Compare other products

We currently don't have that product, but here are others to consider:

How we picked these

This is how home insurance covers tree damage

The way insurance covers tree damage varies between policies, but generally the following applies:

- You are covered for falling trees and branches: if a tree or branch falls on your property then you are covered for resulting damage under the "impact" insured event section of the policy. Depending on the policy, this might only be available as an optional extra, and might only cover the cost of removal of debris that actually damaged your home. It typically doesn't cover the costs of digging up and removing tree stumps that remain after a tree falls, or any related landscaping or gardening costs.

- You are covered for damage to pipes or drains: if tree roots are destroying or blocking them – the insured event is commonly known as 'Escape of liquid'.

- You are not covered for damage caused tree lopping or pruning: either by yourself or someone who was doing it with your approval.

- You are not covered for damage caused by tree roots if: tree roots cause damage to your home or its surroundings.

If my neighbour's tree falls on my property, who is responsible?

- If they have altered the tree in any way – such as removed its roots to repair a driveway.

- If there is evidence to suggest that they knew the tree was dangerous – for example, an arborist recommended its removal.

- If the tree is on their property and they have home insurance policy that includes liability cover.

- If the tree is solely on or also on your property.

- If you were responsible for altering the tree – for example tree lopping or pruning.

Finder survey: Why do Australians of different ages have home and contents insurance?

| Response | Gen Z | Gen Y | Gen X | Baby Boomers |

|---|---|---|---|---|

| Theft | 14.61% | 26.09% | 33.55% | 34.66% |

| Peace of mind | 11.24% | 27.99% | 36.51% | 53.41% |

| Flood protection | 10.11% | 10.05% | 9.87% | 6.82% |

| Fire protection | 8.99% | 22.55% | 32.24% | 40.34% |

| Storm damage | 8.99% | 16.3% | 23.68% | 35.23% |

| Because it is a requirement of my home loan | 9.51% | 7.89% | 3.98% | |

| Other | 0.27% | 0.33% | 0.57% |

What happens if my tree roots are causing damage to my neighbour's property?

When dealing with issues with your neighbours, you should always do your best to keep things friendly and resolve things amicably. Ordinarily, damage as a result of tree roots either to you or your neighbour's home is not something that home insurance covers. If this is the case, it may be worth coming to a solution with your neighbour about removing the tree.

However, in some cases, if the tree roots are causing serious harm to your neighbour's home, you may be liable to pay. This can include things like structural damage to the property, such as crushed pipes, damaged roofs and walls or cracked foundations.

If you do have a large tree on your property, you may want to look into getting cover for damage to your home or other's property. Many policies will specifically exclude damage caused by roots so finding cover can be difficult.

What happens if your neighbour's tree roots are causing damage to your property?

If your neighbour's tree roots are damaging your property, it can be difficult to get cover. That's because it's common for insurers not to cover the cost of removing tree stumps and roots still in the ground. However, there are some things you can do:

Speak to your neighbour

If the tree roots are doing damage to your property, speak to your neighbour and try to come to an amicable agreement. You might be able to go through their insurance or split the costs 50/50.

Take note of the damage

If you can prove that their tree roots are causing serious damage to your home, they may be liable to pay. This can include things like structural damage to the property, such as crushed pipes, damaged roofs and walls or cracked foundations.

Go through your insurer

You may have to go through your insurer if your neighbour is refusing to pay. If this is the case, you'll need to make sure you are covered. While many insurers do not cover you for the roots of trees, you can find cover, for example, if your pipes or drains are destroyed or blocked by roots under the insured event commonly known as 'Escape of liquid'. This might be an easier option that taking the matter to court.

What are the general exclusions when it comes to tree damage?

General exclusions are restrictions that apply to all cover types, including the liability component.

For example, a common general exclusion is “movement of the earth”. If a tree’s roots undermine your neighbour’s property and end up causing the ground to collapse, you might not be covered by your policy.

Get home insurance that covers tree damage

Compare other products

We currently don't have that product, but here are others to consider:

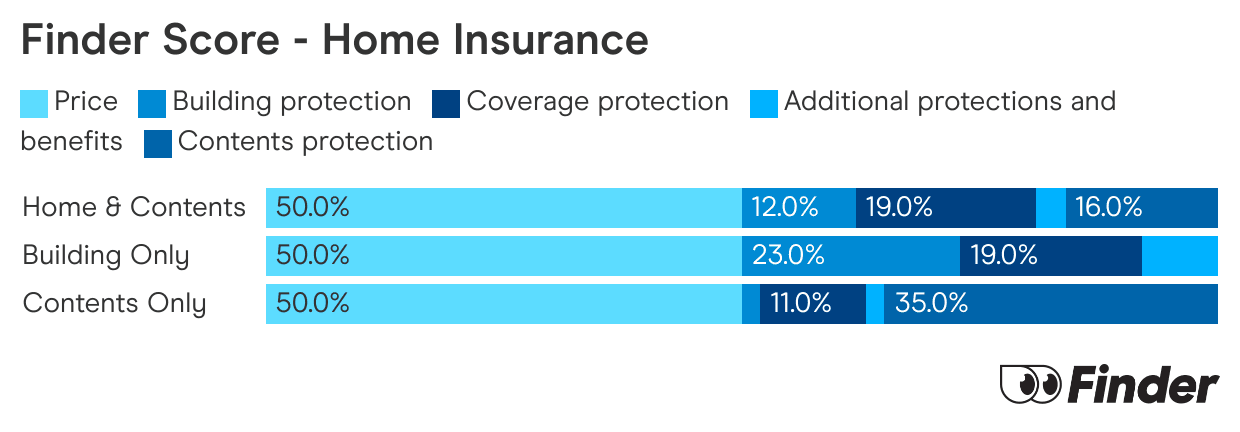

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Finder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

"With some insurance policies, you may need to add on more for the demolition, removal of debris and redesign costs. This component alone could cost tens of thousands of dollars."

FAQs about home insurance tree damage

Ask a question

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.