): https://explorer.matic.network/

Once confirmed, your MetaMask wallet will now be able to communicate with the Polygon blockchain. An option for "Matic Mainnet" should now appear within your Network list.

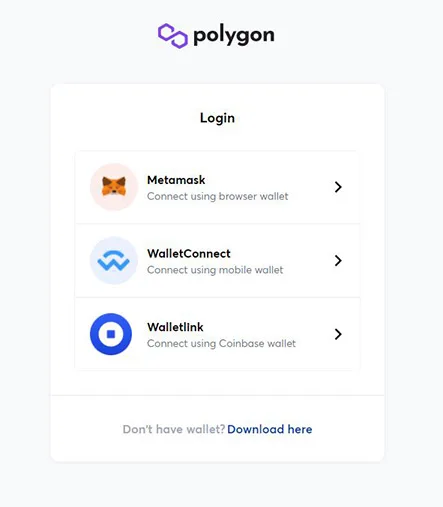

Step 2. Head to the Polygon v2 web wallet. All of the funds within MetaMask will initially be sitting within the Ethereum wallet. To transfer funds on to the Polygon blockchain you need to log on to the Polygon v2 web wallet.

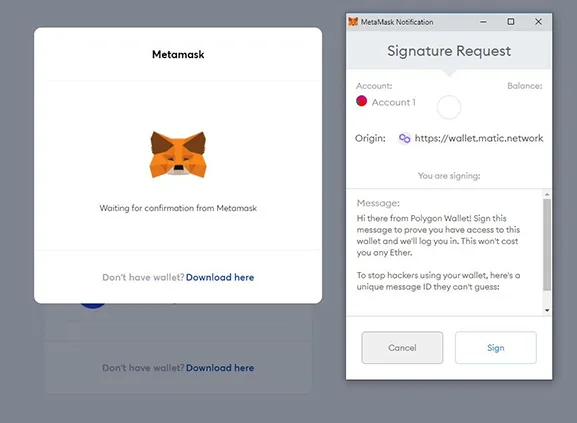

Step 3. Connect MetaMask to Polygon web wallet. Before accessing the site you will be prompted to connect your Web 3.0 digital wallet. In this example we would click on MetaMask. A prompt will open from your MetaMask asking for confirmation of connection. Click "Sign".

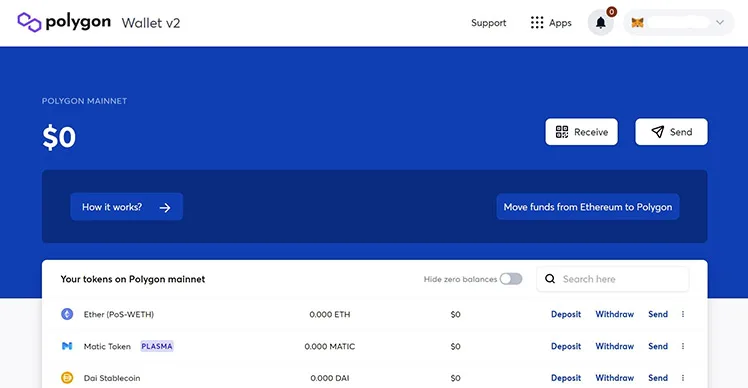

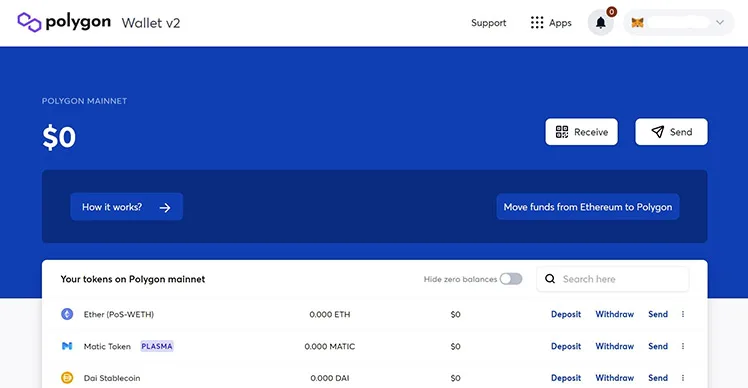

Step 4. Polygon v2 web wallet. After connecting your MetaMask wallet to the Polygon v2 web wallet, the Polygon v2 web wallet will open in your web browser. Now you need to move funds from the Ethereum blockchain to the Polygon blockchain. In the window click "Move funds from Ethereum to Polygon".

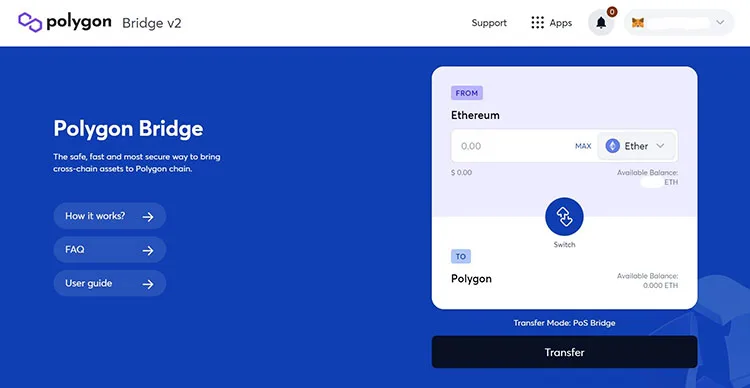

Step 5. Transfer funds from Ethereum to Polygon using the Polygon Bridge. The Polygon Bridge enables users to deposit funds from the Ethereum blockchain to the Polygon blockchain. You need to have either ETH or ERC-20 tokens in your Ethereum mainnet MetaMask wallet. On the Polygon Bridge screen, select the cryptocurrency you would like to transfer and enter the amount.

Note: The "Transfer Mode" used for transferring funds to Polygon is the PoS, or proof-of-stake, bridge. The proof-of-stake bridge takes approximately 7-8 minutes to transfer funds to the Polygon blockchain.

Once you're happy with the amount, click "Transfer". The following popup will outline the estimated time for the transaction. Click "Continue".

Step 6. Confirm transaction. The last prompt will highlight the Ethereum gas fees required to move funds from your Ethereum wallet to Polygon. Click "Confirm". Once the transaction is confirmed, it will take roughly 7 minutes for them to be confirmed in your Polygon address. The funds will then appear within your Polygon v2 web wallet.

Once you have funds on the Polygon blockchain you can begin using them with either Polygon or Ethereum-based DeFi applications. This can significantly reduce your transaction fees.

Using funds from your Polygon wallet

Once you have successfully connected your MetaMask wallet with Polygon, and deposited funds on to the Polygon blockchain, those funds can be utilised on any application associated with the Polygon blockchain or on any compatible Ethereum DeFi application. As funds are being distributed using the Polygon Layer-2 solutions, transaction fees are considerably less than if the same transaction was taking place on Ethereum.

Note: To perform transactions on the Polygon blockchain a user must hold MATIC tokens within their Polygon wallet. The MATIC tokens are required for gas fees on the network. If you don't own any MATIC yet, jump to the table to compare exchanges that trade MATIC.

For each Ethereum DeFi application that a user connects their Polygon wallet to, a user must also be on the Polygon-version of that application. For example, the lending and borrowing protocol AAVE has an AAVE-Polygon version.

Below are just a few examples of where funds from a Polygon wallet can be used:

- Swap and provide liquidity on QuickSwap.

- Borrow and lend on AAVE.

- Provide liquidity on Curve.

- Swap, provide liquidity, lend and borrow on SushiSwap.

How to move funds on to Polygon using an exchange

Some exchanges will let you withdraw funds directly off the exchange onto Polygon, which in some cases may save you on gas fees compared to using the method described above. If Ethereum network fees are high, then using an exchange may be the cheaper option if the exchange offers a fixed-rate withdrawal fee.

At the time of writing these were the fees for transferring the following assets using Ascendex, versus using the Polygon Bridge.

| Polygon Bridge | Ascendex | |

|---|---|---|

| MATIC | US $8.60 | 2 MATIC (US $3.0) |

| ETH | US $8.60 | 0.1 ETH (US $23.44) |

| USDC | US $8.60 | 20 USDC (US $20) |

As you can see, whether or not it is cheaper to use an exchange depends on the specific coin, and the price of gas at the time of writing. As suggested by the data above, this method may be useful when network congestion is high, but more expensive when congestion is low.

How to move funds off Polygon

Step 1. Polygon v2 web wallet. To withdraw funds from the Polygon blockchain back to the Ethereum blockchain, head back over to the Polygon v2 web wallet.

Click "Withdraw" next to the cryptocurrency you wish to transfer.

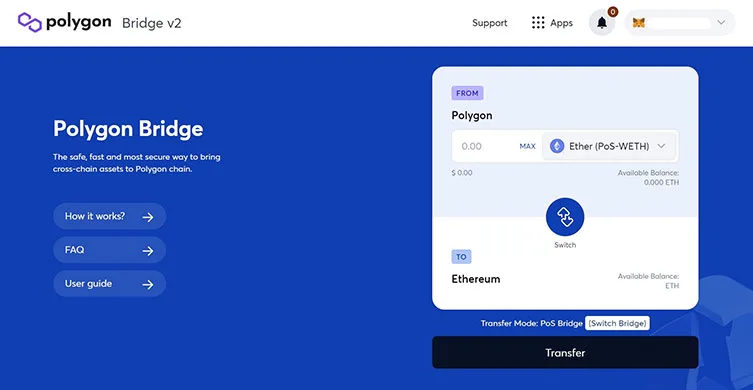

Step 2. Polygon Bridge. By clicking "Withdraw" it should take you back to the Polygon Bridge. The Polygon Bridge should now indicate the option to enter an amount you would like to transfer back to Ethereum. Enter the amount and click "Transfer".

Note: When using the Polygon Bridge to withdraw funds, users have 2 options for "Transfer Mode". These include PoS (proof-of-stake) and Plasma. The proof-of-stake bridge takes approximately 1 hour for a transfer back to the Ethereum blockchain and is the quickest option. The Plasma bridge can take up to 7 days.

Step 3. Confirm the transaction. After clicking "Transfer", you will be prompted to approve the associated gas fees and eventually asked to sign off on this transaction in your MetaMask wallet.

Once the transaction is confirmed, funds will be transferred back across to your Ethereum wallet. These funds can then be used again directly on the Ethereum blockchain.

What is Polygon?

Polygon was originally launched in 2017 as the Matic Network. The focus of Matic was to tackle the scaling solutions of the Ethereum blockchain.

The original Matic blockchain implemented a scaling solution termed More Viable Plasma, an improved version of the plasma scaling solution that was first developed by Ethereum's co-founder, Vitalik Buterin. The method works by using proof-of-stake (PoS) sidechains to process transactions off Ethereum's main chain. The integration with Ethereum allowed for quicker transaction times and improved usability on all decentralised apps (dApps) built on the Ethereum network.

Although designed initially for Ethereum, the intention of Matic was for it to be compatible with any Layer-1 blockchain. Matic even allowed developers to build dApps directly on the Matic sidechains and take advantage of the improved features.

However, in February 2021, the development direction pivoted and the team rebranded to Polygon. Instead of a simple scaling solution, Polygon is now designed as a platform that developers can use to launch interoperable blockchains. With interoperability with Ethereum, it hopes to become Ethereum's Internet of blockchains.

Polygon allows for the interoperability between several scaling technologies and is quickly becoming one of Ethereum's main L2 solutions. It enables different blockchains to communicate with one another, as well as the Ethereum main chain.

Polygon hopes to one day open and connect the world of blockchain networks. Often blockchains can be very independent ecosystems. Polygon aims to create a larger ecosystem of multiple blockchains that all benefit from the higher throughput, lower fees and quicker transaction times of the scaling solutions.

How does Polygon work?

Polygon is a platform that developers can launch blockchains from. Developers can utilise multiple modules, which when combined can be used to form the framework of the chosen blockchain. Each blockchain can be built from 2 chain types: secured or stand-alone.

Stand-alone blockchains are in charge of their own security. They must implement their own validators to validate transactions and secure the network. The flexibility and independence of this option comes at the risk of implementing validators initially.

Secured blockchains are provided security as a service. This is provided either via Ethereum or via a shared pool of validators from the Polygon network. Secured chains don't need to establish their own set of validators.

While secured chains benefit from the original Matic Plasma L2 solution, stand-alone chains benefit from the original Matic proof-of-stake sidechain. Every blockchain created on Polygon benefits from increased speed and throughput. In the future, the network is planning to offer several other L2 scaling solutions for developers. These include: rollups, sidechains, plasma and channels.

With regards to Polygon's architecture, it can be thought of as 4 different layers.

- The first is the Ethereum layer. Blockchains built on the Polygon network can all "lean" on the Ethereum network for its security if required.

- The second is a Security layer. This layer is offered in a secured chain. It offers a set of validators to validate transactions if required. The Ethereum layer and Security layer are optional for developers.

- The third is the Polygon networks layer. This is the layer utilised by all blockchains created by the Polygon platform. It allows for interoperability.

- The fourth is the Execution layer. The Execution layer hosts on-chain and off-chain smart contracts and provides functionality to decentralised applications.

Layer-2 scaling solutions on Polygon

L2 solutions are blockchains, or sidechains, built on top of a Layer-1 network, such as Ethereum. It is a collective term for solutions that help with increasing the capabilities of Layer-1 networks. Most achieve this by handling the majority of transactions off-chain (off the Layer-1 blockchain). The 2 main capabilities that can be improved are transactions per second, and transaction throughput. L2 solutions can also help reduce gas fees, a problem Ethereum has greatly suffered with over the years.

In the future Polygon will host the following L2 solutions:

- Rollups. Rollups bundle or roll up sidechain transactions into a single transaction and generate a cryptographic proof known as a SNARK (succinct non-interactive argument of knowledge). Only the proof is submitted to the main chain. All transactions are handled off-chain. There are 2 types of rollups due to be implemented on Polygon: zkRollups and Optimistic rollups.

- Sidechains. Sidechains are independent Ethereum-compatible blockchains with their own consensus mechanisms and block parameters. This interoperability is made possible by using the same EVM (Ethereum Virtual Machine). Smart contracts that are deployed to Ethereum can be directed to the sidechain.

- Channels. Channels allow participants to exchange their transactions several times while only submitting two transactions to the base layer. The most popular types of channels are state and payment channels.

- Plasma chains. Plasma chains leverage the use of smart contracts to create an unlimited framework of child chains. Only snapshots from the Plasma chain are then sent to the main chain for validation.

What does MATIC token do?

Although the Matic Network rebranded to Polygon in February 2021, the Polygon network's native cryptocurrency token is still called MATIC. The MATIC token is used for a variety of purposes in the Polygon network. MATIC token holders can vote on various governance-related issues and improve the security of the network via staking. The MATIC token is also used for gas fee (transaction fee) payments.

The maximum supply of MATIC tokens is 10 billion. In order to participate in governance issues, you must hold MATIC tokens in your wallet. You can buy MATIC tokens from the following exchanges below, or read our full guide about how to buy MATIC.

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseOther Layer-2 scaling protocols

Polygon seeks to integrate several scaling solutions into its protocol to help reduce friction as well as transaction fees. However, it's important to take a look at how other scaling solutions are being implemented by other L2 protocols. These L2 protocols are also trying to tackle the inefficiencies of blockchains like Ethereum.

Loopring

In development since 2017, Loopring is a L2 platform that facilitates the development of decentralised applications through the use of rollups, more specifically zkRollups. ZkRollups (zero-knowledge rollups) bundle transactions together and store them in an off-chain database. They are very fast and provide a much greater level of efficiency. However, they do not provide an easy way for the existing smart contracts to migrate to L2. The first decentralised exchange was launched on the Loopring platform in 2020.

Optimism

With a soft-launch in early 2021, the Optimism protocol is another L2 solution for Ethereum. Unlike Loopring, Optimism implements Optimistic Rollups. These run an Ethereum-compatible VM called OVM (Optimistic Virtual Machine). The OVM allows execution of the same smart contracts that are executed on the Ethereum blockchain. It makes it easier for the existing smart contracts to maintain composability. The DeFi platform Synthetix has integrated with the solution.

Arbitrum

Like Optimism, Arbitrum leverages Optimistic Rollups, but uses Solidity as its developer code. Solidity is completely Ethereum compatible, and uses the main Ethereum blockchain security model. It aims to help improve the speed and complexity of any Ethereum smart contract. The project has been in a testing phase from 2020 and recently launched its official mainnet in May 2021.

Risks of using Polygon

Whilst generating a huge amount of interest in the last year and lowering transaction costs considerably for consumers, there are certain risks associated with the Polygon network.

The most prominent risk associated with Polygon comes down to centralisation. Like many DeFi protocols, Polygon uses multi-signature (multi-sig) wallets. Multi-signature technology is a way of adding security to cryptocurrency transactions by requiring more than one user to sign a transaction before it can be broadcast. Recently an overly centralised multi-sig wallet was spotted on Polygon. This specific wallet grants access to make changes to the underlying code, such as updating staking contracts and other important features.

It was discovered that the wallet used a 2/3 scheme. This means it only required 2 people to agree in order to make changes. Effectively, the code for governing Polygon was in the hands of just 2 people.

The wallet has now been upgraded to 5/8 scheme, however, 4 of the signatures required are from Polygon founders. This poses a centralisation risk. It allows for a small number of people to overwrite the underlying code and introduce changes to the protocol. At Finder, we are concerned with this potential attack vector, as it could lead to undesirable modifications to the underlying code.

Our Verdict: Should you use Polygon?

Polygon is living up to its Layer-2 promises and is certainly receiving the most attention out of all Layer-2 solutions. It is an extremely interesting project and has quickly taken the lead in Ethereum's scaling race.

The goal of becoming Ethereum's Internet of blockchains is quickly materialising. Announcements of new partnerships are made nearly every day, and it is already being used by a large number of established projects.

Although its governing multi-sig wallet is a concern, Polygon is a superb protocol. It is quickly gaining traction within the developer community, and for DeFi users its quick speed and low fees offer relief from Ethereum's congestion woes. Its all-encompassing integration with other protocols leaves our analysts eager to continue using its platform.

Pros:

- Improves on Ethereum's limitations. Polygon offers quick speeds and extremely low costs

- Interoperability. The Polygon platform allows different blockchains to work together.

- Partnerships. Polygon has managed to attract a large number of enterprise partnerships.

- Accessibility. It offers one of the most interesting infrastructures for developers.

Cons:

- Centralisation. High risk of centralisation for governing multi-sig wallet.

- Ethereum fees. Still requires high Ethereum fees to deposit and withdraw cryptocurrencies from the Polygon blockchain.

Ask a question

More guides on Finder

-

What is a DAO? Decentralised Autonomous Organisations explained

DAOs are already replacing traditional business models and revolutionising the world of investing. Find out how they work and how to invest.

-

DeFi coins and tokens: A simple guide for beginners

DeFi tokens compose a prominent sector in the cryptocurrency markets. Learn the basics of these tokens here.

-

What is impermanent loss?

Impermanent loss can be an unforeseen risk when providing liquidity to DeFi. Here we explain what it is with an easy to follow example, and outline how it can be avoided.

-

Yield farming: A beginner’s guide

Put those cryptocurrency assets to work in the DeFi sector and earn yield with yield farming.

-

DeFi and Web3 wallets in Australia

Find out how a Web 3.0 wallet can allow you to access the world of DeFi, plus discover which wallets we recommend.

-

Liquidity Pools: The backbone of DeFi

Find out how to become a liquidity provider and how liquidity provider tokens can be used.

-

What is an automated market maker?

Discover what an automated market maker is in DeFi and what it offers in comparison to the traditional market-making system.

-

The ultimate guide to decentralised exchanges (DEXs)

A comprehensive guide to decentralised cryptocurrency exchanges, how they work and the benefits they offer to anyone looking to buy or sell digital currency.