Key takeaways

- Liquidity pools make decentralised finance (DeFi) possible.

- You can earn liquidity pool tokens (LPT) by providing liquidity.

- You can then stake your LPTs to earn extra rewards.

Decentralised finance (DeFi) protocols have exploded in popularity and thats thanks largely to the decentralisation of liquidity via global liquidity pools.

Decentralised Exchanges (DEXs), borrow-lend protocols, synthetic assets, on-chain insurance and yield farming all utilise liquidity pools. Liquidity pools are used in conjunction with smart contracts to facilitate financial services.

In traditional finance (CeFi), liquidity is provided by a centralised organisation, such as a bank. In the case of a cryptocurrency exchange, it's usually provided by a market maker that matches buyers with sellers.

However, in DeFi, liquidity is provided by individual users that are incentivised to deposit their cryptocurrency in return for rewards. Rewards can come as a share of the transaction fees or additional cryptocurrency tokens.

What is a liquidity pool?

A liquidity pool can be thought of as a pot of cryptocurrency assets locked within a smart contract. The funds can then be used for exchanges, loans and for many other applications.

By far the most popular use case for liquidity pools is on decentralised exchanges, which have become the backbone of the DeFi ecosystem. Decentralised exchanges allow users to swap cryptocurrency assets via smart contracts. They are able to achieve this through the application of an automated market maker (AMM).

A liquidity pool is usually composed of 2 cryptocurrency tokens that create a market for anyone wishing to exchange between the 2. Some exchanges also offer multiple crypto asset pools.

The most popular decentralised exchange is Uniswap, with billions locked in the protocol at the time of writing. Other popular exchanges that utilise liquidity pools include AAVE, Curve, SushiSwap and Balancer.

What is a liquidity provider?

A liquidity provider (LP) is anybody that supplies a liquidity pool with cryptocurrency assets so that the funds can then be used for the associated DeFi protocol.

Liquidity providers need to deposit cryptocurrencies of equal proportion into a liquidity pool. This provides a market for that cryptocurrency pairing that others can then use to trade.

In return for providing liquidity to a market, the LP is offered a return on investment. Without LPs, trades could not occur, so, as LPs are facilitating trades, they are rewarded with a percentage of the transaction fees. The amount that an LP is rewarded depends on the percentage of the liquidity pool that they provide.

What are liquidity provider tokens (LPTs)?

When liquidity providers offer liquidity to a DeFi protocol they must deposit their own cryptocurrency assets. In exchange for depositing real cryptocurrency assets, LPs receive liquidity provider tokens (LPTs) that represent the users' share of the chosen liquidity pool. LPTs can be thought of as a receipt, used to show proof of ownership.

The liquidity provider token is key to the function of automated market makers (AMMs) used on many exchanges. By receiving LPTs in exchange for deposits it ensures protocols are non-custodial, meaning each user has complete control of their digital assets. The user can use the LPTs to withdraw their staked deposit at any time.

Staking liquidity provider tokens to earn additional rewards

LPTs are created as ERC-20 (Ethereum-native) tokens, which means they can be used on other DeFi protocols just like the underlying assets they represent. Essentially, the LPT represents ownership of a real amount of money, albeit in a new form.

You can think of this as leveraging, or "double-dipping" – taking a single piece of capital and using it for multiple purposes at once. Similar to how a family might choose to use their house as collateral to take out a loan on a second investment property, without having to give up the underlying asset (the family home).

To get a better understanding of this, let's look at how you can earn the SUSHI token on the decentralised exchange SushiSwap.

- Deposit equal portions of ETH and DAI to the ETH-DAI liquidity pool.

- Receive ETH-DAI liquidity provider tokens (LPTs).

- Deposit LPTs to ETH-DAI staking pool.

- Receive the SUSHI token as a reward.

The ETH-DAI originally deposited would be earning a proportion of the fees collected from exchanges on that liquidity pool and at the same time, you would be earning the SUSHI token in return for staking your LPTs.

Popular DeFi platforms to provide liquidity

AAVE

A lending and borrowing protocol for both stablecoins and altcoins. Users are offered both variable and stable rates on loans.

How to use AAVE for lending and borrowing.

Uniswap

The most popular decentralised exchange currently where users can exchange any ERC-20 token with hundreds of liquidity pools.

How to provide liquidity on Uniswap and earn yield.

Balancer

A decentralised exchange where users can create liquidity pools with up to 8 cryptocurrencies rather than the standard 2. LPs can also set the transaction fees when exchanging with a specific liquidity pool.

Curve Finance

A decentralised exchange focused on the trade of stablecoins such as USDT and USDC. The focus on coins of a stable nature lowers fees and minimises slippage when exchanging.

SushiSwap

Touted as the community-governed decentralised exchange, the protocol offers users up to 3 layers of yield-earning potential.

How to make money from liquidity pools

Let's look at an example of how to provide liquidity and earn staking rewards from liquidity provider tokens.

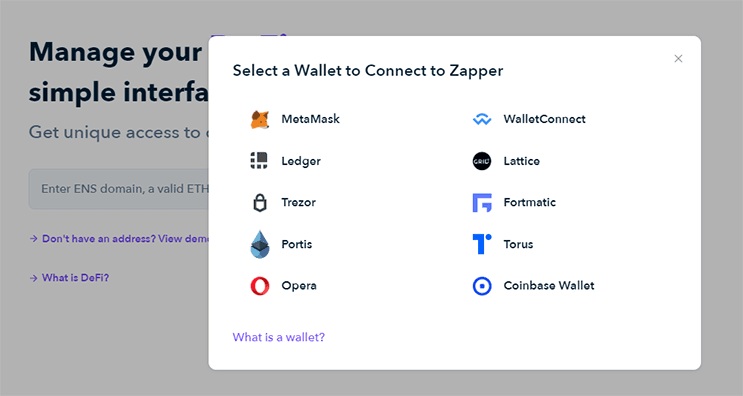

For this example, we'll be using Zapper.fi. Zapper.fi is not a DeFi protocol but is a DeFi product aimed at managing DeFi investments. Investing in the DeFi ecosystem can be confusing. A basic understanding of the Ethereum blockchain is usually required. Zapper.fi aims to simplify that process by allowing users to deposit liquidity to different DeFi protocols all from the comfort of one dashboard.

How to provide liquidity:

To provide liquidity to the DeFi sector you will need to get a web 3.0 digital wallet such as Metamask. Once you have your Metamask set up you then need to deposit some ETH into it so that you have something that can be used to provide liquidity.

- Zapper.fi. Go to Zapper.fi/pools and connect your web 3.0 digital wallet.

- Explore opportunities. Click "Explore opportunities" and search for a liquidity pool that you would like to provide liquidity to.

- Add liquidity. Click "Add liquidity".

- Choose a token. Choose a token that you would like to deposit. This can be either one of the two tokens in the liquidity pool, or Zapper.fi allows for background conversions for the majority of highly liquid assets such as ETH, DAI, USDC and USDT.

- Transaction settings. Set the preferred settings for your transaction including preferred gas price and slippage tolerance.

- Confirm. Click "Confirm" to execute the deposit.

Note: If using a cryptocurrency other than ETH, Zapper.fi may require you to approve a spending limit for the first deposit.

Once the transaction is executed you will receive your associated liquidity provider tokens in your web 3.0 digital wallet. These represent your share of the chosen liquidity pool.

How to stake liquidity provider tokens:

- Zapper.fi. Go to Zapper.fi/farm.

- Search. Search by either token or by the protocol for yield farming opportunities applicable to you.

- Stake. Once you have found a staking opportunity you are happy with, click the "Stake" button to deposit your liquidity provider tokens.

- Earn rewards. Begin earning rewards on your staked liquidity provider tokens.

Once you have staked your LPTs, you will then be earning the associated reward. This can be another percentage of the transaction fees or the native cryptocurrency token of that DeFi protocol.

Risks of liquidity pools

Depositing cryptocurrency assets into a liquidity pool does not come without associated risks and those risks should be evaluated before committing your assets. These risks include:

- Impermanent loss. Price volatility and fluctuations can cause imbalances in the pool, which are taken advantage of by arbitrage traders. This can result in you exiting the liquidity pool with more or less of a token than when you deposited. The new ratio of tokens that you exit with may be worth less than if you had kept the original ratio you entered with.

- Smart contract reliance. All DeFi protocols rely on smart contracts. Although innovative, smart contracts are not without bugs and malfunctions. This leaves any cryptocurrency assets positioned on DeFi protocols at risk of being lost with often very little in the way of recovery.

- Protocol governance. DeFi protocols are intended to be decentralised meaning no one entity has control over development or funds. However, there have been instances where this has not been the case.

Pros and cons

Pros

- Accessibility. Anyone can provide liquidity to a liquidity pool which is a truly unique feature in the world of finance.

- Non-custodial. Users are constantly in control of their own digital assets.

- Yield farming opportunities. Some DeFi protocols offer multiple layers of fee and yield earning.

- Decentralised finance. The use of liquidity pools has opened a world of decentralised trading, lending and yield earning potential.

Cons

- Smart contract reliance. Smart contract bugs and malfunctions can mean cryptocurrency assets are lost within the AMM.

- Impermanent loss. The ratio of deposited assets may change due to price fluctuations.

Frequently asked questions

Sources

Ask a question

More guides on Finder

-

What is a DAO? Decentralised Autonomous Organisations explained

DAOs are already replacing traditional business models and revolutionising the world of investing. Find out how they work and how to invest.

-

DeFi coins and tokens: A simple guide for beginners

DeFi tokens compose a prominent sector in the cryptocurrency markets. Learn the basics of these tokens here.

-

What is impermanent loss?

Impermanent loss can be an unforeseen risk when providing liquidity to DeFi. Here we explain what it is with an easy to follow example, and outline how it can be avoided.

-

Yield farming: A beginner’s guide

Put those cryptocurrency assets to work in the DeFi sector and earn yield with yield farming.

-

DeFi and Web3 wallets in Australia

Find out how a Web 3.0 wallet can allow you to access the world of DeFi, plus discover which wallets we recommend.

-

What is an automated market maker?

Discover what an automated market maker is in DeFi and what it offers in comparison to the traditional market-making system.

-

The ultimate guide to decentralised exchanges (DEXs)

A comprehensive guide to decentralised cryptocurrency exchanges, how they work and the benefits they offer to anyone looking to buy or sell digital currency.