Key takeaways

- Home insurance policies can cover your hearing aids for loss or damage, and some cover accidental damage.

- You can also insure hearing aids when they go outside. You know, on your ears.

- If you already have a home insurance policy, check with your provider as you may already be covered.

Health insurance vs home insurance

This guide is about how to cover your hearing aids after you have bought them. If you're looking for health insurance that covers hearing aids, see our guide here.

Finder survey: What extra features would influence Australians of different ages in choosing a home & contents insurance policy?

| Response | Gen Z | Gen Y | Gen X | Baby Boomers |

|---|---|---|---|---|

| High-value items cover | 10.11% | 22.01% | 21.71% | 19.89% |

| Flood cover | 8.99% | 14.4% | 16.12% | 17.9% |

| None of the above | 7.87% | 14.13% | 16.45% | 26.42% |

| Removal of debris | 7.87% | 13.04% | 13.49% | 26.42% |

| Asbestos removal | 5.62% | 5.43% | 6.58% | 7.1% |

| Temporary accommodation cover | 5.62% | 19.29% | 31.25% | 38.64% |

| Preventative programs | 4.49% | 8.7% | 9.87% | 9.94% |

| Other | 2.25% | 0.82% | 0.66% | 1.99% |

Compare policies with hearing aid insurance in Australia

Compare other products

We currently don't have that product, but here are others to consider:

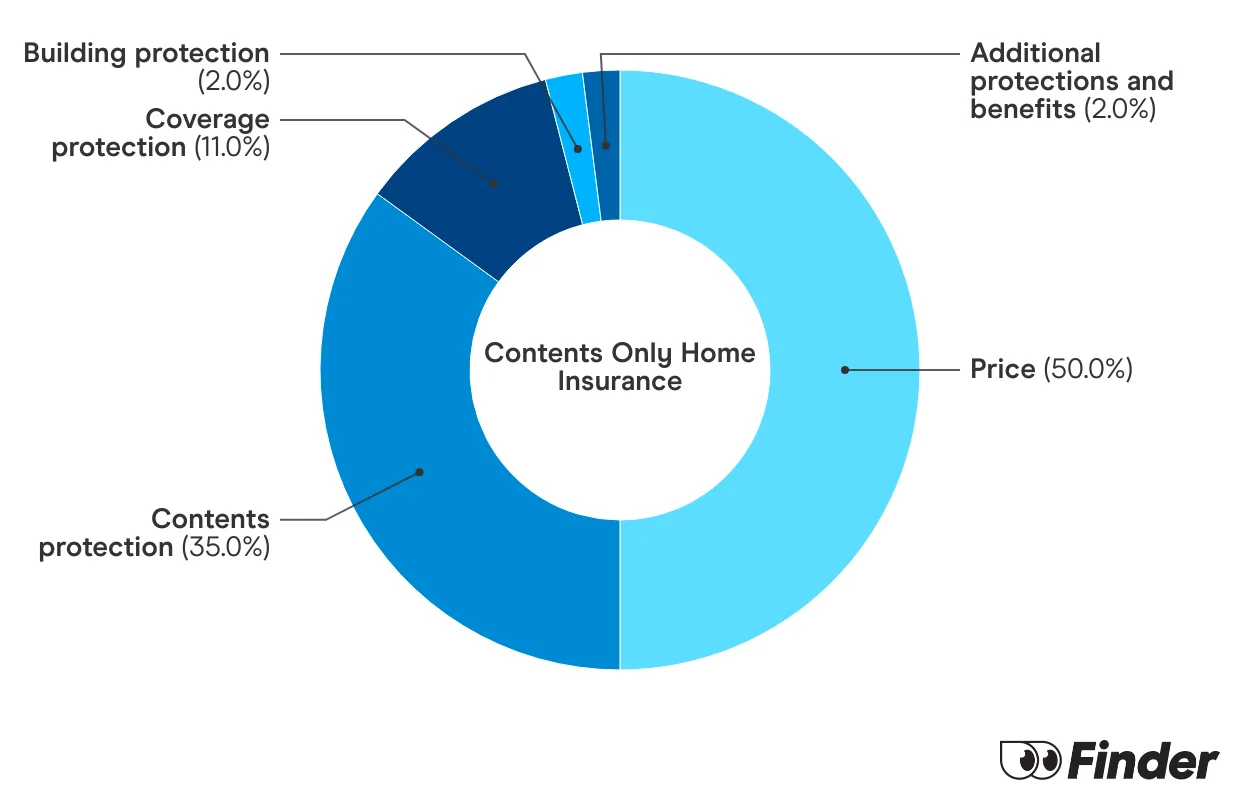

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

What is hearing aid insurance?

You can't really get hearing aid insurance on its own but you can get home insurance that covers hearing aids. It works like this: you pay a certain amount each month to an insurer and in return, they pay you to replace or repair your home and the belongings inside it if they're lost, stolen or damaged. Your hearing aids can be included in this.

Keep in mind though that home insurance policies can't cover manufacturer defects. However, most hearing aids will come with around a 3 year manufacturer warranty so if it does become faulty, you should still be able to get them replaced.

How can I get hearing aid insurance as part of home insurance?

Here's how you can get hearing aid insurance for loss or damage in Australia

Contents insurance.

Contents insurance looks after all the belongings kept at your house. This can include everything from furniture and carpets to jewellery and hearing aids. If something happens to them, for instance they're lost or damaged because of theft, fire or an accident, contents insurance can pay you to replace or repair your items, including hearing aids.

Home and contents insurance.

With a home and contents insurance policy, your hearing aids would still fall under the 'contents' part of the cover. The home refers to the building itself and can cover you against loss or damage caused by things like fires, storms, earthquakes, impact damage and much more. If you want comprehensive home coverage that also includes hearing aid insurance, this is the ideal policy for you.

How do home insurers cover hearing aids?

We had a look at some product disclosure statements (PDS) and pulled out the important parts. We noticed that hearing aids are usually covered under general contents so not many brands outline specific cover limits for them.

Hearing aid insurance for loss or damage in Australia

Cover for accidental damage

Whether you accidentally drop your hearing aids in a mug of tea or put them through the washing machine, accidents happen. Some home insurance policies will automatically include accidental damage in your cover but for others, you'll need to pay extra. Hearing aids cost a lot, so depending on how accident-prone you are, it might be worth getting.

Cover for portable contents

Standard home and contents insurance policies insure everything kept at the property but if you take an item out, and something happens to it, it won't be covered. The same applies to your hearing aids, unless you get portable contents cover for them. This means they'll be insured against loss and damage when you wear them out and about.

Bottom line

Hearing aids are small and expensive so it makes a lot of sense to look for hearing aid insurance. Luckily, finding coverage is really simple. You can get them covered with certain home and contents insurance providers. Compare those policies below.

Frequently asked questions

Sources

Ask a question

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.