- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

16.7 million Aussies are clueless about the cash rate

- 13% think the cash rate is between 5% and 10%

- Household mortgage debt is now at $1.7 billion

- Learn how to negotiate a better rate

13 August, 2019, Sydney, Australia – New research by Finder, Australia's most visited comparison site, shows Australians are in the dark about the current cash rate despite it reaching record lows.

The official cash rate plummeted to 1.0% in July after the Reserve Bank announced its decision to cut the rate for a second time in 2019.

But the survey of 1,002 respondents shows 86% – equivalent to 16.7 million Aussies – are oblivious to the new rate despite household mortgage debt sitting at $1.7 billion.

Bessie Hassan, money expert at Finder, said knowing the cash rate is crucial for anyone wanting to get ahead with their mortgage.

"Even the smallest change to the cash rate can end up saving you tens of thousands of dollars over the life of your loan.

"If borrowers fail to keep tabs on cash rate movements, they could be missing out on a golden opportunity to save big money by either negotiating a better rate or looking elsewhere."

The research found that the majority of Aussies (56%) think the cash rate is higher than it is, with 13% assuming it to be between 5-10%.

One in three (30%) Aussies believe the cash rate to be lower than it is. Just 10% of women and 18% of men could identify the correct cash rate.

Hassan said that economic ignorance is costing Australians.

"Keeping informed means knowing which direction rates are going. Next step is knowing how this impacts the interest on your mortgage.

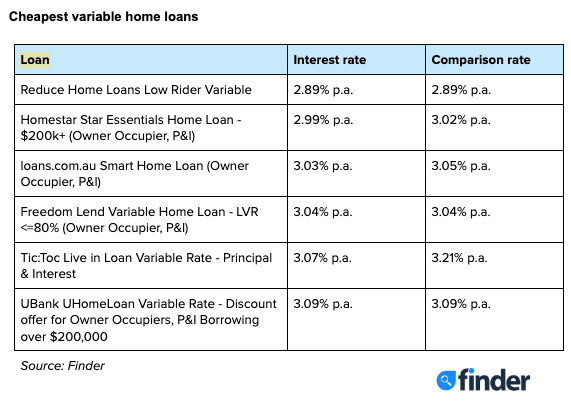

"Take a look at your current interest rate and compare it to what's being offered across the board. If it isn't up to scratch, it may be time to refinance."

How to negotiate a better rate

- Do your research. It's important to know what other rates are available on the market before asking your lender to match them. This includes rates for new and existing mortgage customers.

- Ask your lender to match your offer. Go to your lender with two or three rates that you've found elsewhere, and don't be afraid to haggle.

- Be prepared to refinance. If your lender won't meet your desired rate, start shopping around for one who will. Keep in mind that various fees may apply, so be sure to factor this into your decision.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel