🔥 Hot tip

Set up direct debits so payments are made automatically. Just make sure you have money in the bank account to cover the payment.

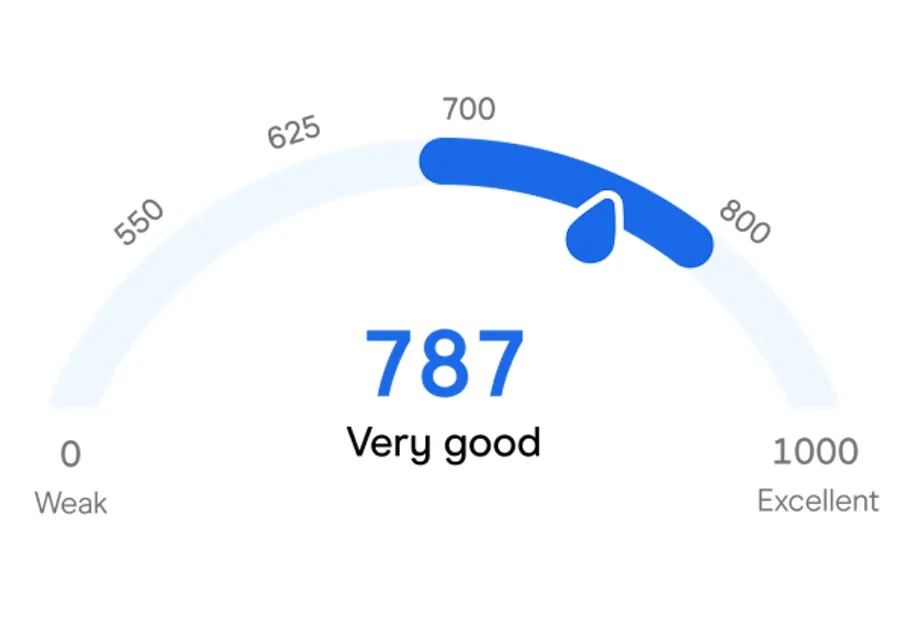

There are a number of things you can do to improve your credit score quickly, and other things you can do to improve it over a longer period of time. Before you get started: you need to check your credit score to see what your baseline is.

You can check your credit score for free through Finder. It takes a couple of minutes and then you'll know exactly what your score is. You'll get a score between 0 and 1,000. The higher the better.

Along with the score you'll get your credit report, which contains:

Once you have your credit score you can identify the best ways to increase it.

Look at the details contained in your credit report. If it all looks accurate, then jump to step 3. But if you find any errors you can get them corrected and your credit score should increase pretty quickly.

Here are some examples of possible errors:

You can request a correction on your credit report through the agency that issued the report. And you can contact the credit provider that made the mistake directly.

You'll need some personal identification, plus the report, the specific detail you're challenging and evidence of the error.

Fix the biggest issues dragging your credit score down as soon as possible. Red marks on your credit report are usually:

Prioritise paying off any outstanding debts, especially a default. Make sure you pay any missed payments before the 14 days if possible. Paying off an outstanding payment looks better on your credit report but the missed payment or default is still recorded.

It sounds obvious, but don't miss a payment on your credit card or loan. Pay off at least the minimum on your credit card before it's due.

🔥 Hot tip

Set up direct debits so payments are made automatically. Just make sure you have money in the bank account to cover the payment.

If you have a credit card you hardly ever use, a personal loan nearly paid off or any other debts you can pay out and close, doing so will instantly give your credit profile a boost.

This is because when you cancel a credit card, you're reducing the amount of overall debt you have access to. This is seen as a positive and may improve your credit score.

If you already have a credit card and you're making repayments on time, you can further improve your credit score by lowering the card limit. That's the maximum amount you can spend using the card.

It's much easier to get into financial trouble with a card that lets you spend $10,000 versus one with a limit of $2,000. If you don't need to make big purchases on your credit card, lower your limit and your credit score should increase by the following month.

Your credit record collects both positive data (all the years you've spent paying your phone, internet, electricity and gas bills on time) and negative data (late payments, defaults). When you pay your bills on time, you're building a positive credit score over time. Setting up direct debits for your bills (or even automatic reminders) is the easiest way to do this.

You might think someone who has never had a cent of debt to their name would have a perfect credit score. But that's not the case.

To prove you are a reliable borrower you need to actually have a history of managing debt responsibly. If you've never had a loan or credit card before it can be hard to show this. You can start to build your credit rating with a credit card.

Just make sure:

Having some debts is good – a borrower with a single credit card and a home loan who never misses a repayment is likely to have a strong credit score.

But if you have 3 credit cards and 2 personal loans, you may struggle to improve your credit score even if you never miss a repayment.

If you can cut down to 1 or 2 credit cards and consolidate your loan debts you can lift your score.

Alternatively, prioritising paying off one of the loans completely would help too. A balance transfer credit card can be the best way to roll card debts into one manageable debt.

Buy now pay later (BNPL) products like Afterpay might not seem like credit products. But using BNPL can harm your credit score.

Missing BNPL repayments will hurt your credit score. And some BNPL providers make a credit enquiry when you sign up, meaning the company takes a look at your credit report. This can impact your credit score too.

When you apply for a loan or credit card the lender requests a copy of your credit report. This is called a hard inquiry and it can negatively affect your report.

This is because multiple applications for credit in a short time are considered a bad sign.

To avoid this:

🔥 Hot tip

Getting rejected for a credit application hurts your credit score because of the hard inquiry mentioned above. Avoid applying for another credit product until you understand why you got rejected for the first one. Multiple inquiries can harm your credit score even more. Checking your own credit score is considered a soft inquiry and doesn't affect the score in any way.

| Response | |

|---|---|

| No | 68.8% |

| Yes | 31.2% |

Unfortunately there is no quick fix or shortcut to improving your credit score. If you have a poor score, it can often take time before you see a huge improvement in your credit rating.

However, by consistently following the steps above you should see your score gradually increase.

One exception may be if you have multiple errors in your credit report that are harming your score. Getting these corrected and removed from your report may have an immediate impact on improving your credit score. In the meantime:

If you've had a very bad run with your finances – missed payments, defaults, a bankruptcy – then time is your friend.

In Australia, defaults stay on your credit report for 5 years. Missed payments stay for 2. If you were declared bankrupt, the bankruptcy stays on your report for 2 years from the end date or 5 years from the date you became bankrupt (whichever of the 2 is later).

So while all the tips we've outlined above are very useful, for people with terrible credit the passage of time also helps a lot. Just avoid getting into more credit trouble in the meantime.

There may be mistakes on your credit report you can fix. And there are companies that offer credit repair services who can fix those for you.

But these companies can charge high fees and are often just doing things you can easily fix yourself, for free.

Paying off debts completely is good financial advice. But it's often worth keeping a credit card you rarely use and have always paid off on time. This card is a good example of your creditworthiness.

Just make sure you keep the limit as low as possible.

If you're struggling to make repayments and need financial help you have options:

Credit Repair Australia can help you sort out your credit score and improve your chances of getting a loan or credit card.

Missing a phone bill can end up hurting your credit score, but simply having a mobile plan won't impact your credit report.

Follow these tips to get a handle on your credit with this free tool.

The average Australian has a "very good" credit score according to Finder analysis. Here's how credit scores are categorised in Australia, and how to check yours.

Credit reporting bureaus issue credit reports and scores to consumers and lenders. Discover how they work in this guide.

If you're planning to cancel a credit card, here's what you need to know about the impact it could have on your credit score.

How to remove incorrect negative listings from your report and adopt positive money habits to get your credit history back on track.

How to remove enquiries from your report in 4 steps and a guide for improving your credit score.

Discover how you can use a credit card to build or repair your credit history.

Hi there,

How do I go about finding out what my credit score is? How do I improve it? Is it free and simple to find out my score and fix it or does it take years to do? I’m only on DSP since I suffered a stroke.

Hi Kat,

Thank you for your enquiry.

You can request your credit score for free through our website. It’ll just take you few minutes to fill out the form and you’ll then know your credit score.

There are several ways to improve your credit score like paying your bills and debts on time and avoiding unnecessary debts. You can get more tips on how to improve your credit score on this page.

Fixing or building up your credit score might take some time but it’ll be beneficial for you once your credit score improves.

I hope this helps.

Kind regards,

Jason

How can I get a Visa Debit card?

Hi Tofaelm,

Thanks for your question.

You check and compare Visa debit cards. Once you have chosen a particular card, you can click on its name to check the requirements to apply. To submit an application, just click the ‘open button.’

Cheers,

Anndy

Does my savings account factor into my credit score?

Hi Nat,

Thanks for your question.

Your savings account has no effect on your credit score, but a solid savings history may also help you be approved for a loan as you can often list it along with other assets on an application.

Hope this helps,

Elizabeth