WorldCare provides affordable travel insurance for those travelling both in and outside of Australia. Their partnership with Allianz Global Assistance ensures you receive world-class 24/7 emergency help overseas and their domestic travel plans, particularly for frequent travellers, represent excellent value for money. This guide looks at the types of cover they offer and the pros and cons of taking out insurance with WorldCare Travel Insurance.

Get your WorldCare travel insurance promo code

Current Travel Insurance Deals Available on Finder

How do I apply for cover with WorldCare?

How do I apply for cover with WorldCare?

Step 1 – Get a quote

The first to step to using your WorldCare Travel Insurance discount code is to head to their website and fill out the form. When you're doing so you will need to be able to answer:

- Where are you going?

- Asia

- Europe

- Pacific

- Worldwide

- Australia

- How long are you going for? Enter your travel dates.

- Who is going? Ages of adults and children travelling.

Once you've entered your details, click Get Quote.

Step 2 – Choose your policy

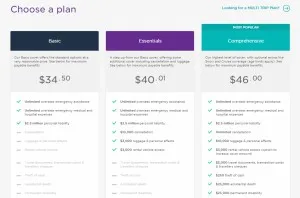

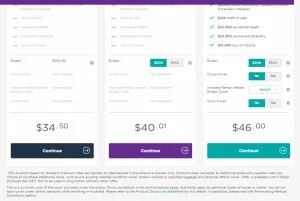

You'll be given a choice of four policies:

- Comprehensive

- Basic

- Essentials

- Multi-Trip

Each policy has it's own benefits and drawbacks:

- Comprehensive. Great if you're after a high level of cover but more expensive than the budget option.

- Basic. Excellent for those on a budget but the policy provides limited cover.

- Multi-Trip. Good idea for people who travel a lot but is expensive initially.

Once you're happy with your choice, click Buy Now.

Step 3 - Optional extras, excess and specified items

Excess Buyout

At this point you'll need to choose whether you want the Excess Buyout option.

What is an Excess Buyout? This means that for an additional upfront cost, you won't be slugged with an excess in the event you need to make a claim.

Specified Items

Next you'll need to enter any specified items you're taking with you.

What is a Specified Items? If you require extra cover for expensive items, you may need this extra benefit. This includes cover for items such as laptops, jewellery and cameras.

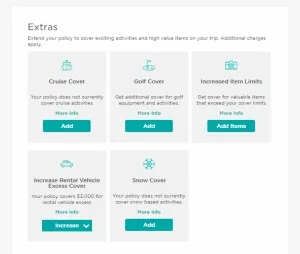

Extras

You can also choose to add golf cover, cruise cover, snow cover and increase your rental vehicle excess for an additional cost.

Once you are satisfied with your answers, click continue.

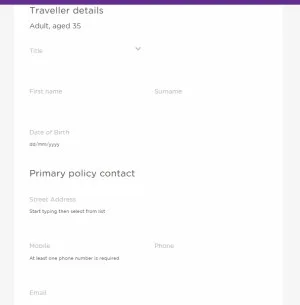

Step 4 – Personal Details

In this section, you'll need to enter the following personal information:

- Full name and title

- Date of birth

- Street Address

- Suburb

- Postcode

- State/Territory

- Phone number

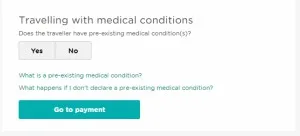

Existing conditions

If you have a pre-existing condition you will need to click yes, if not, you can hit no and move on.

During this step, you will also be asked if you suffer form any existing conditions. Be sure to answer these questions  honestly as not doing so may end in your cover being void.

honestly as not doing so may end in your cover being void.

Once you are satisfied with your answers, click continue.

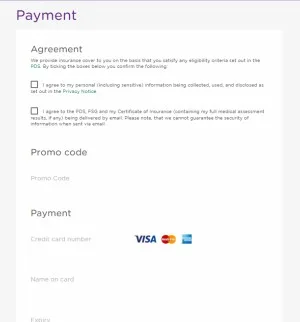

Step 5 – Payment

Tick the boxes

Prior to entering your payment details, you will be requested to confirm that you have:

- Read the Privacy Policy

- Read the Duty of Disclosure

- Read the Product Disclosure Statement

- Answered all the previous questions honestly.

If you are unhappy with your policy, you're given a 14 day cooling off period.

Enter your payment details

You'll need to enter your:

- Cardholder full name and title

- Type of card

- Card number

- Security code

- Expiry date

Once you're done filling this out, click Pay Now, and you're done.

What policies are available from WorldCare?

WorldCare offers a range of policies for both overseas trips and travel within Australia, with single trip and comprehensive options available. WorldCare Travel Insurance policies include:

- Basic. Includes the essentials but at an affordable price, offering unlimited cover for emergency medical and hospital expenses, 24/7 emergency medical assistance and personal liability cover.

- Essentials. The same medical cover as a Basic policy but you'll also get cancellation cover, additional expenses and travel delay cover.

- Comprehensive. Complete peace of mind, with unlimited overseas emergency medical, hospital and repatriation expenses, cancellations, additional accommodation and travel costs if you are unable to travel due to illness, lost travel documents, luggage, stolen cash and money towards your rental vehicle accident excess.

- Multi-Trip Plan. All the benefits of Comprehensive cover but all year long, rather than for one trip, also with a maximum journey limit is 15 days, 30 days or 45 days.

- Domestic. Excludes medical but will cover you for cancellation, including additional expenses as well as travel delay and accidental death.

- Non-Medical. If you're travelling somewhere but do not need medical cover, you can still get travel insurance that'll cover you for cancellation, travel delay, luggage and other non-medical related benefits.

- Returning residents. Ideal for Australian residents who are currently overseas and want cover for their trip home.

Who is WorldCare underwritten by?

WorldCare is a locally operated company that has been providing Australians with domestic and international travel insurance for over 20 years. WorldCare policies are underwritten by Allianz Australia Insurance Ltd, a company that service over 78 million policy holders in 70 different countries. WorldCare’s assistance provider is Allianz Global Assistance, which is part of the Allianz Global Assistance Group, one of the largest assistance companies in the world.

Pros and Cons of WorldCare

There are a number of benefits to insuring with WorldCare when you travel including:

Pros

- Save on agent fees by purchasing online

- Provides cover for some pre-existing medical conditions at no extra cost

- 24/7 contact centre and medical assistance through Allianz Global Assistance

- Simple claims process (95% of all claims paid).

Cons

- Cover must be pre-purchased in Australia, unless you buy the returning residents policy.

- Essentials and Basic plans will not cover you if you're aged 74 years or older.

How do I apply for WorldCare Travel Insurance?

It’s easy to apply for WorldCare Travel Insurance. Once you have read and compared the levels of cover available and decided which is best for you, you can purchase your travel insurance online at the WorldCare website. To get a quote, just enter the required fields in the featured box on their home page, selecting:

- Your destination (the part of the world you are travelling to, or Australia in the case of domestic travel)

- The date you will start your journey

- The date you will end you journey

- The number of adults and children requiring cover.

Then simply click on Get Quote to receive your premium estimate. Alternatively, you can call WorldCare on 1800 008 614 and talk to one of their representatives.

How do I make a claim with WorldCare?

The WorldCare claims process is also straightforward. When making a claim, be sure to give WorldCare notice of your intention to do so as soon as possible by calling them on 1300 726 087.

You can access a claim form online at www.travelclaims.com.au by entering your policy details as they appear on your Certificate of Insurance. Or if the matter is urgent and you are still overseas, you can contact WorldCare’s 24/7 emergency assistance team.

Remember to include with your claim form any documentation that is required, such as police reports, medical reports, valuations, original receipts or proof of ownership. You can email, fax or post your completed claim form to WorldCare within 30 days of your return.

WorldCare F.A.Qs

Can I cancel my WorldCare policy if I’m not happy with it?

If you change your mind for any reason or are dissatisfied with your policy, you can cancel it within 14 days of your Product Disclosure Statement (PDS) and Certificate of Insurance being issued. You will then be given a full refund of the premium you have paid.

Compare WorldCare travel insurance policies today

However, you must not have commenced your trip or exercised any right under the policy, such as making a claim. If you cancel your policy after the 14-day cooling off period, no refund, either whole or partial, will be given.

Compare WorldCare Travel Insurance Products

Sources

Ask a question

More guides on Finder

-

Best travel insurance policies Australia

The best travel insurance policies are different for each individual traveller.

-

Bali travel insurance

Compare Bali travel insurance quotes from over 16 brands.

-

Looking for a travel insurance discount in February 2026?

Check out these travel insurance coupons to save on your policy.

-

2026: How to turn 20 days of annual leave into up to 69 days off

Annual leave is precious, don't waste it! Here's the ultimate Australian travel hack to maximise your holidays in 2026.

-

Debit card travel insurance

Compare the insurance offerings from different debit cards to determine whether your card can provide the travel insurance protection you need.

-

USA travel insurance

Ready to get moving? See quotes and compare travel insurance policies for USA from 15

brands -

Cruise travel insurance

A guide to understanding cruise insurance - why you need it, what's covered, and what's not.

-

Travel insurance for backpackers

Review affordable backpacker insurance for your next overseas adventure and find the right insurance policy to cover commonplace backpacking travel risks.

-

Business Travel Insurance

Travelling for business? Find corporate travel insurance for individual and group trips.

-

Domestic travel insurance: Australia

Domestic travel insurance can provide cover for trip cancellation (domestic flights), loss or damage to luggage and expensive items, car rental excess charges and much more. Find out why domestic travel insurance is worth getting and compare policies from Australian insurers.