RBA survey: 87% experts say international borders to remain closed until 2021

Australia is projected to lose $25 billion in foreign spending as COVID-19 cripples tourism from outside of Australia.

In this month's Finder RBA Cash Rate Survey™ – the largest of its kind in Australia – 42 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy.

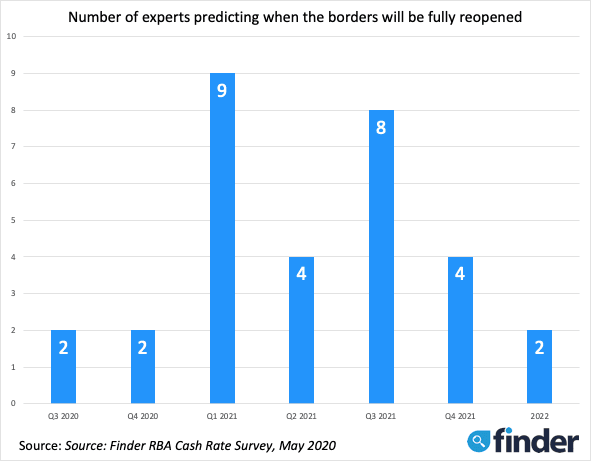

The vast majority of experts (87%, 27/31) who weighed in on tourism, expect Australia's borders to remain closed for the rest of the year, with only 4 respondents (13%, 4/31) indicating international travel restrictions would be lifted in 2020.

In total, 13 believe the border will fully reopen in the first 6 months of 2021, while 12 think it will happen later in the year.

Graham Cooke, insights manager at Finder, said there is a risk that the volume of international travellers won't return for many years.

"Continuing restrictions are projected to result in millions fewer tourists into 2021 and with it, billions in foregone spending.

"This is a problem for all corners of Australia, with 44 cents of every tourism dollar spent in regional destinations," Cooke said.

Tourism directly employs 666,000 Australians making up 5% of Australia's workforce, according to Tourism Australia.

Australia shut its borders to non-residents amid the coronavirus pandemic on 20 March.

International tourists delivered $45.4 billion to the economy last year, Tourism Research Australia figures show.

Of that, $17.2 billion was spent by holidaymakers and $7.6 billion was spent by tourists visiting friends and relatives. Just over $13.3 billion was on education from visitors on a student visa.

Foreigners typically spend around $5,211 on Australian travel and tourism per trip.

John Rolfe, head of Elders Home Loans said Australia has put itself in a good position to be highly considered by tourists in the future.

"Australia has definitely put health ahead of the economy – unlike most of the rest of the world. There are a number of positives that could come out of this.

"The biggest being that... Australia could be seen by future international travelers as 'the safest' destination (from a health perspective)," Rolfe said.

95% expect cash rate to hold at 0.25%

Only 2 out of the 42 economists who participated in Finder's RBA Cash Rate Survey are expecting the RBA to cut the cash rate on Tuesday.

Alison Booth of ANU and Nicholas Frappell of ABC Bullion both expect the cash rate to hit 0% this week due to the state of the economy.

"With effective cash rates at around 0.15%, another reduction may just formalise the current effective rate scenario," Frappell said.

As for when the cash rate will next move, experts were flummoxed.

21 respondents indicated an eventual rise, but could not point to any particular time in the next 3 years.

Interestingly, 10 other economists selected both a potential rise and cut in the future indicating that the next actions of the RBA really do remain uncertain.

Here's what our experts had to say:

Commentary

Nicholas Frappell, ABC Bullion (Cut): "The impact of the slow down with expectations of a 10% contraction in H1, combined with expectations in the cash futures market tilted towards a reduction. With effective cash rates at around 0.15%, another reduction may just formalise the current effective rate scenario."

Alison Booth, ANU (Cut): "[The RBA will cut] because of the state of the economy."

Nicholas Gruen, Lateral Economics (Hold): "They should cut to zero or below, but they've said they won't. I hope they change their mind. Anyway, the important things are now happening in fiscal policy as monetary policy can't do much in this situation."

Shane Oliver, AMP Capital (Hold): "The cash rate is as low as it's going to go and the next move in rates will be up but it's at least three years away, probably more. The RBA has said on several occasions that it regards 0.25% as the effective lower bound for the cash rate. Based on the experience of other countries there is no value in taking rates negative. So any further easing in monetary policy will have to come from quantitative easing. In the meantime the coronavirus related shutdown will cause a big hit to growth that will take years to fully recover from. This in turn will mean that it will be many years before we see full employment and inflation in the target range of 2–3% which in turn will mean rate hikes are many years away."

John Hewson, ANU (Hold): "Recession/flat economy will last longer than expected."

Malcolm Wood, Baillieu (Hold): "RBA on hold at effective zero for many years."

David Robertson, Bendigo and Adelaide Bank (Hold): "No more interest rate cuts required (not effective below this 'lower bound' of 1/4 %) – and no increases will occur until 'full employment' achieved: 2022/23?"

Peter Boehm, Boehm (Hold): "I think interest rates will stay where they are for the foreseeable future and until such time as there is more certainty on where the economy is heading after COVID-19 is brought under control. Right now, I don't expect the outlook to be overly positive for the remainder of this year and probably into next year as well, either here in Australia or overseas. It is difficult to predict if/when interest rates might move when it's hard to forecast with reasonable certainty what the economy might look like over the next six months, let alone next year."

Ben Udy, Capital Economics (Hold): "I don't think the RBA will change the cash rate in the next two years as the governor has said."

Saul Eslake, Corinna Economic Advisory (Hold): "The RBA has explicitly indicated that it won't raise the cash rate until it has made progress towards full employment and inflation within the 2–3% target band. I am sceptical of forecasts of a 'V-shaped' recovery from the current downturn, and think that the RBA will keep the cash rate at its current level for at least 2 years."

Craig Emerson, Craig Emerson Economics (Hold): "The RBA has publicly stated the cash rate at 0.25% is the lower bound."

Trent Wiltshire, Domain (Hold): "The RBA won't be raising the cash rate for the next few years."

John Rolfe, Elders Home Loans (Hold): "We are going into an enforced recession. I cannot foresee when this will end as we are showing little or no chance to reverse whilst still in lockdown. The recovery rate will drive."

Mark Brimble, Griffith Uni (Hold): "COVID impacts seem likely to endure for a period of time and the economy will need support in the medium term to stabilize and then rebuild."

Tony Makin, Griffith University (Hold): "The timing of any future cash rate change will depend on how and when the lockdown restrictions are lifted, and on how quickly the economy is expected to spring back."

Peter Haller, Heritage Bank (Hold): "The RBA has committed to a cash rate at the effective lower bound for at least the next two years."

Alex Joiner, IFM Investors (Hold): "It will be a very long time before the RBA returns to conventional policy. It will wind back its unconventional policy first and then need to see material progress, in terms of recovery, of the labour market the timeline for this is unknowable at this stage but I was suspect it will be beyond 2022."

Andrew Wilson, Independent Economist (Hold): "There are unlikely to be any moves in the near future. The RBA are likely to take a "wait and see" approach and retain the remaining leverage they have. No decisions are likely until the economic repercussions of COVID-19 become clearer."

Leanne Pilkington, Laing+Simmons (Hold): "The Reserve Bank Governor recently challenged the Government to focus on growth and productivity strategies to help the economy, eventually, emerge from the COVID-19 crisis. More efficient taxation solutions including the removal of stamp duty is an obvious place to start. Interest rates are already rock bottom and on this score the RBA has done its part."

Nicholas Gruen, Lateral Economics (Hold): "They should cut to zero or below, but they've said they won't. I hope they change their mind. Anyway, the important things are now happening in fiscal policy as monetary policy can't do much in this situation."

Mathew Tiller, LJ Hooker (Hold): "The RBA is expected to maintain its current policy to support the economy through COVID-19."

Geoffrey Harold Kingston, Macquarie University (Hold): "Following 1–2 years of falling inflation, there is a good chance inflation will eventually pick up, as a belated consequence of massive stimulus."

Jeffrey Sheen, Macquarie University (Hold): "Indications from RBA that cash rate is likely to remain at its all-time low for a few years."

Stephen Koukoulas, Market Economics (Hold): "The recovery will be in full swing and inflation pressure may be emerging."

John Caelli, ME Bank (Hold): "The RBA has clearly indicated that the cash rate will not go up for much of the next 3 years."

Michael Yardney, Metropole Property Strategists (Hold): "It is unlikely the cash rate will move for a number of years."

Mark Crosby, Monash University (Hold): "There is too much uncertainty re the duration of the impact of COVID-19. Further rate cuts would not stimulate the economy, and the question now is of the form and nature of QE in 2020 and 2021."

Julia Newbould, Money (Hold): "I think there may have been some signs of recovery."

Susan Mitchell, Mortgage Choice (Hold): "I expect the Reserve Bank to hold the cash rate at its monetary policy meeting in May. In his speech on the 21st of April, Governor Lowe said that the cash rate was to remain at 0.25% until we make sustainable progress towards the goal of full employment and inflation. We are still waiting for economic data to reveal the extent of the impact of the COVID-19 pandemic but the latest indicators suggest that interest rates will have to stay low for longer. As expected, consumer sentiment plummeted to an all-time low in April, with Westpac reporting the single biggest monthly decline in the 47 year history of the survey. Social distancing measures have knocked the wind out of the sails of the property market but time will tell if this will translate to declining dwelling values."

David Lowe, Newcastle Permanent (Hold): "The RBA have been consistent in promoting the lower for longer rate environment, and by targeting the 3 year bond rate at 0.25%, it is indicating a period of around three years of rates at the current level."

Jonathan Chancellor, Property Observer (Hold): "The RBA has advised they won't go to zero, so the next move must be up, but to a completely unknown timeline."

Rich Harvey, Propertybuyer (Hold): "No change. Rates are already at the lowest level the RBA has indicated they are prepared to go. Next move from here is QE and new fiscal policies to kick start the economy after hibernation."

Matthew Peter, QIC (Hold): "The RBA will not be in a position to raise rates for at least four years. The current impact on growth dictates rates at the lower bound until the end of 2021. After that, high levels of government and private sector debt will mean the RBA cannot lift interest rates."

Noel Whittaker, QUT (Hold): "We are living in an uncertain world, even the budget has been pushed back to October. There are too many unknowns to make any sort of meaningful predictions."

Jason Azzopardi, Resimac (Hold): "Inflation will not increase for a long time keeping rates low."

Sveta Angelopoulos, RMIT University (Hold): "Hard to estimate at this point and will depend on the rate of restrictions being eased and businesses being able to return to trading will also depend on whether the easing of restrictions result in another outbreak and if restrictions are imposed again."

Christine Williams, Smarter Property Investing Pty Ltd (Hold): "I believe once we come out of ISO and Retail, Tourism (within Australia) and Hospitality are at full working capacity the RBA will increase the rate to recoup our holdings."

Besa Deda, St.George Economics (Hold): "Governor Lowe has made it clear in his speeches that the cash rate will remain at its lower bound for some time. We will need to see the removal of the three-year bond target and the associated unwinding of quantitative easing. A rate hike is therefore not likely to occur within the next three years."

Brian Parker, Sunsuper (Hold): "Next rate increase is beyond the scope of the dates provided."

Mala Raghavan, University of Tasmania (Hold): "I am not sure if any accommodative (conventional and unconventional) monetary policy measures will help to revive the economy, considering that the COVID-19 crisis has a larger effect on the supply-side of the economy relative to the demand-side. I am not sure if flushing the economy with liquidity helps to stimulate the economy, unless and until the pandemic is contained."

Andrew Reeve-Parker, NW Advice (Hold): "The rate won't change for a long time."

Other participants: Bill Evans, Westpac (Hold). Angela Jackson, Equity Economics (Hold).

Ask a question