Key takeaways

- Hip replacements are complex surgery, with big price tags and long wait times.

- Medicare will cover the cost in a public hospital, but surgery lists can be months or years.

- Out of pocket costs for private patients with insurance can be between $1,000 and $5,000.

How much does hip replacement cost?

Hip replacement surgery is a really big, complex procedure, so it's also really expensive. In the private system, without insurance, the cost of a hip replacement is typically around $25,000 for a unilateral procedure (one side of the hip) of close to $50,000 for a bilateral replacement (both sides of the hips).

The good news is you hopefully won't have to pay that! Medicare will cover the cost of the surgery in a public hospital, but you'll be subject to surgery waiting times that can stretch from months to years. Private health insurance will partially cover the cost of surgery, but you'll likely still have out of pocket costs to pay. You'll also need a pretty comprehensive policy, either a Silver Plus or Gold policy, to cover hip replacement.

According to Medical Costs Finder, typical out of pocket costs are around $1,000 for a unilateral replacement, and around $5,000 for a bilateral replacement.

Does Medicare cover hip replacement surgery?

Medicare covers most medically necessary surgeries like hip replacements. Public patients should have no out-of-pocket expenses for surgery in a public hospital. Additionally, Medicare pays 75% of the Medicare Benefits Schedule (MBS) to private patients in public hospitals, meaning it will cover 75% of the public rate for the surgery, anaesthesia and diagnostic work.

The trouble is the public system has much longer waiting lists for surgery than the private system. Hip replacement surgery is a complex surgery, so the lists can be months to years, depending on your procedure.

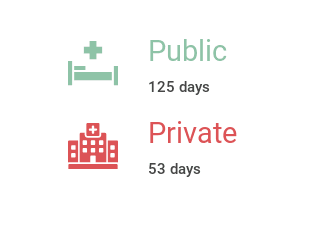

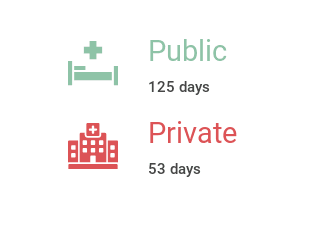

Average public vs private wait times in Australia for hip replacement surgery

What do different insurers offer for hip replacement surgery?

Below are some Silver Plus and Gold policies from Finder Partners that cover joint replacement surgery. All prices are based on a single individual with less than $101,000 income and living in Sydney.

How to work out the gap you'll have to pay

You'll need a Silver Plus or Gold policy to have hip replacement covered by private health insurance. Let's say you have cover and want to know how much you'll be up for out of pocket. Here are a few ways to get a bit more information.

- Ask your private health fund as a first step. They'll help you understand the process.

- Call your surgeon to get their cost. The average cost of a hip replacement can vary by more than $20,000, so it's worth looking into.

- Ask if your surgeon is on your private health insurer's preferred list to help find the most affordable option.

- Ask for their extras cost as things like an anaesthetist can cost a lot.

- Make sure there are no hidden out-of-pocket expenses like X-rays.

- Ask for the Medicare code.

- Call your private health insurer and give them your Medicare code.

- Call the anaesthetist and ask for a cost estimate.

- Find out your doctor's estimated rebate.

When might you need hip replacement surgery?

Hip replacement is usually recommended after other treatments like physical therapy, exercise and medication have failed to improve your condition. You may need a hip replacement if:

- Your pain isn't improved by medication

- Your hip has become weak and unstable

- Pain stops or limits you from getting out and being as active as normal

- Pain affects your sleep

Finder survey: How many Australians have made a hospital claim for joint replacements?

| Response | Male | Female |

|---|---|---|

| Joint replacements | 2.92% | 1.72% |

While Medicare provides hip replacements with little or no out-of-pocket expenses for public patients in public hospitals, you may have to wait several months before receiving surgery. It's also worth remembering that you won't be able to choose your doctor if using the public system.

Average public vs private wait times in Australia for hip replacement surgery

Source: Australian Institute of Health and Welfare (AIHW) Private health insurance use in Australian hospitals 2006–07 to 2016–17

How does private health insurance cover hip replacement surgery?

If you go private, you'll have your choice of surgeon and hospital. There's a good chance you'll also have more say over when the surgery takes place.

To be covered, you'd need a private hospital policy, normally medium to high level. If you're getting joint replacement cover for the first time you'll also have to serve a waiting period of 12 months.

For the treatment, you're likely to receive out-of-pocket costs depending on things like your excess and what your doctor charges. That's why it's important to do your research beforehand.

What does hip replacement surgery involve?

There are two types of hip surgery: anterior, where an incision is made at the front of the hip and posterior, where the incision is on the side. Each surgery has a slightly different procedure:

Anterior:

- Anterior hip replacement is a minimally invasive approach associated with a faster early recovery for the patient.

- The procedure is performed under general anaesthesia and a small incision is made, usually between three and six inches long on the front of the thigh.

- The femur bone is then separated from the acetabular socket and any damaged cartilage and bone is removed and reshaped.

- The acetabular prosthesis is secured using special cement or screws and the femur is prepared using special instruments so that the new prosthesis fits perfectly into the bone.

Posterior:

- The procedure is performed under general anaesthesia: an incision is made close to the buttocks and the surgeon must part the muscle to gain access to the hip joint.

- A posterior total hip replacement replaces the femoral head and acetabulum with artificial prosthesis.

- In this case, the femoral head is removed and the femoral component is secured using cement or screws.

- Your surgeon will slide the femoral head into its acetabular counterpart.

How long is the recovery time for hip replacement surgery?

Typically, patients return to normal life activities within one to six months. The most discomfort ordinarily comes after surgery where you'll probably feel some pain but will receive medication to ease the discomfort. 24 hours after surgery you'll be given exercises and a walking aid, such as a stick, to get you moving and begin strengthening the muscles around the hip.

Short-term recovery involves getting off painkillers and managing to sleep without discomfort. You'll find you're on the road to recovery when you no longer need any walking aid and can move about the house without pain. It usually takes around four to six weeks to get to this stage of recovery.

Long-term recovery is when you can return to work and do normal, daily activities. You should also find that surgical wounds and soft tissue have healed, generally feeling normal again.

Sources

Ask a question

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.