Key takeaways

- You can get laptop insurance as part of contents insurance which covers all belongings kept at your home – this is often a better value-for-money option.

- You can insure your laptop with single item insurance – this is usually a cheaper option.

- If you want protection outside the home, you can add on portable cover to contents or single item insurance policies.

What is laptop insurance?

Laptop insurance can protect your laptop from theft or accidental damage. Depending on your policy chosen, you can be covered for inside the home and while you're out and about (if you add portable contents cover).

What are my laptop insurance options?

Contents insurance

Contents insurance is designed to cover all the belongings inside your home, including your laptop. If you want to protect specific items you frequently take outside, like your laptop, you can add on portable contents insurance to your policy.

Single item insurance

This is a cost-effective way to insure the items you value most, like your phone or laptop. It's a good option if you only want cover for specific items and you can pay extra to protect your laptop outside your home.

Compare contents insurance policies for your laptop

Compare other products

We currently don't have that product, but here are others to consider:

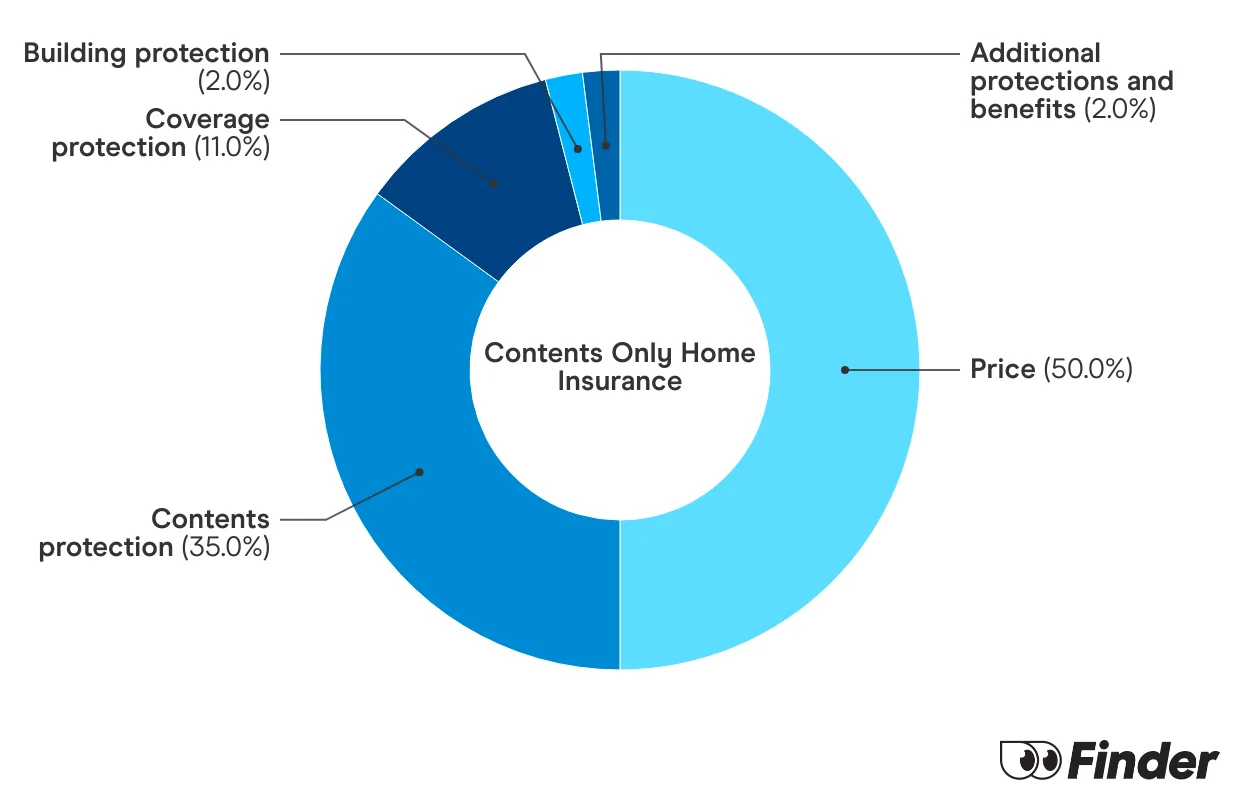

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

How much does it cost to insure a laptop?

This depends on how you choose to insure it and how much it's worth. To give you an idea of what costs could look like, we got quotes for a contents policy worth $80,000 and added portable contents insurance for a $3,000 laptop.

How much does Laptop insurance cost?

| Provider | Premium cost without laptop | Premium cost with laptop |

|---|---|---|

| $516.20 | $771.53 |

| $533.83 | $681.83 | |

| $394.22 | $519.21 | |

| $1,039.87 | $1,264.09 | |

| $400.89 | $673.87 |

This information is accurate as of September 2024.

FAQs

Sources

Ask a question

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.