Compare RAMS savings accounts

Find out how RAMS can help boost your savings today.

In 1995 RAMS opened to help provide alternative home loan solutions in Australia. As their business grew so did their product line, allowing them to offer simple bank accounts to meet other financial needs. Feel secure to save with RAMS knowing that they are participants in the Australian Government’s guarantee scheme on deposits of up to $250,000 per person.

We currently don't have that product, but here are others to consider:

How we picked theseWe currently don't have that product, but here are others to consider:

How we picked theseThe Finder Score is a simple score out of 10. The higher a savings account's score, the better we think it is for the average customer.

We score each savings account in our database of hundreds based on a data-driven methodology with 2 main criteria: Does the account offer a high interest rate? And is it easy for savers to actually earn that rate?

Although their focus is on affordable home loans, RAMS offers their customers an easy alternative to savings with a competitive account that is accessed and maintained entirely online. With bonus interest and no fees, Australians can easily make their money grow towards that future dream purchase.

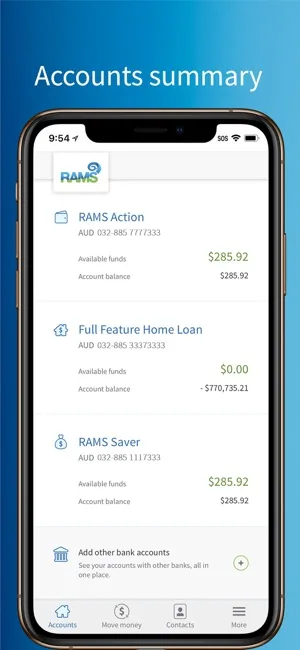

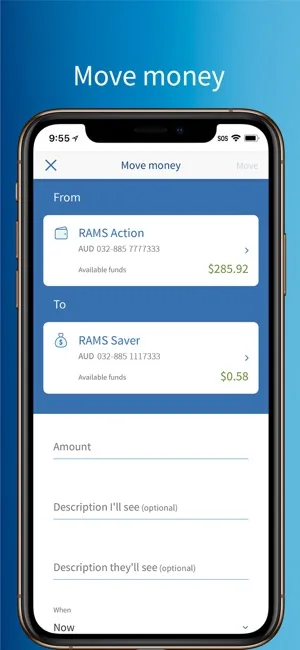

The myRAMS online banking and mobile banking platforms give RAMS customers the ability to check account balances, go through transaction history, transfer money between accounts, and manage and schedule payments. With scheduled payments, you have the ability to make changes and delete them. You can view interest summaries that give you clear indication of interest paid and earned.

RAMS relies on a number of security measures to ensure that much needed peace of mind. For additional safety, you can register for SMS notifications.

| Login | Accounts | Fund Transfer |

|---|---|---|

|  |  |

There are some conditions you will need to meet in order for your application to be accepted.

When making a decision as important as where to deposit your money for savings, it is a good idea to compare various banks and the account options they offer. This will help in making an informed decision about which institution provides you with the features and services you want.

Explore how the typical Australian uses their debit card in our detailed guide to debit card statistics.

It's common to have a few different bank accounts that each have a different purpose. Here's how you may benefit from having multiple bank accounts and the traps to avoid.

PayID allows you to transfer money in real-time without entering your recipients BSB and account number. Read this guide to learn about the benefits of PayID and how to set it up.

What are virtual debit cards, how do they work and what benefits do they offer? Find out here.

Some banks allow you to send money using someone's phone number instead of a BSB and Account Number. If your bank doesn't have this feature you can usually use PayID instead - here's how.

Learn what to do if, in the unlikely event of a cybercrime attack, your bank account is hacked.

A travel debit card is just a regular Australian debit card with less international fees an charges, making it a great option to use overseas. See a range of debit cards suited for travel in this guide.

With a rewards debit card in your wallet, you can earn points or get cash back while using your own money.

The best bank account will help you manage your everyday spending with low fees and easy access to your money. Check out our Top Picks curated by experts.

When used wisely, a debit card provides you with great flexibility when it comes to handling your everyday financial needs.

hi can you please tell me if they charge fees to take your money out of the savings account. thanks

Hi Allie,

Thanks for your query.

RAMS Saver is a fee-free account. You won’t be charged if your take money out of your account. However, it’s important to note that you will not earn the bonus interest rate if you withdraw your money.

I hope this helps,

Harry

I have two RAMS saver accounts. Seek confirmation that contravention of conditions one account does not affect the bonus interest on the other.

Hi Rod,

Thanks for your question.

If you have two RAMS Saver accounts but you only miss the bonus interest conditions on one of your RAMS Saver account, you can still receive the bonus interest on the other.

Cheers,

Shirley

re~rams saver account in accordance with the $200 dep monthly with no withdrawals to get 3.60 p.a, does the invested amount need to be in for a minimum period of 12 mths?

Hi Jo,

Thanks for your question.

No the invested amount doesn’t need to be in for a minimum period of 12 months. If you meet the conditions for the bonus interest, you’ll receive that on the balance in your account for that month.

Cheers,

Shirley