Key takeaways

- Drug and alcohol treatment generally involves residential psychiatric care, covered by gold hospital policies.

- Waiting periods apply, but mental health has some specific waiting period policies that might help.

- If you can't afford private health insurance, help is available via Medicare but this is limited.

Health insurance that covers drug and alcohol rehab

All prices are based on a single individual with less than $101,000 income and living in Sydney.

Finder Score - Hospital cover health insurance

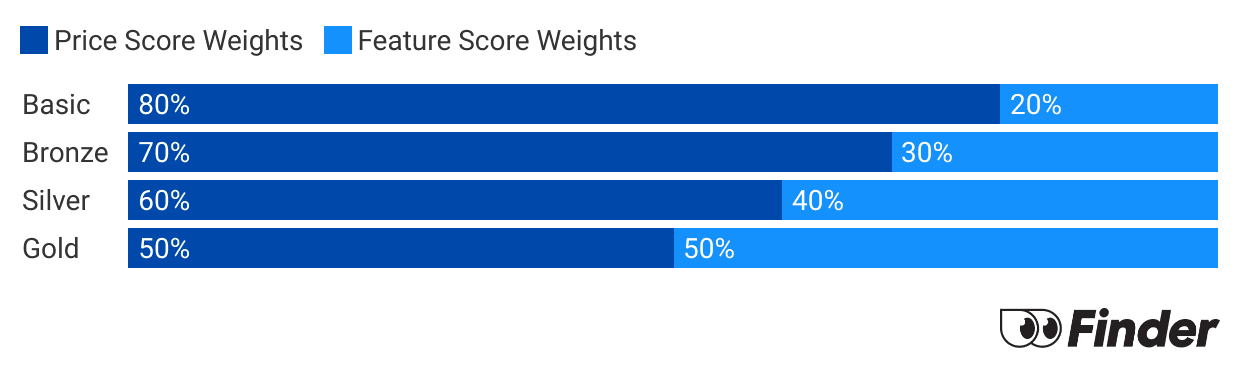

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

How health insurance for addiction works

Drug and alcohol addiction can be treated in a lot of ways, but it is generally classed as a psychiatric or mental health condition. Treatment generally requires a residential stay at a hospital or inpatient facility, generally from a few weeks to a month or so. In Australia, inpatient care is covered under private hospital insurance (as opposed to extras).

To get access to 'psychiatric care' you'll need a gold hospital policy. Residential care is expensive, so it tends to be only available in top tier policies. If you have a lower tier policy you might have what's called restricted cover on psychiatric care. You should consider this to not have coverage - you'd pay a lot out-of-pocket if you used it. However, is are waiting period exceptions for mental health that can help you.

It's important to note that outpatient rehabilitation is not covered by private health insurance. Even the treatments that are covered may still carry out of pocket expenses as every insurer has benefit limits that will apply. Additionally, a gold policy will typically have waiting periods of 2 months before you can access these services, however, there are some exceptions if you're eligible for the mental health waiver. There's more information about that further down the page.

Drug and alcohol addiction treatments

| Treatment | Description | How a gold health insurance policy can help |

|---|---|---|

| Withdrawal or detoxification | Ceasing drug and alcohol use, while minimising side-effects and the risk of harm. | If this is taking place in a hospital, private health insurance can cover your in-patient costs (hospital bed, medications used while in hospital). |

| Pharmacotherapy | Substitution of a harmful drug with medication to reduce cravings and the risk of overdose. | If this takes place in a hospital, you'd be covered under 'in-patient' treatments. |

| Counselling | Different approaches include talking through your problems and learning how to change the way you think and deal with difficult situations. | Health insurance doesn't cover this unless it's in a hospital with a psychiatrist |

| Rehabilitation programs | A long-term approach to achieving a drug and alcohol-free lifestyle, with no further medication provided once withdrawal is successfully completed. | If this rehab is done in a hospital, you may be covered under 'in-hospital treatments', 'rehabilitation' or 'psychiatry'. |

| Complementary therapies | Treatments such as relaxation therapies and natural remedies, which can be useful in managing withdrawal symptoms. | Health insurance won't cover this. |

| Support groups | Support programs such as Alcoholics Anonymous and Narcotics Anonymous | Health insurance doesn't cover this. They're typically free community groups. |

Government support for drug and alcohol help

The Australian government has a range of support services available to help those who are struggling with drug and alcohol addiction. These services are also available to those who are affected by someone else's addiction.

Free support

If you or someone you care about is experiencing problems with drugs or alcohol, the below help lines are available for counseling, treatment, information and support.

- National Alcohol and Other Drug Hotline - 1800 250 015

- Counselling Online - this allows you to chat online or email a counsellor 24/7

- Family Drug Support - 1300 368 186

- Kids Help Line - 1800 55 1800

- Lifeline - 13 11 14

- Hello Sunday Morning - this is an app designed to assist people with changing their relationship with alcohol.

How Medicare can cover drug and alcohol support

Mental health services are available via Medicare, but this can be limited. Every Australian resident is entitled to 10 sessions of mental health services (like a psychologist or a psychiatrist), which Medicare will cover a certain amount for. However, oftentimes, the practitioner will charge more than what Medicare covers so you're still left with some out of pocket expenses.

FAQs

Sources

Ask a question

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.