0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

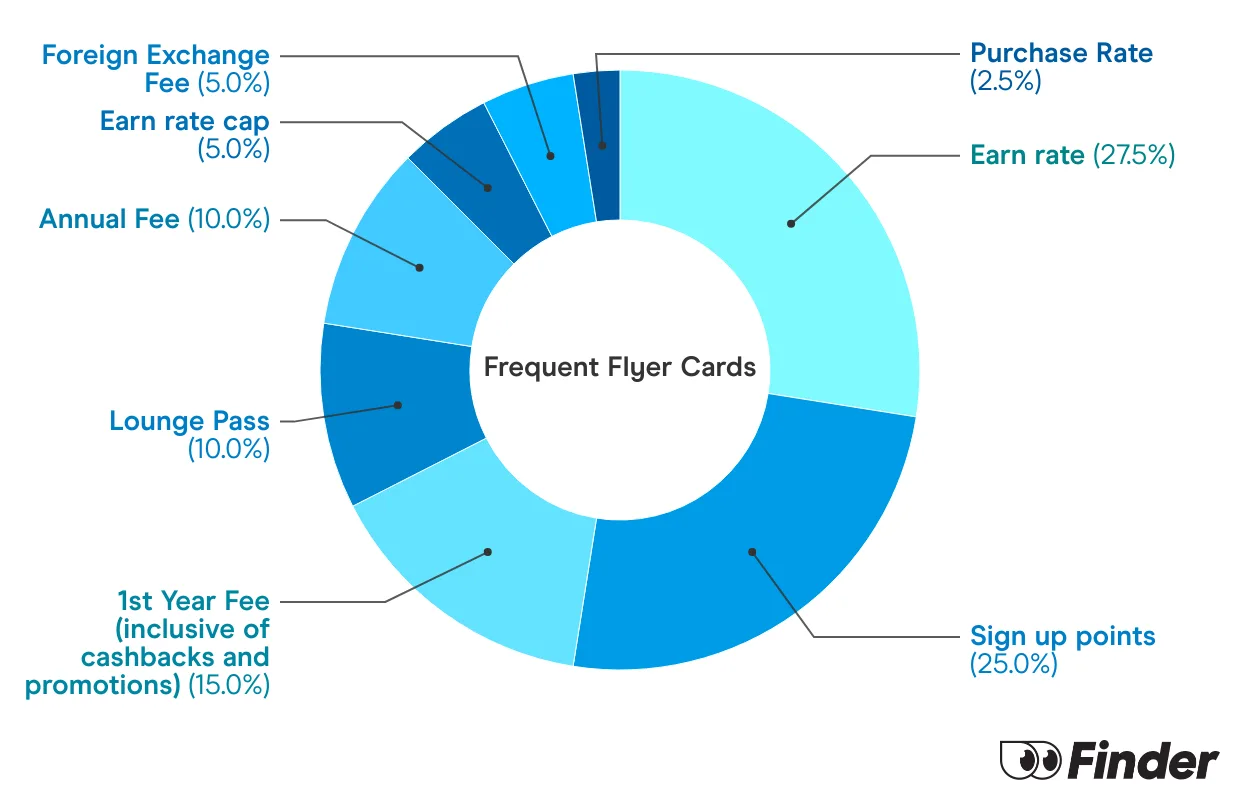

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

How many Qantas Frequent Flyer points do I have now?

Hi Keith,

You can log into your frequent flyer account to get this information. If you don’t have access to this, you can contact Qantas FF customer support on 13 11 31 or frequent_flyer@qantas.com.au. Best of luck!

I currently have a Woolworths credit card linked to my Qantas Frequent Flyer account, which earns me Qantas points. Am I still eligible for the additional 15,000 points offered by Finder if I sign up to a new Qantas credit card?

Hi Amanda,

Unfortunately, if you currently earn Qantas Points through a credit card (or have in the past 12 months), you wouldn’t be eligible for the the extra 15,000 Qantas Points. But if you want a new Qantas credit card, you can still get bonus points through an introductory offer. I hope this helps.

Could you tell me if all credit card companies have the same eligible purchase policy in regards to what constitutes a NON ELIGIBLE PURCHASE and an eligible?

Also, I have a CBA credit card as it partners with flight centre and I have 700,000 points but my points value is terrible so I’m looking at a Qantas card to replace it so I can get better value for points. I also want to enjoy lounges when I travel.

Hi Peter,

Not all credit card issuers have the same list of eligible purchases thus it would be best for you to review the card’s Product Disclosure Statements/Terms and Conditions or contact the provider if you have specific questions.

The CommBank Awards program offers you awards points for everyday spending and it also gives you options for earning either Qantas or Velocity frequent flyer points. If you choose to apply for a credit card with free lounge access, please use our comparison table to compare your options. When you are ready, press the ‘Go to site’ button to apply.

What card would give me the highest amount of points for international travel? I am planning on being away for a year or so and require a card that can reward me with Qantas points.

Hi Trace,

While we do not provide specific product recommendations, we can help guide you through the process of comparing options. On the page you’re on, we have a comparison table that provides a list of cards that offer Qantas points.You may sort them by ‘Rewards Points per $ spent’,the page will automatically provide you the card you are looking for. You may hover your mouse to the ‘i’ symbol to know the details about how much point you get earn.

Hi,

We joined Frequent Flyer (Bronze) 2 months ago, as yet no card. Is this normal?

Thank you.

Bruce

Hi Bruce,

Please note that if you joined through the Qantas Club Service Centre, your membership card will be delivered within 14 days. Since you mentioned that it has been 2 months when you joined, kindly contact the Frequent Flyer Service Centre as soon as possible to report this matter. Additional info, Bronze Frequent Flyer Cards are only issued to eligible members residing in Australia. A Replacement Card Fee might be charged when a replacement card is issued. However, you may request to waive the said fee since you did not receive the initial membership card.