- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

China on my mind: Experts concerned about overseas relations as rate holds

- 96% of experts and economists believe the RBA will hold the cash rate tomorrow

- 27% tipped the US-China trade deal as a top concern for the Australian economy

- Economic sentiment tips higher across key indicators following second rate cut

5 August, 2019, Sydney, Australia – The Reserve Bank of Australia (RBA) is set to return to a holding pattern tomorrow (6 August 2019), leaving the cash rate at 1.00%, according to Finder, Australia's most visited comparison site.

In this month's Finder RBA Cash Rate Survey – the largest of its kind in Australia – 44 of the 46 experts and economists (96%) predict the board will sit on its hands at the August meeting to let the June and July cuts trickle through the economy.

Almost all experts (92%, 38*) expect the next cash rate move will be a cut. Nearly half (49%, 21) are predicting a final low of 0.50%, while a third (35%, 15) believe it will bottom out at 0.75%.

But the holding pattern may not last long; the most popular months cited for another cash rate cut are November (35%, 17) followed by October (23%, 11).

Graham Cooke, insights manager at Finder, said that with the effects of recent cuts still unrealised, the board is hesitant to cut in three consecutive months.

"The jury's out on the impact of these most recent cuts – it's simply too soon to tell.

"Economists feel slightly more confident that recent cuts will have a positive effect on the economy once given time to roll out. While positivity is generally still low, housing affordability remains the most positive economic element."

"The falling cash rate combined with falling house prices creates a catch-22 for Aussies looking to break into the property market. Buyers will be wanting to take advantage of historically low rates, but also wanting to purchase at the bottom of the market."

Despite US rate cut, economists are focused on China

When asked to indicate their two main economic concerns for Australia right now, decisions by the Federal Reserve in the US ranked towards the bottom of the list, being cited by just three economists (5%).

(Note: some responses were submitted just before the first US cash rate cut since 2008, which saw its lending rate fall to 2.25%.)

Instead, experts tipped international relations like the fate of the US-China trade deal (27%, cited by 17 respondents) and Australian-Chinese trade in general (14%, 9) as massive concerns for the economy, above issues like unemployment, inflation and housing prices.

"What's happening between China, Australia and the US right now could have far more potential impact on Australia than the Fed Reserve," Cooke said.

"If the US and China can finally agree on a trade deal, this may result in US imports replacing Australian ones in some Chinese sectors.

"With Australian beef and dairy being particularly strong trade commodities in this space right now, such a deal could be bad for Aussie farmers, and ultimately our economy."

Peter Boehm of KVB Kunlun said domestic concerns are just part of the equation.

"The impact of international trade negotiations will also play an important role in determining the need or otherwise for another rate adjustment."

Top 10 economic concerns (as of 31 July 2019)

| Rank | Concerns | % |

|---|---|---|

| 1 | The fate of the US-China trade deal | 27% (17) |

| 2 | GDP growth | 17% (11) |

| 3 | Chinese trade | 14% (9) |

| 4 | Housing market | 11% (7) |

| 5 | Unemployment rate | 10% (6) |

| 6 | Underemployment rate | 8% (5) |

| 7 | Inflation | 5% (3) |

| 8 | Federal Reserve decisions | 5% (3) |

| 9 | Aussie dollar | 2% (1) |

| 10 | Brexit | 2% (1) |

Source: Finder RBA Cash Rate Survey™

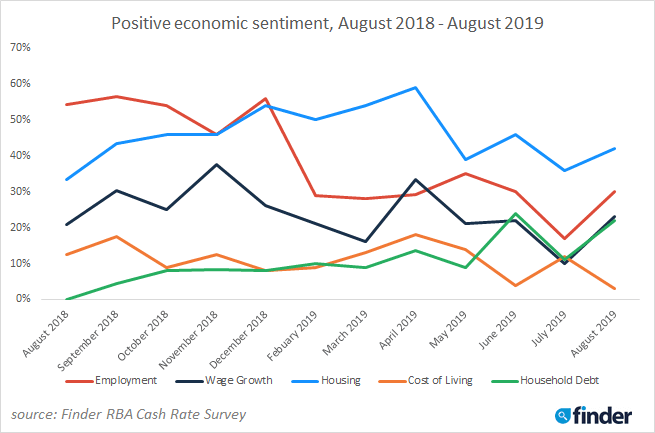

Results from Finder's Economic Sentiment Tracker, which gauges five key indicators – housing affordability, employment, wage growth, cost of living and household debt – show nearly all tipped more positive this month following the second rate cut.

Introduced in March 2018, this month's tracker set an all-time low for economic sentiment in cost of living (3%).

*Please note: While all economists participate in the rate forecast part of the survey, additional questions are optional. Therefore, the number of experts answering each question varies.

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion (Hold): "The RBA has time to observe the impact of the last two rate cuts and upcoming tax cuts before making another reduction later 'if required'."

Shane Oliver, AMP Capital (Hold): "The RBA is now in wait-and-see mode. Basically waiting to see the impact of the rate cuts in June and July and tax refunds for low and middle-income earners."

Alison Booth, ANU (Hold): "Not warranted to have further decrease yet, though I predict one later this year."

John Hewson, ANU (Hold): "The RBA will] wait to see the effects of 50 basis point cuts."

Julie Toth, Australian Industry Group (Hold): "This year has already seen two cash rate cuts, a federal election and a sizeable tax rebate for many households. We should now pause, wait for the effects and then take stock."

Malcolm Wood, Baillieu (Hold): "RBA will wait to assess the impact of its two rate cuts in June and July."

Rebecca Cassells, Bankwest Curtin Economics Centre (Hold): "Moving the cash rate any lower than 1.0% at this point will create further uncertainty in the market, countering any potential benefits and will do little to stimulate investment and consumption responses. Unemployment has held steady as labour force participation continues to climb and inflation has gained some modest ground on the latest figures. Best to hold for the moment."

David Robertson, Bendigo and Adelaide Bank (Hold): "The RBA will probably take the opportunity to pause for a few months to observe the impact of the recent rate cuts, the tax cuts and the lower Australian dollar, all of which should help to a degree. "

Ben Udy, Capital Economics (Hold): "The Bank's tone has been more balanced in recent communications. Therefore, we expect the RBA to remain on hold until the economic data deteriorate further by the end of this year. "

Michael Blythe, CBA (Hold): "RBA in wait-and-see mode and following the labour market trends"

Dr Craig Emerson, Craig Emerson Economics (Hold): "When the RBA changes the cash rate it usually does it in two successive months and then waits to assess impacts."

Tim Moore, CUA (Hold): "With two successive cuts, the RBA will want to stand back and observe the effects while also giving the consumer the time to digest the actions as otherwise at risk of further scaring the consumer around the urgency of the cuts, having the opposite effect to being desired."

Trent Wiltshire, Domain (Hold): "The RBA will want to assess the labour market data and leading indicators of the labour market before committing to further cuts. "

John Rolfe, Elders Home Loans (Hold): "I believe they went too early with the second cut. They now need to 'cool their heels' a little to allow the two cuts to take effect."

Debra Landgrebe, Gateway Bank Limited (Hold): "Further deterioration required to trigger a further cut."

Mark Brimble, Griffith University (Hold): "It is likely the RBA will pause to see the impact of the two decreases and will also want to hold some monetary policy capacity if needed re the global context."

Tim Nelson, Griffith University (Hold): "No material change from the previous month in relation to key data points and the RBA has indicated the time is needed to see if demand growth responds to recent stimulus."

Tony Makin, Griffith University (Hold): "Allow the effects of the last cut to work through."

Peter Haller, Heritage Bank (Hold): "After cutting in June and July, the RBA will pause to see the impact of recent easing and wait for a potential boost in consumer spending resulting from tax return refunds."

Tim Reardon, Housing Industry Association (Hold): "They will wait and observe the impact of two rate cuts on economic growth."

Alex Joiner, IFM Investors (Hold): "The RBA have stressed that further policy accommodation will be forthcoming 'if needed'. This implies that it would like to assess the impact of its initial 50bp of cuts on the real economy and asset prices before moving again."

Michael Witts, ING Bank (Hold): "There is sufficient stimulus in the system already, the RBA will want until they get an idea on the previous easings and the various fiscal and regulatory measures."

Peter Boehm, KVB Kunlun (Hold): "Time is needed for the two previous rate cuts to work their way through the economy. Also, further time is needed to assess the sustained direction of key indicators such as the rate of unemployment and inflation. The impact of international trade negotiations will also play an important role in determining the need or otherwise for another rate adjustment. The elephant in the room is the impact rate cuts are having on wealth inequality, specifically with regard to retirees who have seen their standard of living decline along with the earnings from their savings accounts. At some point, their interests will need to be given more priority when considering rate reductions. I can't see further rate reductions on their own providing the necessary stimulus to the economy – government spending initiatives must now take on a more predominant role. "

Leanne Pilkington, Laing+Simmons (Hold): "Consecutive cuts in the previous two months need time to take effect. The impacts are yet to be felt so another cut now would amount to guess work. The RBA should leave the door open to a further cut down the track once the economy's adjustment to the new 1.00% cash rate is clearer."

Nicholas Gruen, Lateral Economics (Hold): "The Governor is reluctant to lower rates so a pause can be a nod to him."

Geoffrey Harold Kingston, Macquarie University (Decrease - 25 basis points): "1. Breakeven inflation is down to 1.4% p.a. and 2. Dovish comments by RBA Governor last week."

Jeffrey Sheen, Macquarie University (Hold): "Need to wait to see if the Australian economy responds to previous stimulus measures this year."

Stephen Koukoulas, Market Economics (Hold): "Waiting for recent stimulus to impact."

John Caelli, ME Bank (Hold): "With the RBA cutting the cash rate twice in the past few months, we expect them to hold this month as they wait and see what impact the recent changes have had before making their next move."

Michael Yardney, Metropole Property Strategists (Hold): "While the RBA has signalled it is prepared to drop rates further to stimulate employment and boost inflation to within its desired band, it will now wait and see how its two recent rate cuts are working."

Mark Crosby, Monash University (Hold): "This decision will be a close call. The RBA has indicated its willingness to cut further, but the question is whether the next cut will be now or in a month or two."

Katrina Ell, Moody's Analytics (Hold): "Further rate cuts are coming but the central bank will wait to assess the impact of earlier easing."

Jacqueline Dearle, Mortgage Choice (Hold): "Despite Governor Lowe flagging an extended period of low-interest rates and his strong commitment to achieving the inflation target, the Reserve Bank of Australia is unlikely to do the hat trick and cut the official cash rate to 0.75% in August. With the cash rate at 1%, the RBA said there's no immediate need for further monetary easing, although a third cut is on the cards in October or November, based on current economic factors.

Mortgage Choice data shows fixed rate home loans demand is the lowest in eight years (sitting at a mere 13.5%) and we have seen a significant spike in demand for variable loans at the end of July. Lenders on our panel have trimmed fixed rates to entice borrowers to fix, which suggests their long-term outlook is that rates will remain low.

All of this has resulted in mortgage holders finally feeling the benefits of lowered interest rates and – added to APRA's serviceability changes, which reduces the home loan servicing floor rate from 7% to the borrower's base rate + 2.5% – will enable people to borrow more. In turn, this will put some positive motion back into Australia's property cycle just in time for spring selling season."

Dr Andrew Wilson, My Housing Market (Hold): "Having decided to go back-to-back with rate cuts over the past two months, the RBA will likely hold over coming months to gauge impact. Another cut this year, however, cannot be discounted, particularity if the labour market deteriorates as is increasingly likely. Continued sharp declines in planned construction, ongoing subdued consumption and the associated shakeout in the retail sector will constrain jobs growth despite low rates. With the US and Eurozone now also pushing rates down, any likely downward trajectory on the AUD due to lower local rates will be neutralized. Lower rates, however, are a positive for housing markets with signs predictably emerging of a revitalisation of buyer activity – particularly in Sydney. The RBA, however, will likely remain perplexed with the ineffectiveness of monetary policy to re-inflate the Australian economy – with higher jobless levels now looking increasingly likely."

Alan Oster, NAB (Hold): "RBA waiting to see any impact from recent stimulus. Will need to do more but not yet."

Andrew Reeve-Parker, NW Advice Pty Limited (Hold): "Conducting a wait-and-see approach following the recent two cuts."

Jonathan Chancellor, Property Observer (Hold): "The RBA have the time to wait and see whether the two consecutive cuts make a difference."

Matthew Peter, QIC (Hold): "Having cut rates at the last two meetings, the RBA will pause. However, Governor Lowe has placed the RBA in a difficult position by emphasising the view that the unemployment rate must hit 4.5% before sustained wage growth can be achieved. This sets up another RBA rate cut before year-end."

Noel Whittaker, QUT (Decrease - 25 basis points): "Because they have hinted it."

Sveta Angelopoulos, RMIT University (Hold): "[There is] time needed to assess the progress of the economy and how the previous rate cuts and policy changes may be impacting."

Christine Williams, Smarter Property Investing (Hold): "With the loosening of APRA's policy together with lower interest rates, the property market has adjusted positively."

Janu Chan, St.George Bank (Hold): "The RBA has signalled that it is open to lowering interest rates 'if needed', but there is less urgency in its language than previously. After the back-to-back rate cuts in June and July, the RBA is therefore likely to pause. Nonetheless, the soft pace of growth in the economy and softening leading indicators on employment point to a risk that the unemployment rate will rise, suggesting the RBA will act and lower official interest rates further later this year."

Brian Parker, Sunsuper (Hold): "After a couple of rate cuts I think they'll want to see a bit more data and perhaps watch how consumers respond to the tax cuts which have started to flow."

Mala Raghavan, University of Tasmania (Hold): "Inflation rose slightly, due to rising fuel prices, medical bills and depreciating Australian dollar. However, the rate of 1.6% is still below the target level. Hence, the board would hold on, to see if by maintaining the cash rate at 1.00%, help to boost the inflation and the economy in the next quarter."

Clement Tisdell, UQ-School of Economics (Hold): "Probably the RBA can hold its ammunition for a little while."

Other participants: Bill Evans, Westpac (Hold).

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel