Do you have what it takes to be a property developer?

As we head into a recession, property expert Rich Harvey takes us through the risks and opportunities for property development in Australia.

When a market is starting to cool and soften, the smartest property developers are looking around and rubbing their hands together. They live by the famous Warren Buffet mantra: "Be fearful when others are greedy and greedy when others are fearful."

In fact, a lot of the most famous real estate deals in history are done during tough economic times. The Rockefeller Center in New York was built during the Great Depression, for example, and Century City in LA when Warner Brothers almost went broke.

In Australia, Harry Triguboff had to fund his own developments in the 1970s when access to finance was difficult – but look at where he stands today.

What these examples show is that developing property takes creativity, great emotional intelligence and perseverance. And when it's successful, it offers huge financial benefits.

So if you're interested in development opportunities or want a snapshot of the market conditions in Australia, here are some of the biggest factors to keep in mind.

How does a property developer think differently to a property investor?

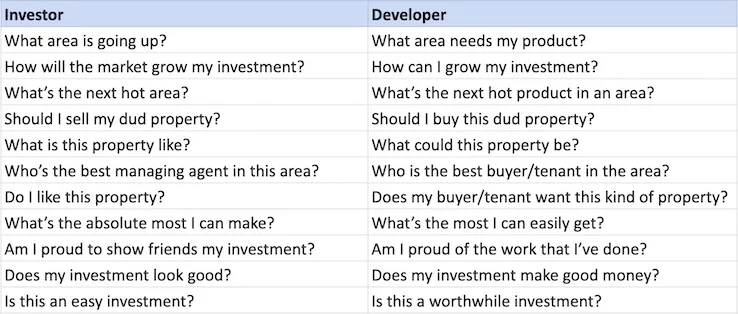

Developers consider ways to make money on the purchase of property, during the hold period (which may also include construction) and on the exit of a property investment. Rarely does a developer rely on the market movements alone for growing their investments. They will study their proposed market and even the product they intend to invest in before putting any money on the line.

Below are some examples of the different questions an investor would ask, compared to those a property developer would ask.

Something else to consider here is that most property developers are also investors. So, if they hold certain projects for their rental return and cash flow, they might use that money to pay for their ongoing costs on other development projects.

It is a bigger leap for property investors to become developers because there is so much more to consider for bigger projects. But the only way to know for sure is to try (or consider doing a joint venture with a more experienced developer). Just don't be lured by the potential profit of developing – it is very hard and difficult work and many fail.

How risky is property development?

The most common risk property developers face is cash-flow problems. Developers are often paying for things for a long time before they see any money return to them in the form of profits – and a lot of inexperienced developers can find this disheartening.

That's why it is important for developers to have a team of experts involved in every stage of the process. As well as architects and builders, there are financial brokers to help with cash flow and buyers' agents to help with site selection and purchasing negotiations. In order to minimise the risks, find people who know more than you – and that you can trust – and work with them to build your profits together.

What are the risks of developing during a recession?

The current property market has been spooked by the COVID-19 crisis, with consumer sentiment falling dramatically during March, April and May of 2020. However, recent surveys show that sentiment is improving.

There is no doubt unemployment will continue to rise and struggle as the economic impact of the pandemic works its way through the economy. But the initially feared "worst case" scenarios are very unlikely to eventuate.

With our borders still closed and the migration tap temporarily turned off, the underlying demand for new dwellings is a concern for developers. But this is a short-term impact. In the long term, Australia will continue to have a strong focus on its skilled migration program because it is essential for our economic growth and prosperity.

Many home buyers and investors put their property-buying plans on hold during COVID-19 (as they tend to follow the herd). But as the stimulus packages filter through and business gets back to normal, we will see the strong underlying demand for property resume its natural cycle – and that will flow through to developers.

A recessionary phase does create some extra risks for developers, as they must ensure sufficient capital to ride out an extended downturn if they are actually selling completed stock. But most developers take 12 to 18 months to get a DA (development application) approved and then another 12 to 18 months to build. So by the time the finished property hits the market, it is likely to be in a much more favourable environment.

Those developers with the ability to make offers now – and capitalise on a softer market – could find the best opportunities to buy during recession times.

Where are the opportunities in today's market?

Opportunities exist in today's market where there is a lack of specific housing types with a pent-up demand, for example, high-quality down-sizer apartments in premium suburbs.

The capital cities of Sydney and Melbourne will always need more places to live. Affordable apartments close to areas that provide a great lifestyle close to shops, transport or the beach and other amenities. There are opportunities in aged care, seniors living, prestige markets, land subdivisions, childcare, boarding houses, duplexes and boutique apartment blocks and townhouses.

But the most profitable sites are the ones you understand the best and which have plans you feel confident about. Usually, if you have done your hard work upfront during the purchase, planning and building stages, then you can expect great returns at the end.

I've also saved the best fact to last – there have been more millionaires made from property than any other asset throughout history. If that's the case, then why couldn't the next one be you?

Rich Harvey is a buyers' agent, economist, property investor and CEO of Propertybuyer – an independent buyers' agency that specialises in searching, appraising and negotiating real estate exclusively for buyers. Rich and his team at Propertybuyer have purchased over 3,000 properties for their clients and won 34 major awards including the prestigious National Telstra Business and National Buyers' Agent "Award for Excellence". Rich has also served as President of the Real Estate Buyers Agent Association of Australia (REBAA) and Chairman of the Buyers Agent Chapter of the Real Estate Institute of NSW to improve the professionalism and standards within the buyers' agents industry.

Disclaimer: The views and opinions expressed in this article (which may be subject to change without notice) are solely those of the author and do not necessarily reflect those of Finder and its employees. The information contained in this article is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Neither the author nor Finder has taken into account your personal circumstances. You should seek professional advice before making any further decisions based on this information.

Read more Finder X columns

-

Australian credit card debt soars 10% in a year: How can you escape the trap?

6 Feb 2026 |

-

4 cashback home loan offers to ease the pain of RBA rate hike

4 Feb 2026 |

-

Finder’s RBA Survey: Easing cycle ends as RBA delivers first rate hike since 2023

4 Feb 2026 |

-

Ubank Save is increasing its bonus rate up to 5.35% p.a.

3 Feb 2026 |

-

Top savings account rates after the RBA’s cash rate increase

3 Feb 2026 |

Images: Getty Images, Supplied

Ask a question