RBA survey: 68% of experts say NSW property prices will peak this year

The non-stop rise in house prices may hit an apex this year, according to the latest expert housing predictions from Finder.

In this month's Finder RBA Cash Rate Survey™, 40 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy, with all panellists expecting a rate hold for this month.

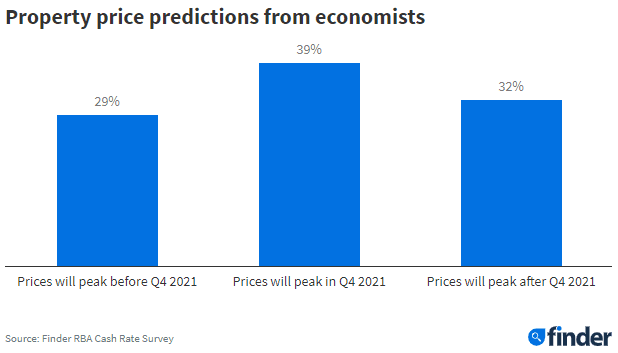

While all experts and economists surveyed expect the cash rate to hold at 0.10% (40/40), the majority of those who weighed in on NSW property prices (68%, 19/28) expect property prices to peak in 2021.

Nearly 2 in 5 (39%, 11) expect NSW property prices will peak in the final quarter of the year, while nearly a third (29%, 8) believe prices will peak within the next 3 months.

The remaining 1 in 3 (32%, 9) think we won't see prices peak until 2022 or beyond.

According to ABS data, after borrowing a record $48 billion for housing in the first 4 months of 2020, Aussies borrowed $75 billion in the first 4 months of 2021.

Graham Cooke, head of consumer research at Finder, said the rising property prices have led to unprecedented borrowing.

"Aussies borrowed $27 billion more for housing from January to April this year compared to last – and last year was a record.

"Many feel that these increases can't keep going indefinitely and our panel tends to agree. Expect the current rise in prices and activity to peter out by 2022.

"For first-time buyers, this means that the bottom rung of the housing ladder should stop becoming steeper within the next 6 months," Cooke said.

78% say housing is unaffordable for the average Australian

A vast majority of economists (25, 78%) agree that housing is becoming unaffordable for the average Australian, with some experts blaming wage growth and extremely low home loan rates.

Tony Makin of Griffith University warned that a real estate bubble is emerging due to extremely low interest rates.

Shane Oliver from AMP Capital said this problem has been an issue for 25 years.

"For the average Australian first home buyer, housing affordability has been deteriorating since the mid-1990s," Oliver said.

Noel Whittaker from QUT said you need only look at the average wage numbers against the average house price to understand why housing is getting more and more unaffordable.

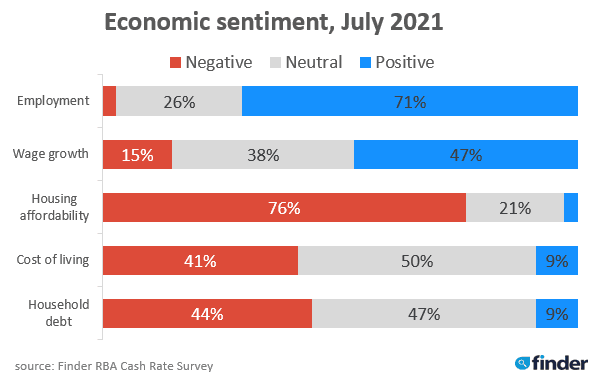

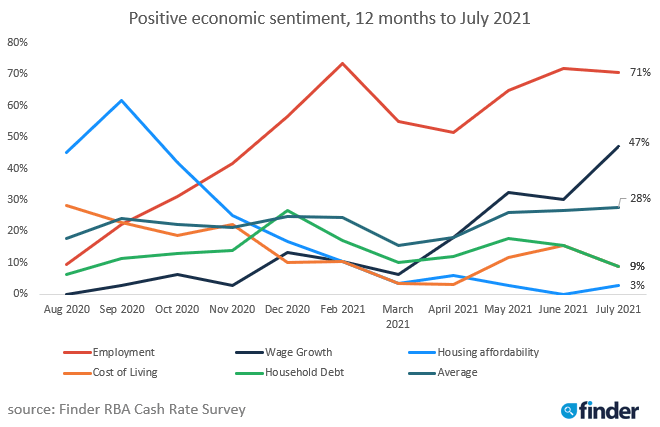

Finder's Economic Sentiment Tracker gauges experts' confidence in 5 key indicators: housing affordability, employment, wage growth, cost of living and household debt over the next 6 months.

Despite predictions that the housing market may peak before 2022, experts are still not optimistic about the affordability of housing. Just 3% (1/34) are positive about the metric with 76% (26/34) saying they have a negative sentiment about it in the next 6 months.

Cooke said next year is shaping up to be better for affordable housing than 2021.

"Positivity around housing affordability is still low, but if expert predictions of prices peaking later this year are true, 2022 could prove a much better year for housing affordability.

"Anyone saving for a deposit now could start to target a purchase next year," Cooke said.

First home buyers would get a $25,000 grant to help them enter the market in NSW in a government move to overhaul property tax.

More than half (55%, 17) of experts believe that the new $25,000 NSW first home buyers grant should not be implemented in other states, due to fears that it could increase property prices even further.

Dale Gillham, founder of Wealth Within, said this grant is not helping fix the problem.

"We constantly hear that property is overpriced and that first home buyers struggle to enter into it. Encouraging more demand from first home buyers only perpetuates this snowball," Gillham said.

Peter J Tulip, chief economist at the Centre for Independent Studies, agreed, saying that without measures to boost supply, this just reshuffles a fixed quantity of housing.

Most experts (21, 68%) believe that first home buyers are being forced to compromise on their home due to fear of missing out in the property market.

Positive sentiment about housing affordability has been on a sharp decline since September of 2020.

Commentary

Nicholas Frappell, ABC Bullion: "Domestic CPI and employment data allow a continuation of the ultra-low policy. Eventual reopening and a return to global growth suggest tightening may come sooner than 2024."

Shane Oliver, AMP Capital: "While the recovery has been stronger than expected, there is still a way to go to reach the RBA's conditions for a rate hike – in particular, wages growth of 3% or more and inflation sustainably in the 2-3% target zone. Particularly with coronavirus still causing periodic problems. That said, we expect the conditions for a rate hike to be in place by 2023 so anticipate a 2023 rate hike, ahead of the RBA's own expectations for no rate hike until 2024 at the earliest."

Rebecca Cassells, Bankwest Curtin Economics Centre: "The most recent data from the May labour force survey revealed just how resilient the economy and labour market was at this point. Despite a fall in employment as JobKeeper ended, employment bounced back, adding 115,200 workers to the labour market, participation lifted and both unemployment and underemployment fell substantially. Job vacancies are now at a 12-year high and a number of states are seeing unemployment rates below 5%. A tightening labour market should lead to wage increases, which will also be helped along by the recent Fair Work decision to raise minimum wages by 2.5%. But recent virus outbreaks and lockdowns across the nation will dampen this positive trajectory – by just how much and for how long remains to be seen. In the meantime, the RBA will continue to hold the cash rate at 0.1% but likely introduce greater flexibility into its bond purchase program, aligning with what is looking to be a protracted and bumpy ride through the pandemic."

David Robertson, Bendigo Bank: "The pace of job creation and broader economic progress (despite ongoing COVID-19 lockdowns) suggests that the RBA will need to start increasing interest rates in 2022/23, with November 2022 or February 2023 most likely based on current projections."

Sean Langcake, BIS Oxford Economics: "The labour market continues to outperform expectations and has weathered the withdrawal of JobKeeper well. But we are still some time from seeing broad-based wage pressures emerge."

Benjamin Udy, Capital Economics: "The continued tightening in the labour market will cause the RBA to begin tapering asset purchases in November. However, we think it will take until early 2023 before wage growth rises enough to satisfy the RBA and causes the Bank to lift rates."

Peter J Tulip, CIS: "The RBA will not raise rates until inflation exceeds 2%. That is unlikely before 2023."

Peter Boehm, CLSA Premium: "Steady as she goes for now but there'll likely be an interest rate increase sooner than previously envisaged, possibly sometime in 2022."

Stephen Halmarick, Commonwealth Bank: "Wages and inflation pressures to be evident by the end of 2022."

Saul Eslake, Corinna Economic Advisory: "I think the RBA is absolutely correct to insist that it won't lift the cash rate until the labour market is sufficiently tight to have started to generate wages growth at a pace sufficient to ensure that 'underlying' consumer price inflation returns sustainably to the 2-3% target band – but where I differ from the RBA is that I think these criteria will be satisfied sooner than '2024 at the earliest', in part because the continued closure of Australia's international borders is resulting in faster reductions in the unemployment rate."

Craig Emerson, Emerson Economics: "The RBA has indicated it will not increase the cash rate before 2023."

Angela Jackson, Equity Economics: "While economic recovery is continuing at pace, there remains an ongoing need for monetary policy to remain very accommodative."

Mark Brimble, Griffith University: "Uncertainty is still the dominant force as we are seeing today in NSW. There is much more to be played out in this crisis and MP will need to be accommodating for some time yet."

Tim Nelson, Griffith University: "COVID-19 impacts are likely to be felt longer than anticipated. Loosening monetary policy is unlikely to be feasible so the next cycle will still be tightening but not for a while yet. The property market is better addressed through prudentials and land planning."

Tony Makin, Griffith University: "Depends on when the Federal Reserve acts in response to higher inflation in the US. Inflation here is also likely to jump in coming quarters. Meanwhile, upward pressure on bond rates worldwide will persist due to unprecedented government borrowing to fund budget deficits."

Tom Devitt, Housing Industry Association: "It will still take a while before wage growth and inflation are sustained enough at elevated levels to warrant an interest rate increase."

Alex Joiner, IFM Investors: "Despite the progress made in the economic recovery, the RBA wants to observe inflation within the target band and the unemployment rate close to 4% to generate wage inflation. These objectives may be sooner than the RBA's original guidance of 2024 but still remain some way off."

Michael Witts, ING: "Although current indicators are showing promising developments, there is still a way to go to meet the RBA criteria to start to adjust rates."

Leanne Pilkington, Laing+Simmons: "Despite some major lenders tipping the RBA will increase rates as soon as next year, we still see the current settings and the RBA's previously announced timeline as appropriate, especially given the most recent lockdowns."

Nicholas Gruen, Lateral Economics: "Recovery has been compromised by our appalling performance on vaccine rollout. However, rates may rise owing to strong demand and some price pressures in the US."

Jeffrey Sheen, Macquarie University: "The RBA has committed itself to no change in the cash rate until inflation is trending above its target. There will be a transitory jump in inflation in 2021-23 due to supply constraints, but these will abate if there are no more significant lockdowns. Beyond 2023, I expect wage growth will just be sufficient to raise the trend in inflation and trigger modest rises in the cash rate."

Michael Yardney, Metropole Property Strategists: "While there is much speculation in the media that interest rates will rise sooner rather than later, and there is a strong likelihood that inflation is going to increase, I can't see the RBA raising interest rates until wages growth reaches 3 to 4% per annum and that's a long way off."

Mark Crosby, Monash University: "No rate rises until 2023 are well flagged, though it will be interesting to see the next couple of inflation reads to see if this changes."

Julia Newbould, Money Magazine: "The economy is starting to move but a rise in interest rates might affect too many people who are currently too highly geared. I think the RBA will be mindful of any negative effects a rise might cause."

Susan Mitchell, Mortgage Choice: "The current lockdowns will put a strain on economic activity so I don't expect to see any major changes from the RBA Board at its July meeting. Despite a strong result in the ABS's latest labour force survey, a cash rate hike is still a while off."

Alan Oster, NAB: "The economy is still recovering and core inflation will not be sustainably in the middle of the 2-3% target till then."

Malcolm Wood, Ord Minnett: "It will take time to reach the RBA's policy targets."

Rich Harvey, Propertybuyer: "I think there will be a move upward in official interest rates just before the end of 2022 as our economic recovery gathers at a faster pace and RBA will need to moderate inflationary pressures."

Matthew Peter, QIC: "The RBA will not change its rate call at the July meeting. But it will eventually pull the first rate hike into 2023. The RBA will follow the Federal Reserve, which means we can expect the RBA to target the second half of 2023 for lift-off."

Noel Whittaker, QUT: "They will be forced [to raise the cash rate] by pressure in the housing market."

Cameron Kusher, REA Group: "A lot of people have been pulling forward their RBA rate hike forecasts and it seems to be on the back of a few strong labour force prints. There's still a lot that can go right or wrong between now and 2024 and the RBA is clearly determined to wait until wages are increasing, we've reached full employment and inflation is in the middle of the target range. They were unsuccessful at achieving these things prior to the recession, I suspect they will want to ensure the recovery is firmly entrenched and international borders are reopened and the impact of that is seen before lifting rates."

Jason Azzopardi, Resimac: "I expect border closures driving labour gaps to stoke wage growth materially, increasing inflation and prompting RBA to start increasing rates."

Brian Parker, Sunsuper: "Even with a stronger than expected labour market, it'll still take time to get wage and price inflation high enough to justify a rate hike."

Mala Raghavan, University of Tasmania: "According to the RBA governor, the board is not expecting to increase the cash rate, as long as inflation and wage pressures are subdued. Inflation could rise to 2% around the middle of next year, mainly driven by supply factors such as rising oil prices, supply chain disruptions and rising transportation costs. On the other hand, as long as there is a large share of the casualised workforce and underemployment issues, the rise in the wage price index will be sluggish."

Jakob B. Madsen, University of Western Australia: "They cannot keep the interest rate low forever – the ageing population will further reduce saving."

Jonathan Chancellor, Urban.com.au: "Despite some recent positive economic data, the erratic recovery from the pandemic will likely mean the next rate rise will be in 2023."

Dale Gillham, Wealth Within: "Whilst our economy is growing, it is growing slowly, and in the current COVID-19 situation, the RBA would most likely be more cautious about raising rates too quickly."

Brodie Haupt, WLTH: "We have seen a number of institutions increase their longer term fixed rates recently, but after the recent lockdown in Melbourne and the most recent COVID-19 outbreak in Sydney and Brisbane, I can't see the RBA increasing rates any time soon, due to the uncertainty that exists, especially with the rate of vaccinations in Australia still being so low. However, I don't think they will be sticking to the 2024 date that was previously stated by the reserve bank. Dare I say it, that COVID-19 could potentially have some positive effects from a consumer's perspective in this scenario by delaying the aggressive cash rate hikes that have been predicted."

Other participants: John Hewson, ANU; Geoffrey Harold Kingston, Macquarie University.

Ask a question