- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA survey: Banks to raise variable mortgage rates independent of the RBA, experts say

- 57% of experts believe banks will raise mortgage rates by 2021 despite cash rate freeze

- All experts (40/40) expect the cash rate to hold at 0.25% in September

- 88% say more banks will follow Westpac and ANZ by slashing or deferring dividends

31 August 2020, Sydney, Australia – Banks may increase variable mortgage rates to recoup pandemic-induced losses despite a stagnant cash rate, according to experts.

In this month's Finder RBA Cash Rate Survey™, 40 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy.

While all the experts surveyed expect a cash rate hold in September (40/40), more than half of those who weighed in (57%, 16) believe that banks will raise their variable mortgage rates despite the Reserve Bank indicating that the cash rate will remain motionless for some time.

When asked about the expected time frame for this movement, half of the respondents (50%, 8) said banks are likely to announce out-of-cycle rate hikes during the first half of 2021.

Graham Cooke, insights manager at Finder, said that prospective variable rate increases mean future homebuyers should tread cautiously.

"Banking profits have nosedived off the back of billions of dollars worth of loan deferrals, a shrinking pool of first-time buyers, low-interest rates and minimal credit growth.

"This may send banks scrambling to recoup lost funds by pushing up home loan rates to absorb some of these costs, which will come at a detriment to mortgage customers.

"A flat cash rate does not mean homeowners are in the clear. We learned this during the most recent period of cash rate stagnation. While the rate held at 1.25% for 34 months starting in 2016, banks changed their variable rates seven times."

"This means that homebuyers considering a variable mortgage should still factor in a potential repayment increase of 2-3% to their budget to prevent rate shock," Cooke said.

Further cuts to dividends expected

Earlier in August, Westpac and ANZ announced that they are cutting or deferring dividends to shore up company profits.

The majority of economists who weighed in (88%, 22) believe that the nation's other big banks will soon follow suit by slashing dividends or removing them altogether.

Cooke said that banks are taking a cautious approach as we enter a period of economic uncertainty.

"Banks are slashing shareholder dividends in an attempt to mitigate the financial disruption caused by the virus.

"This won't come as welcome news for existing shareholders, but many investors will be seeing these plunging share prices as a great opportunity to buy discounted stocks," he said.

Economic sentiment spikes

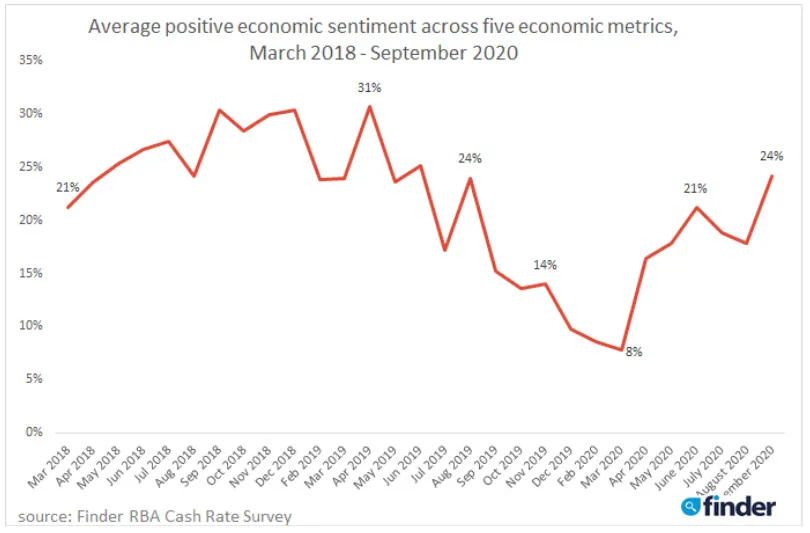

Finder's Economic Sentiment Tracker, which gauges five key indicators – housing affordability, employment, wage growth, cost of living and household debt– shows a significant increase in overall economic sentiment since its lowest point in March 2020, rising from 8% to 24% in August

Despite the uncertainty regarding the virus, more than half (57%, 20) of respondents believe that Australia will see GDP growth in 2020.

Leanne Pilkington of Laing+Simmons said Australia has been able to weather the economic storm of coronavirus better than other nations.

"Relatively speaking, the economic fallout of the coronavirus that is reverberating around global markets has not impacted Australia as hard as many other nations.

Even considering Victoria's second wave and the potential for subsequent outbreaks elsewhere, employment figures are encouraging and other key indicators point to our economy's overall resilience," she said.

Here's what our experts had to say

Nicholas Frappell, ABC Bullion: "The case for another cut (or not) appears fairly finely balanced, however the Governor is suggesting that fiscal support is the best solution to lifting the economy and alleviating unemployment. I think that is the best way to go given the degree of spare capacity and the speed of the economic contraction."

Shane Oliver, AMP Capital: "For now the RBA will remain on hold. It views the March monetary easing package as continuing to help the economy and the main action now being in fiscal policy. There is a significant chance it may cut the cash rate to 0.1% and it may do more aggressive quantitative easing but that would not be for several months. And it remains "extraordinarily unlikely" to cut the cash rate below zero. The next interest rate move of significance is likely to be a hike but with high unemployment and underemployment, lots of spare capacity in the economy and underlying inflation way below target this is at least three years away."

Alison Booth, Australian National University: "Given comments of the RBA governor, it seems unlikely the cash rate will be changed. With the level of uncertainty over the next few months, I'm unwilling to hazard a guess as to when a change will occur, though I do expect that any change will be downwards."

Malcolm Wood, Baillieu: "RBA to leave rates at effective zero until economy approaching full employment and inflation sustainably in the 2-3% range. This appears years away."

David Robertson, Bendigo and Adelaide Bank: "No change in rates likely for at least 2 years, unless the RBA decides to cut to 0.10% from 0.25 %, but most likely rates are on hold here at 0.25% prior to a slow tightening cycle 2–3 years down the track."

Sean Langcake, BIS Oxford Economics: "We don't see the cash rate increasing until mid-late 2023."

Ben Udy, Capital economics: "We think the RBA will launch a second tranche of QE in early 2021."

Peter Boehm, CLSA Premium: "The RBA needs to hold tight until the full extent of the Victorian crisis washes through the state and national economies, and until the impact of the withdrawal of federal financial support i.e. Jobkeeper (at the end of Q1 next year), can be measured. Further announcements by the federal government on additional financial support, especially for Victorian businesses, will also need to be considered."

Saul Eslake, Corinna Economic Advisory: "Based on recent comments by the Governor, as well as my own outlook, I think the first increase in rates is likely to be some time in 2023. It's not impossible that, well before then, the RBA could lower its cash rate target to 0.10%, but since cash has been at around 0.13% for some time now, that would be more symbolic than anything else."

Craig Emerson, Emerson Economics: "There is no inflation in prospect domestically or globally."

Angela Jackson, Equity Economics: "RBA will hold until signs of recovery - which is hard to predict given uncertainty around a vaccine for COVID-19."

Mark Brimble, Griffith University: "The next six months are full of almost unpredictable uncertainty in relation to the virus and geopolitical issues. Should the virus escalate further the RBA is likely to move, if it doesn't then they are likely to not adjust rates but hold low for the long term."

Tony Makin, Griffith University: "If economic history since Roman times is any guide (and there is no reason to doubt it), the money base expansion here and in other advanced economies due to central bank monetisation of public debt (either directly or indirectly via QE or targeting the 3-year bond yield), will put upward pressure on the price level as economies recover, necessitating a rise in official interest rates. The lagged inflation response to money base growth has conventionally been assumed to be 18-24 months later."

Tim Reardon, Housing Industry Association: "[The RBA] can not lower rates, and an increase is not for seeable."

Alex Joiner, IFM Investors: "The RBA should not be looking to remove policy stimulus before it gets the unemployment rate near levels approaching full employment. Its own forecasts have the unemployment rate well above this level by the end of 2022."

Leanne Pilkington, Laing+Simmons: "Relatively speaking, the economic fallout of the coronavirus that is reverberating around global markets has not impacted Australia as hard as many other nations. Even considering Victoria's second wave and the potential for subsequent outbreaks elsewhere, employment figures are encouraging and other key indicators point to our economy's overall resilience. Low, steady interest rates for the foreseeable future are appropriate to support the recovery."

Nicholas Gruen, Lateral Economics: "It will bump along the bottom for a good while yet."

Mathew Tiller, LJ Hooker: "Given there is little room for a significant downward movement, the RBA should keep the cash rate steady. It is likely to continue to use other measures to help stimulate economic activity."

Geoffrey Kingston, Macquarie University: "Economic activity should have picked up enough by this point to warrant an increase."

Jeffrey Sheen, Macquarie University: "The RBA has committed to an unchanged cash rate for three years."

Michael Yardney, Metropole Property Strategists: "Interest rates won't rise until unemployment drops to 4.5% and that won't be for 3-4 years, and it's unlikely the RBA will drop rates further."

Mark Crosby, Monash University: "Until a vaccine for COVID-19 exists, rates won't be increasing. It also seems likely that recovery will be slow, so no changes likely in 2020 or 2021."

Julia Newbould, Money magazine: "The cash rate is already at its lowest level and there is still great uncertainty of what will happen next and how quickly the economy may recover."

Susan Mitchell, Mortgage Choice: "The RBA is unlikely to change its dovish stance on monetary policy given the uncertainty caused by the Coronavirus pandemic. In a speech delivered to the House of Representatives Standing Committee on Economics, Governor Lowe indicated the cash rate is likely to remain on hold for at least 3 years. The low cash rate continues to stimulate activity in the home loan market and the lowest cost of borrowing in history which is encouraging borrowers to lock in a fixed rate and to refinance to access a better deal."

Dr Andrew Wilson, My Housing Market: "Monetary policy continues to be sidelined with economic activity generally now better than expected notwithstanding significant new challenges now for Victorian economy with obvious repercussions for national growth. Some better news balanced by some worse news."

Jonathan Chancellor, Property Observer: "The RBA will take the opportunity to go lower as necessitated by the unfolding economic circumstances in early 2021."

Rich Harvey, Propertybuyer: "The current recession has some time to play out. Once stimulus measures subside it will take some time for the full impacts to materialise and low interest rates continue to provide a buffer for the economy."

Matthew Peter, QIC: "The RBA has signalled that it will keep rates on hold for around 3 years. Governor Lowe has also indicated that the RBA is highly unlikely to shift rates into negative territory. It is more probable that the RBA will lower the cash rate to 0.10% if the outlook deteriorates. However, at this point, the RBA is likely to remain on hold for the foreseeable future."

Noel Whittaker, QUT: "The future is so uncertain – and the possibility of a vaccine is a major factor. Given that international air travel will not happen for at least another year there will be no reason to increase rates in the next year. And lowering any further would be pointless."

Cameron Kusher, REA Group: "The RBA statements indicate it remains reluctant to cut official interest rates. On the other hand, their forecasts would seem to indicate they remain a long way away from achieving their economic goals which would put them in a position to start increasing rates."

Jason Azzopardi, Resimac: "Despite the RBNZ indicating a negative OCR is on the horizon, the RBA stance of a period of stable cash rate appears to be stabilising funding markets."

Sveta Angelopoulos, RMIT University: "Given the current conditions, the rate is likely to remain on hold for the rest of the year, and likely well into next year."

Christine Williams, Smarter Property Investing: "Monitoring the unemployment [rate] and potential defaults on home loans will require a reduction in the interest rates to reduce loan defaults."

Besa Deda, St.George: "The RBA Governor has repeatedly indicated that the cash rate is unlikely to be raised for 3 years. Additionally, although the possibility of cutting the cash rate target to 0.1% has been raised, its effectiveness is likely to be negligible so this policy response is unlikely."

Janu Chan, St.George Bank: "The RBA is not likely to lift rates any time soon while the unemployment rate remains elevated and spare capacity remains in the economy. If there was a risk of shifting its monetary policy stance, it would be towards greater easing. However, the RBA appears reluctant to deploy additional policy measures. The onus has been placed on the government to provide additional support. "

Mala Raghavan, University of Tasmania: "The uncertainty is very high and the economic recovery heavily depends on how the coronavirus is contained (as there is always the fear of second and third waves) and the possibility of finding a vaccine. People need time to get used to this new norm of living and working style."

Other participants: John Rolfe, Elders Home Loans. Tim Nelson, Griffith University. Stephen Koukoulas, Market Economics. Brian Parker, Sunsuper.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel