Commonwealth Bank Business Banking

Commonwealth Bank provides a wide range of products and services for your business, including accounts, loans and payment processing services.

Starting, managing and growing a business is no easy task, which is where the Commonwealth Bank of Australia comes in. As well as offering products that are essential for the financial management of your business, CommBank provides a range of resources, services and technologies that can help with your business's progression. From developing your business plan and choosing the right type of finance to buying, selling, managing or growing your business, CommBank offers support for companies both large and small.

We currently don't have that product, but here are others to consider:

How we picked theseWe assess multiple product features for transaction accounts from over 100 providers and assign each product a score out of 10.

We currently don't have that product, but here are others to consider:

How we picked theseThe Finder Score is a simple score out of 10. The higher a savings account's score, the better we think it is for the average customer.

We score each savings account in our database of hundreds based on a data-driven methodology with 2 main criteria: Does the account offer a high interest rate? And is it easy for savers to actually earn that rate?

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score assigns Term Deposit products a score out of 10, comparing interest rates and features, to make comparison easier. We assess over 150 products from more than 90 providers, assessing products across different terms to determine an average score per product.

We currently don't have that product, but here are others to consider:

How we picked theseWe assess multiple product features for transaction accounts from over 100 providers and assign each product a score out of 10.

We currently don't have that product, but here are others to consider:

How we picked theseThe Finder Score is a simple score out of 10. The higher a savings account's score, the better we think it is for the average customer.

We score each savings account in our database of hundreds based on a data-driven methodology with 2 main criteria: Does the account offer a high interest rate? And is it easy for savers to actually earn that rate?

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score assigns Term Deposit products a score out of 10, comparing interest rates and features, to make comparison easier. We assess over 150 products from more than 90 providers, assessing products across different terms to determine an average score per product.

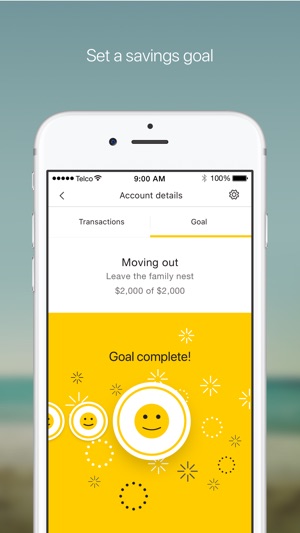

| Manage Accounts | Ask Ceba | Set a savings goal |

|---|---|---|

|  |  |

The application process depends on what type of product or service you wish to apply for. It also depends whether you intend to start your own business or if you’re looking for a product that will help you run your existing business.

If you already have a NetBank account, you can apply straight away for the following products.

You may need the following documentation for your application:

With such a wide range of services available from CommBank, it's a good idea to consider what your business needs so you can choose the products that are suited to your goals. You may also want to consider talking to a CommBank representative about how these products can be tailored to your specific business needs to help you get a solution that really works for your business.

The Commonwealth Bank Business Transaction Account offers a Business Visa debit card, easy access to your funds and a range of convenient tools to help you manage your business’s cash flow.

The CommBank Business Term Deposit offers terms from 1 month to 5 years, with fixed interest rates and no account fees.

The Commonwealth Bank Business Transaction Account offers a Business Visa debit card, easy access to your funds and a range of convenient tools to help you manage your business’s cash flow.

With an account structured like Commonwealth Bank’s Business Online Saver, you have the opportunity to grow your business’ wealth.

When you and ur partner open a business account in both names does it take both of u to close the account

Hi Stephen,

Thanks for your question.

Generally, yes both parties will need to agree to close the account. You can have alternative arrangements in writing, depending on how accommodating your bank is.

Cheers,

Shirley