Compare RAMS savings accounts

Find out how RAMS can help boost your savings today.

In 1995 RAMS opened to help provide alternative home loan solutions in Australia. As their business grew so did their product line, allowing them to offer simple bank accounts to meet other financial needs. Feel secure to save with RAMS knowing that they are participants in the Australian Government’s guarantee scheme on deposits of up to $250,000 per person.

We currently don't have that product, but here are others to consider:

How we picked theseWe currently don't have that product, but here are others to consider:

How we picked theseThe Finder Score is a simple score out of 10. The higher a savings account's score, the better we think it is for the average customer.

We score each savings account in our database of hundreds based on a data-driven methodology with 2 main criteria: Does the account offer a high interest rate? And is it easy for savers to actually earn that rate?

Although their focus is on affordable home loans, RAMS offers their customers an easy alternative to savings with a competitive account that is accessed and maintained entirely online. With bonus interest and no fees, Australians can easily make their money grow towards that future dream purchase.

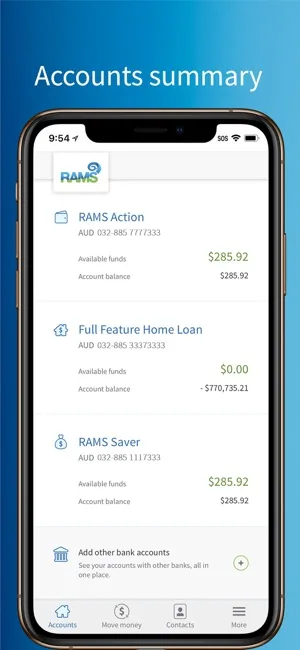

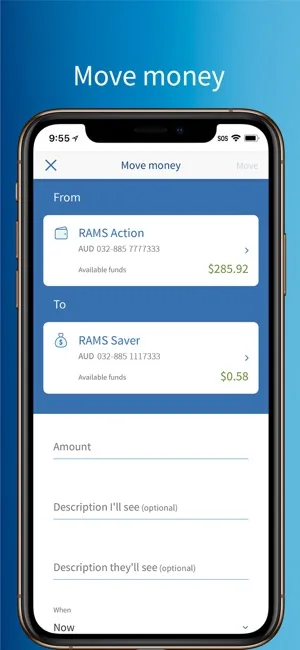

The myRAMS online banking and mobile banking platforms give RAMS customers the ability to check account balances, go through transaction history, transfer money between accounts, and manage and schedule payments. With scheduled payments, you have the ability to make changes and delete them. You can view interest summaries that give you clear indication of interest paid and earned.

RAMS relies on a number of security measures to ensure that much needed peace of mind. For additional safety, you can register for SMS notifications.

| Login | Accounts | Fund Transfer |

|---|---|---|

|  |  |

There are some conditions you will need to meet in order for your application to be accepted.

When making a decision as important as where to deposit your money for savings, it is a good idea to compare various banks and the account options they offer. This will help in making an informed decision about which institution provides you with the features and services you want.

Explore how the typical Australian uses their debit card in our detailed guide to debit card statistics.

Westpac, NAB, CommBank and ANZ plus many more Australian banks offer Google Pay. See the full list of supported banks in this guide.

Check if your bank offers Apple Pay in Australia and learn how to set up and use the digital wallet for contactless payments.

Does your bank offer real-time payments using Osko and PayID? Find out below.

What are virtual debit cards, how do they work and what benefits do they offer? Find out here.

Find out which bank accounts let you withdraw from ATMs for free.

Don’t pay unnecessary bank fees, compare financial institutions and learn about the pros and cons of a fee-free bank account.

A travel debit card is just a regular Australian debit card with less international fees an charges, making it a great option to use overseas. See a range of debit cards suited for travel in this guide.

The best bank account will help you manage your everyday spending with low fees and easy access to your money. Check out our Top Picks curated by experts.

Opening a joint bank account is a big step for any couple. Find out more about what to look for in an account and how to avoid the common pitfalls.

Do you have term deposits and where can I locate the rates? Reading some of the comments that it pays to open a saver account!

Hello Therese!

You got that right, it pays to have a savings account! :)

If this interests you, please check our list of term deposits from different banks and their rates.

Don’t forget to use our savings calculator to know which amount and term work for your needs!

Hope this helps.

Cheers,

Jonathan

On Rams Saver Account, the 3.00% special interest rate is paid monthly compounded or only yearly?

Thanks

Hi Felix,

Thanks for your inquiry. Please note that we are not affiliated with RAMS or any company we feature on our site and so we can only offer you general advice.

For the RAMS Saver Account, interest is calculated daily and paid monthly. If you withdraw from the RAMS Saver, the month that the withdrawal is done, the interest will not pay for that month. As the next month comes along, the conditions restart again.

You may contact RAMS directly for further inquiries.

Cheers,

Rench

Are deposits held in RAMS Savings Accounts covered by the Australian Government’s guarantee scheme on deposits? The introduction above says they are, but I cannot find RAMS listed on the FCS website.

Andy

Hi Andy,

Thanks for your question.

Yes, RAMS Saver Account is covered by government guarantee up to $250,000 per person, per institution. They are covered under the Westpac license.

Cheers,

Anndy

Currently have a mortgage with Rams Balance owing $39000.00.I have savings of approx $100.000.00.Im looking at maximising returns with a competitive earning interest rate,

Can you advise me as to what you can offer me.

Regards

Don Esposito

Hello Don,

Thank you for your question.

Our company, Finder, is a comparison website and general information service. We are designed to help consumers to make better decisions and we don’t actually represent other companies. What we can give you is an option where you can review the best offer that will fit your requirements. You may check our page about high-interest savings accounts and see if it is helpful.

I hope this information has helped.

Cheers,

Harold

With the Rams Saver account (3.15%) + $ 200.00 deposit each month,

WHAT IS THE MOBILE PHONE USED FOR? as I have a mobile but mostly in this area there is NO signal, reception.

Thanks, Fred

Hi Fred,

Thanks for your question.

If you have access to the internet on your mobile, you can use it to check your balance, make transfers and perform a host of other banking tasks. Otherwise, RAMS may ask for your number so they can send you sms notifications if you wish to receive this service. Typically it is used as an extra security measure when transferring funds or making payments.

Hope this has helped.

Clarizza