Send Payments review

- Number of Currencies

- 31

- Minimum Transfer Amount

- $250

- Pay By

- Bank transfer, PayID

- Fees (Pay by Bank Transfer)

- $0

Summary

Fee-free transfers in nearly 40 currencies to 180 countries.

Pros

-

Good for sending funds in 30+ currencies

Cons

-

Not so great for sending small amounts

Details

Product details

| Product Name | Send Payments |

| Pay By | Bank transfer, PayID |

| Receiving Options | Bank account |

| Customer Service | Phone, Email |

| Maximum Transfer Amount | $25,000,000 |

| Number of Currencies | 31 |

Formerly known as SendFX, Send Payments is an Australian based money transfer service with a mission to become a destination for overseas transfers. The company specialises in cross-border payments for personal and business customers looking to save on FX transactions. It aims to offer a concierge-style service to customers and partners with established brands to offer competitive deals on international currency transfers.

Why should I consider Send?

- 30+ supported currencies. Send allows you to transfer money to 180 countries in 31 different currencies.

- Fee-free transfers. Send doesn't charge any transaction fees on international money transfers.

- Australia-based support. Send's customer support team is based in Australia and can be contacted via phone and email.

- Dedicated account manager. When you register with Send, you're assigned a dedicated account manager who oversees your account and acts as a point of contact for any questions you may have.

What to be aware of

- New company. As Send officially launched in May 2019, using the service means accepting the risks associated with a newcomer to the market. You feel more comfortable sticking with a more established provider such as TorFX or OFX.

- Still in development. Some features such as the Send mobile app and Send Visa card, are yet to be launched. The company also no international offices.

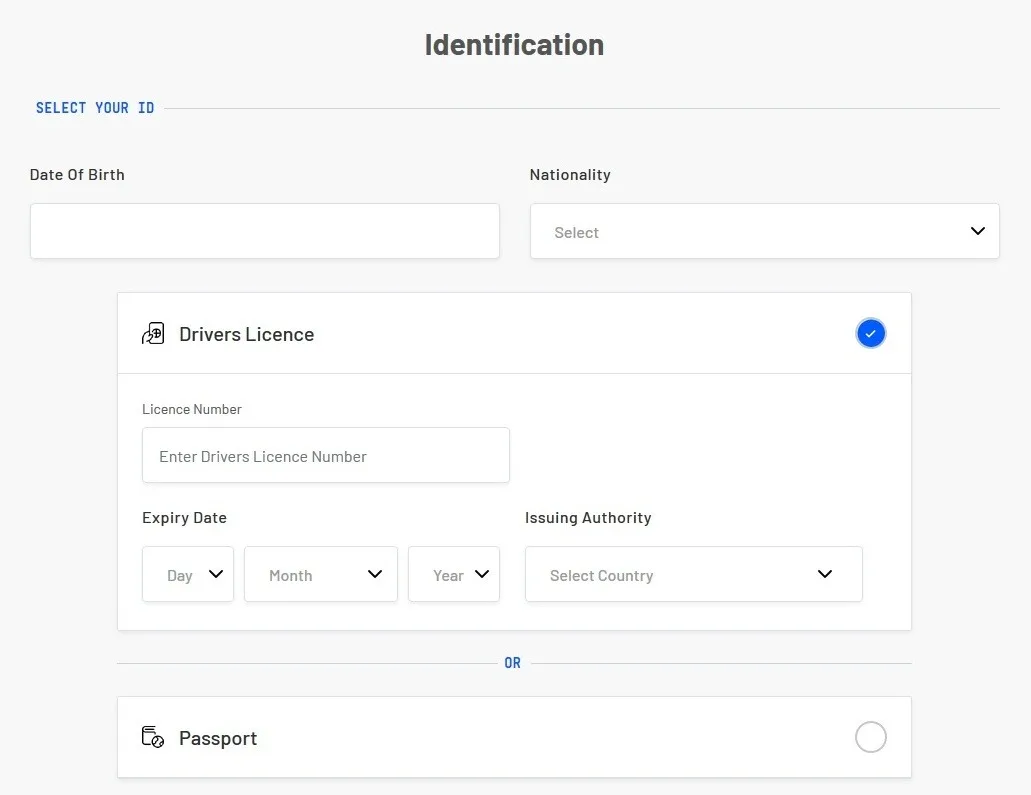

- Identity verification. You will need to provide enough information for Send to verify your identity in order to use its service.

How much are Send's transfer fees?

Send doesn't charge any transfer fees. However, like other money transfer providers, it adds a margin to the exchange rate. As well as this, corresponding and intermediary banks may charge fees for sending or receiving money from abroad. It is best to check with your bank if this is the case.

How are Send's exchange rates?

Send makes money by adding a margin to the exchange rate. These exchange rates can vary, so pay attention to the total amount expected to be transferred.

It is best to compare the displayed rate on Send with the current mid-market rate to work out the size of the margin charged. You can also then use the interbank rate as a benchmark for comparing the rates of other money transfer providers.

What your transfer with Send could look like

Complete the form and a representative from Send will call you back. If you complete the form on a weekend you'll get a call during a business day.

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

What are the ways I can send money abroad with Send?

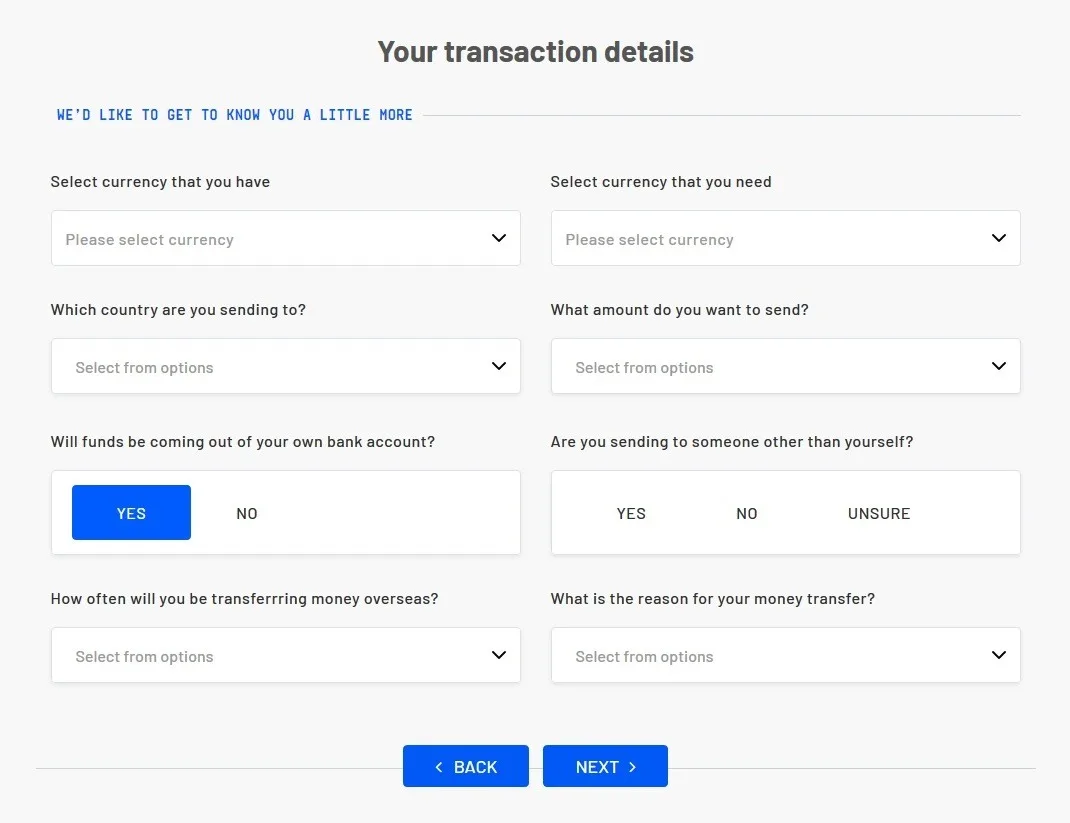

Send offers bank account transfers in more than 30 currencies. However, there are a few different options available to help you get the best exchange rate for your transaction. These include:

- Spot contracts. These are one-off transfers made using the best exchange rate currently available. If sending a spot contract, you also have the option of setting up limit and stop orders.

- Forward contracts. These contracts allow you to lock in an exchange rate now for a transaction that will take place up to 12 months in the future.

- Regular payments. You can also ask Send to set up a recurring payment up to 12 months in advance using either a recurring spot contract or a series of forward contracts.

Send Payments reviews and complaints

Send Payments is rated as "excellent" on Trustpilot and has a score of 4.9 out of 5, based on 207 reviews. Positive reviews from customers highlight their friendly customer service and competitive rates on large transfers. There aren't many negative reviews but one customer in the UK was frustrated as they had to ring during the night because customer support is based in Australia. 96% of customers rated them 5 stars and only 2% gave them a score of 3 stars or lower.

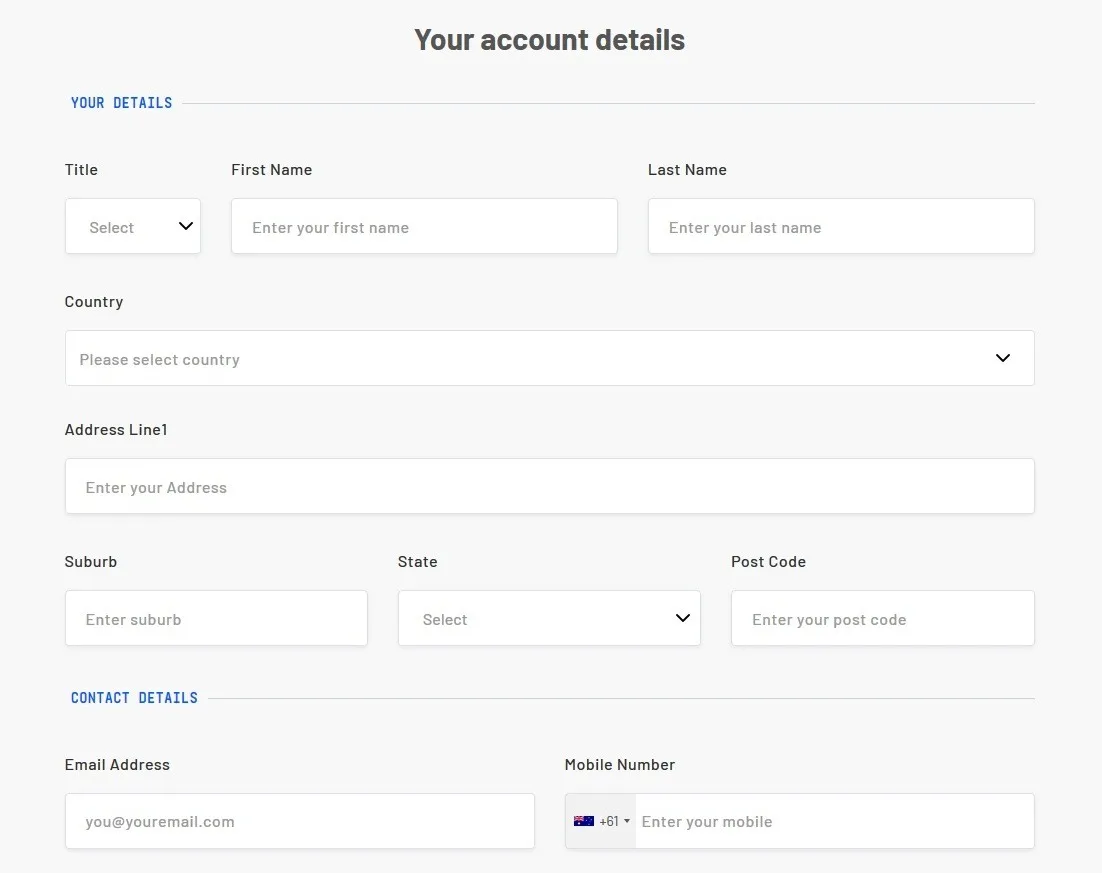

How to send money transfer online with Send

To make an online money transfer with Send, you first need to register an account. It's free to do, just complete the following steps:

What are Send's payment options?

You can deposit funds with Send via the following payment methods:

- Bank account. Register a bank account when you register and this will be used to transfer funds.

- PayID. You can make a payment into Send's account with PayID.

How long does a transfer with Send take?

Send aims to process payments quickly and transfer funds as soon as possible.

The funds you transfer should arrive in your recipient's account within 24-48 hours of Send receiving your deposit.

Transfers typically take![]()

24 hours

Is Send safe to use?

- Regulation: Regulated by ASIC.

- Established: 2019.

- Reviews: TrustScore of 4.8/5* on Trustpilot from 207 reviews.

- Investors: Novatti Group Limited.

SendFX Limited is the Australian company behind Send’s global transfer service. Send is regulated by the Australian Securities & Investments Commission (ASIC). It is also a registered remittance provider with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and holds an Australian Financial Services Licence.

How does Send compare to other providers?

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Frequently asked questions

Sources

Your reviews

Tim Finder

Writer

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.