Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseThe lowdown on Finder Score

Let's face it, the average person doesn't spend all day comparing credit cards. But we do. That's why we developed the Finder Score.

It's a quick, easy way you can see how one credit card compares to others on the market.

But a lot of work goes into that number. Every month we:

- Analyse 127 credit cards with balance transfer offers.

- Assess seven features of each card and give each component a rating.

- Combine the ratings via a weighted methodology to decide the Finder Score.

We give different scores for different categories. So one card might get a 9 in the balance transfer category but only a 7 in the rewards category.

The Finder Score methodology is designed by our insights and editorial team. We review products objectively. Commercial partnerships do not affect the scores.

Remember that Finder Score is just one factor to consider. Look at other aspects like fees, features, benefits and risks to make sure a product is suitable for you. Double-check details that matter to you before applying or buying.

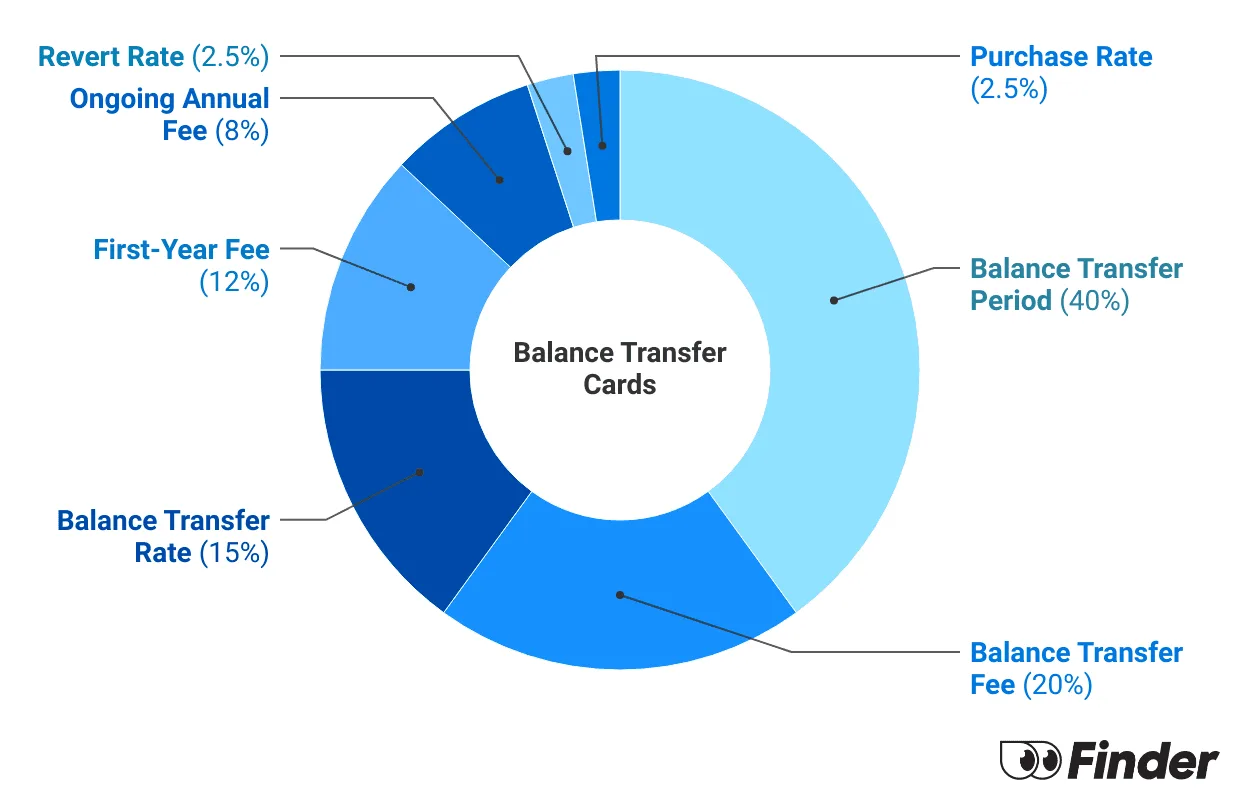

Balance transfer credit cards - score weightings

| Feature | Definition | Assessment | Weight |

|---|---|---|---|

| Balance Transfer Period | Length of the interest-free period on transferred balances (in months) | Longer periods earn more points, up to the market maximum | 40% |

| Balance Transfer Fee | Percentage charged on the transferred balance | Lower fees score higher. 0% fee receives the maximum points | 20% |

| Balance Transfer Rate | Interest rate on transferred balances after the introductory period ends | Lower rates score higher. 0% rate receives the maximum points | 15% |

| First-Year Fee | Annual fee charged in the first year of ownership | Lower fees score higher. $0 fee receives the maximum points | 12% |

| Ongoing Annual Fee | Annual fee charged from the second year onwards | Lower fees score higher. $0 fee receives the maximum points | 8% |

| Revert Rate | Interest rate applied to remaining balance after the introductory period | Lower rates score higher | 2.5% |

| Purchase Rate | Interest rate on new purchases | Lower rates score higher | 2.5% |

Finder Scores: What they mean

- 9+ Excellent - These cards offer the longest 0% interest periods, lowest balance transfer fees, and competitive revert rates for maximum savings.

- 7+ Great - Tackle debt with generous interest-free periods, reasonable balance transfer fees, and potential for additional perks.

- 5+ Standard - Reduce interest costs with reasonable interest-free periods and balance transfer fees.

- Less than 5 – Basic - These are generally cards aimed as general audiences which include a balance transfer feature.

Ask a question