Compare Circle Alliance Bank Accounts

Help your nest egg grow with a competitive savings account from Circle Alliance Bank.

On June 2023, Circle Alliance Bank has merged with Bendigo Bank.

Existing Circle Alliance Bank customers will be notified directly about changes to their banking.

Set up by members more than 50 years ago, Circle Alliance Bank now offers banking products and services to more than 5,000 customers around Australia. With branches in Deer Park, Victoria, and Murarrie, Queensland, it is backed by Bendigo and Adelaide Bank.

Circle Alliance Bank is part of the Alliance Bank Group. This Group was formed following the alliance of four independent mutual entities (Circle Mutual Limited, BDCU Limited, AWA Mutual Limited and Service One Mutual Limited) with Bendigo and Adelaide Bank. This partnership means that Circle Alliance Bank can offer an extensive range of banking products on behalf of Bendigo and Adelaide Bank, but it also gets to maintain its history and presence in the community.

As well as home loans, personal loans, credit cards and insurance solutions, Circle Alliance Bank offers a number of transaction and savings accounts. These accounts combine a variety of flexible features with easy access to your funds, including the ability for Circle customers to use rediATMs Australia-wide without incurring any fees.

We currently don't have that product, but here are others to consider:

How we picked theseThe Finder Score is a simple score out of 10. The higher a savings account's score, the better we think it is for the average customer.

We score each savings account in our database of hundreds based on a data-driven methodology with 2 main criteria: Does the account offer a high interest rate? And is it easy for savers to actually earn that rate?

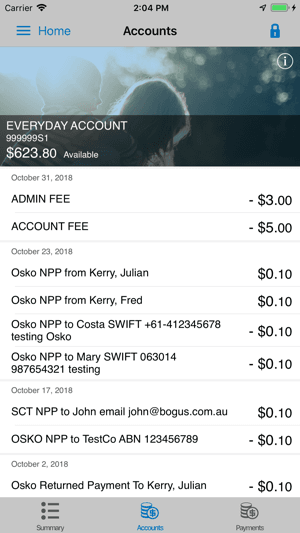

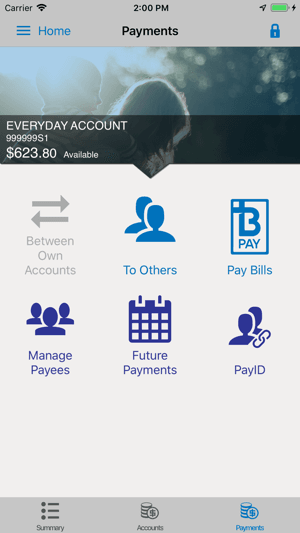

Every Circle Alliance Bank customer can manage their accounts via the bank’s Internet banking portal. This allows you to check your balance, transfer funds and update your account details online.

| Login page | Accounts | Payments |

|---|---|---|

|  |  |

A Circle Alliance Bank General Account offers a Visa debit card and provides easy access to your account via electronic and physical means. A monthly fee applies per card linked to the account and the minimum balance required is $1.

Designed to help you save money so you can cope with the cost of Christmas, the Christmas Club Account combines a competitive variable rate with no monthly fees. You can only access your balance between November 1 and December 31 each year.

Earn tiered interest on this interest-bearing account from Circle Alliance, and be rewarded with a higher rate of interest on larger deposit amounts.

Receive ongoing interest on the funds in your account, with no minimum balance or minimum opening deposit.

If you want the security of a guaranteed rate of return, Circle Alliance Bank offers term deposits with terms ranging from one month to five years. The minimum investment amount is $1,000 and interest rates vary depending on the amount you deposit and the term you select.

If you’d like to apply for a savings account with Circle Alliance Bank, click the “Apply now” link on this page and you will be taken to the Circle Alliance Bank website. You can then download an account application form. Complete this form with your membership details and the type of account you’d like to open.

If you’re a new member, a membership application form is also available from the bank’s website. You’ll need to provide your name, contact details, date of birth and proof of ID when filling out this form.

Circle Alliance Bank offers a wide variety of accounts to suit the savings and transaction needs of an even broader range of people. Compare its accounts with other products from Australian financial institutions to ensure that you find the best account for your money.

Explore how the typical Australian uses their debit card in our detailed guide to debit card statistics.

Westpac, NAB, CommBank and ANZ plus many more Australian banks offer Google Pay. See the full list of supported banks in this guide.

Check if your bank offers Apple Pay in Australia and learn how to set up and use the digital wallet for contactless payments.

Does your bank offer real-time payments using Osko and PayID? Find out below.

What are virtual debit cards, how do they work and what benefits do they offer? Find out here.

Find out which bank accounts let you withdraw from ATMs for free.

Don’t pay unnecessary bank fees, compare financial institutions and learn about the pros and cons of a fee-free bank account.

A travel debit card is just a regular Australian debit card with less international fees an charges, making it a great option to use overseas. See a range of debit cards suited for travel in this guide.

The best bank account will help you manage your everyday spending with low fees and easy access to your money. Check out our Top Picks curated by experts.

Opening a joint bank account is a big step for any couple. Find out more about what to look for in an account and how to avoid the common pitfalls.