- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

$40K home loan hack: Why borrowers should keep their repayments on hold

- Borrowers could shave 3 years off their loan by keeping payments on hold

- 6 million homeowners with loan debt urged to 'make hay while the sun shines'

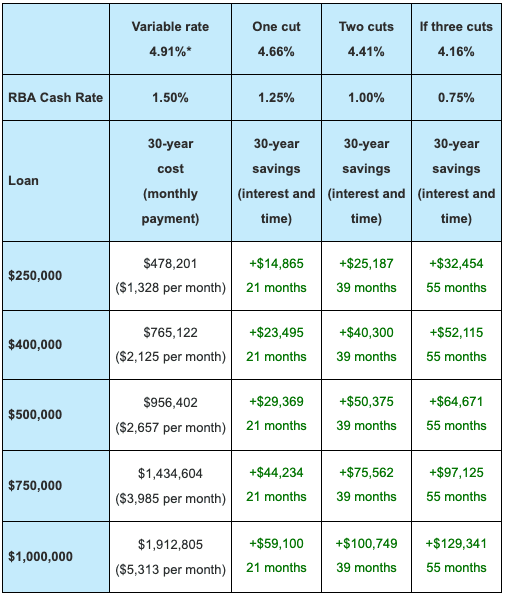

- Potential savings on different loan amounts

19 July, 2019, Sydney, Australia – Borrowers who commit to keeping their repayments at the same level despite recent interest rate cuts could save thousands on their loan, according to Finder, Australia's most visited comparison site.

The new Finder analysis shows that homeowners with an average variable mortgage who keep paying the same repayments, despite reduced rates, could shave $40,000 and 3 years off their loan.

In early July, the Reserve Bank of Australia (RBA) lowered the cash rate for the second time in two months, dropping it to just 1.0%.

Variable rate home owners are set to save over $100 a month as a result of these two cash rate cuts.

The average mortgage in Australia is around $400,0001. At 4.91% – the average variable rate as of June 3, before the first cut – monthly repayments would be $2,125 and the total cost of the loan would be $765,122, over a 30-year period.

If lenders were to pass on the full 50 basis point discount of the two rate cuts, in other words move a borrower's rate from 4.91% to 4.41%, the new monthly payment could be $2,005.

However, if borrowers paid that extra $120 a month toward their loan, they'd be saving $40,300 in interest 39 months (3 years and 3 months) off their loan term.

Graham Cooke, insights manager at Finder, urged borrowers to use the rate drop to get ahead on their mortgage debt.

"If borrowers are accustomed to that higher repayment amount, it won't cause them any extra pain for a lot of long-term gain.

"No one expects the rates to stay this low forever, so savvy homeowners will 'make hay while the sun shines'.

"If you can make additional repayments now, you'll reduce the chances of mortgage stress if and when rates eventually do go back up," he said.

Any extra repayments homeowners make above the minimum set by their lender go toward the principal of the loan.

According to new research by Finder, 32% of Australians are paying off a mortgage, meaning more than 6 million Aussies have home loan debt.

"Mortgage debt is a major responsibility and there's never been a better opportunity to get on top of it.

"If you truly want to feel the effect of these payments, make this a habit and not just a once off contribution.

Cooke said now is also the perfect time to 'ditch and switch' your home loan provider.

"Shop around to find a variable home loan that offers a lower interest rate than your current provider. The very lowest rates now have a '2' in front of them," Cooke said.

By deliberately putting those savings back into the mortgage you could make a significant difference to the amount of interest you pay over the life of the loan.

1Average mortgage in Australia as of November 2018 was $384,700 (most recent ABS data)

Potential savings on different loan amounts (if borrower kept payment amount the same):

Source: Finder

*Average home loan rate across all variable based on live products

viewable online as of 3 June 2019 (before first rate cut). Savings are approximate.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel