- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

In this low interest world, are fixed home loans dying?

- Fixed home loans fall to a 21-month low

- List of July 2018 out-of-cycle rate changes

- finder.com.au reveals now might be a good time for mortgage holders to fix

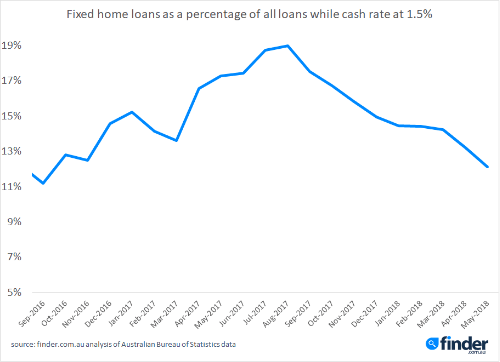

12 July, 2018 - According to the latest Australian Bureau of Statistics (ABS) housing finance figures analysed by comparison site, finder.com.au, the percentage of fixed home loans issued in Australia has fallen to a 21-month low:

Money Expert at finder.com.au, Bessie Hassan said the RBA cash rate has been stagnant at 1.5% since August 2016.

“Over this period, the percentage of fixed loans on the market reached a high of 19% in August 2017, as Aussie homeowners jumped on board the low-interest bandwagon.

“Since then, the proportion of fixed loans had fallen back significantly to 12% which is around where it was when the cash rate first fell to 1.5%.

“The fact that the cash rate remains at a historical low with no change in almost two years, indicates that there’s less urgency among Aussie homeowners to lock in a rate. They’ve been riding this wave for a while now – however the tide could be turning.

“A rate rise is a matter of ‘when’ and not ‘if’ – with 84% of leading economists predicting the next cash rate move to be in a positive direction. With this in mind, now might be a good time to consider locking in your rate – especially given the number of out-of-cycle rate changes we’ve seen in recent weeks,” Ms Hassan said.

Out-of-cycle rate changes:

| Lender | Change | Date effective |

|---|---|---|

| Variable rate | ||

| Bank of Queensland | Up by 0.09% - 0.15% | July 2 |

| Heritage Bank | Up by 0.05% - 0.30% | July 2 |

| IMB | Down by 0.20% | July 2 |

| QBANK | Up by 0.06% | July 4 |

| Macquarie Bank | Up by 0.06% - 0.10% | July 10 |

| Fixed rate | ||

| Heritage Bank | Down by 0.14% - 0.20% | July 2 |

| The Rock Building Society | Down by 0.09% | July 5 |

| MyState | Down by 0.09% | July 5 |

(source: finder.com.au)

Ms Hassan said even a small interest rate rise could hurt Aussies especially those already struggling to keep up with their mortgage repayments.

“With more than half of Australian mortgage holders already admitting they couldn’t handle a $100 rise in monthly repayments, it’s evident many Aussies are already faced with mortgage stress.

“Refinancing could save you thousands. Additionally, fixing could give you the added peace of mind you’ll be able to keep up with your mortgage repayments, regardless of any future rate changes,” she said.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel