Key takeaways

- Medicare or insurance will not pay for cosmetic surgery that is not medically neccessary.

- However you can get cover for reconstructive surgery with a valid medical reason.

- This is covered by the bronze tier of private hospital insurance.

How does Medicare or health insurance cover cosmetic surgery?

Plastic surgery can be split into two categories - reconstructuve and cosmetic surgery. Whether your treatment will be covered by Medicare or private hospital insurance depends on which category it falls into.

Reconstructive surgery

Reconstructive surgery is performed to correct abnormalities. These could be from birth or acquired through life, or be damage as a result of trauma or a bad accident.

Reconstructive surgery is generally considered medically neccessary and will covered by both Medicare and your private hospital insurance.

Cosmetic surgery

Cosmetic surgery is typically carried out to improve appearance rather than health. For example, facelifts, implants, eyelid surgery and liposuction.

It's not covered by Medicare or health insurance because it's not considered medically necessary.

Finder survey: How many people made a hospital claim for any of these conditions?

| Response | Female | Male |

|---|---|---|

| Plastic or reconstructive surgery | 0.96% | 0.21% |

What counts as medically neccessary for plastic surgery?

There are a lot of valid medical reasons for plastic surgery. A few examples include the following:

- Reconstructive facial surgery after a bad car accident

- Surgey to correct your nose if you're unable to breathe properly

- A single breast reduction to even them out after removing a cancerous breast

Policies that cover medically neccessary plastic surgery

Here's a sample of policies from Finder partners that include private cover for plastic surgery. All prices are based on a single individual with less than $101,000 income and living in Sydney.

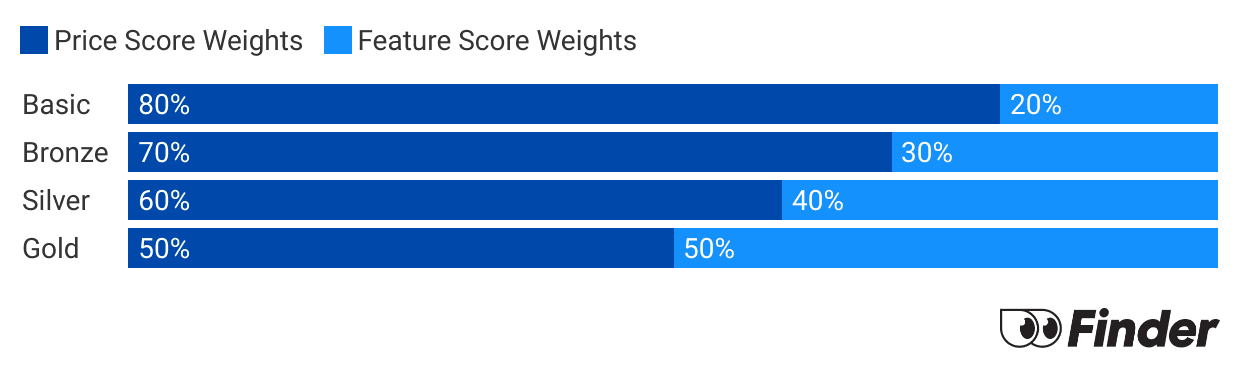

Finder Score - Hospital cover health insurance

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

Medicare vs private for medically neccessary plastic surgery

There will be some differences to your experience in the public or private system. Assuming your hospital cover is enough to cover the procedure, the big differences will be around surgery wait times and out-of-pocket costs.

Surgery wait times

When you need surgery, you'll be put into a queue of people waiting for a spot with a surgeon. There are wait lists for both the private and public system, but the private lists are generally a lot shorter.

How long are the lists? It depends, unfortunately. Public waiting lists can often be in the months or years. It will also depend on how urgernt your condition is. If you need urgent work as the result of trauma, you'll probably get seen very quickly. On the other hand, surgery that's deemed less urgent might see you drop down the list a lot.

Private hospital insurance is generally the most reliable way to get quick treatment.

Out-of-pocket costs (the gap payment)

In the public system, you won't need to pay anything for your surgery, though there may be some incidental costs. This is the benefit of going 100% public. Private treatment, though offering your choice of surgeon and faster treatment, could see you have some out-of-pocket csots.

How much these costs are vary significantly based on the exact surgery you're going in for. Here are a couple of examples from Medical Costs Finder, the government database of typical out-of-pocket costs for private patients:

- Unilateral breast reduction: Typcially $1,000, up to $6,500+

- Bilateral breast rexuction: Typcially $8,400, up to $11,000+

- Droopy eyelid surgery: Typcially $650, up to $3,100+

- Septoplasty (nose reconstruction): Typcially $680, up to $2,100+

To get an estimate of your out-of-pocket costs, you can check Medical Costs Finder, but you should also call your health fund for a more accurate estimate.

Sources

Ask a question

2 Responses

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.

Query: re:Breast reduction surgery when medically needed for health reasons, how does this work regarding costs? I have HAD hospital cover?

Hi Karren,

Thank you for your comment.

Generally, health insurance covers surgical and accommodation costs under the hospital cover policy if the breast reduction surgery is medically necessary and not only for cosmetic purposes. You may learn more on how insurance cover breast reduction surgery. To compare the policies, you may fill out the form on the page provided and click the “Search Policies” button. Once done, you’ll see the quotes from different health insurance providers with a list of detailed benefits.

Please make sure to read the eligibility criteria, features, and details of the policy, as well as the relevant Product Disclosure Statement PDS/T&C’s of the policy before making a decision and consider whether the product is right for you. If necessary, speak to the insurance brand to verify any details.

Regards,

Jhezelyn