Mortgage misery: 40% of Aussies struggling to pay their home loan

A record number of Australian homeowners are struggling to pay their mortgage, according to new research by Finder.

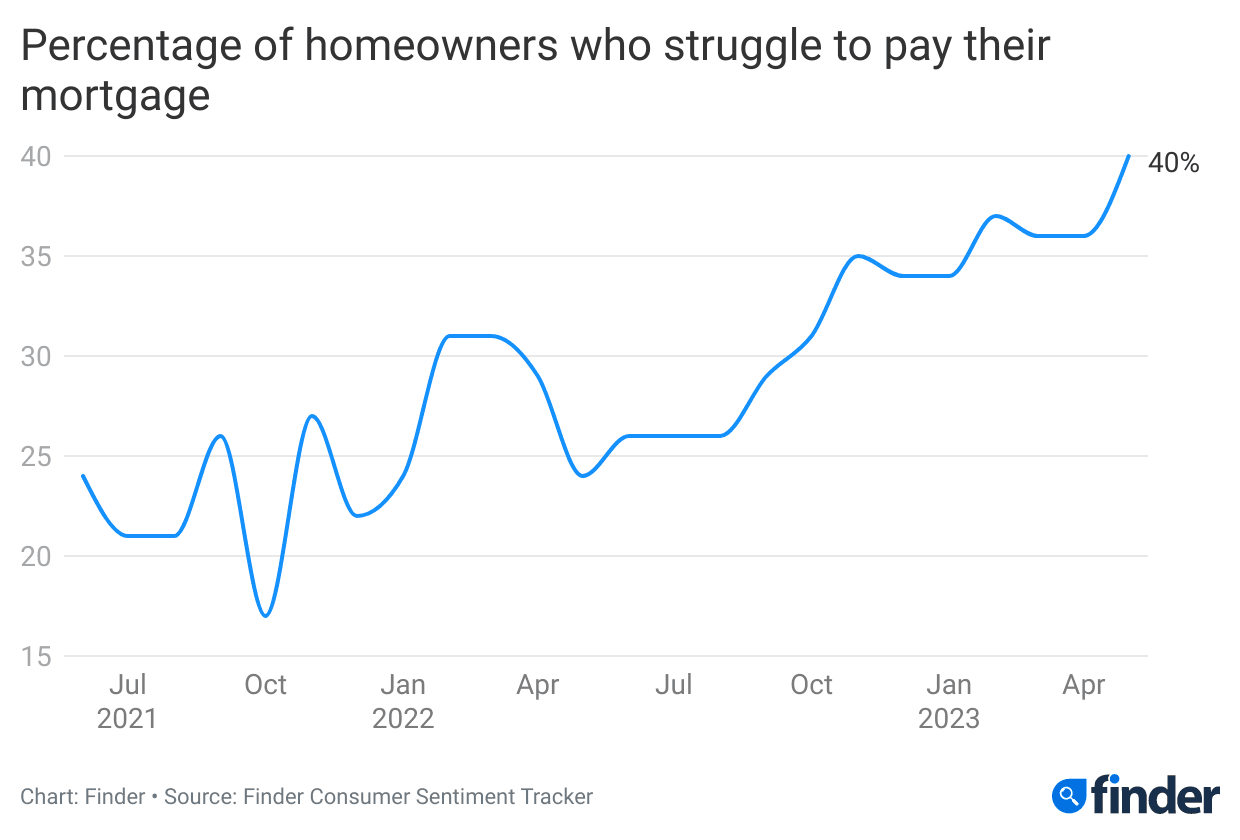

A staggering 40% of Aussie mortgage holders – equivalent to 1.32 million households – admit they struggled to pay their home loan in May.

This is the highest proportion recorded since Finder began tracking the question in 2019.

The percentage of those struggling to pay is up from 24% – or 792,000 households – 12 months ago in May 2022.

This comes as 44% of experts from Finder's RBA Cash Rate Survey forecast another increase to the cash rate in June.

Graham Cooke, head of consumer research at Finder, said panic was starting to set in.

"With 11 interest rate rises over the past 12 months, and potentially another one or two on the horizon, millions of mortgagees are at the end of their tether.

"Many are facing the frightening prospect of defaulting on their loans and potentially losing their homes.

"If you haven't already, try to negotiate a lower rate with your lender. If you don't get it, it might be time to refinance somewhere else," Cooke said.

Finder's data shows mortgage stress is most prevalent among women, with a worrying 47% of women struggling to pay their home loan in May, compared to 32% of men.

Millennial homeowners are the hardest generation hit, with a sizable 49% admitting they are having trouble making their mortgage repayments, compared to 33% of Gen X.

Finder launches Mortgage Stress Calculator to help Aussie homeowners

Finder has today released its new free Mortgage Stress Calculator to help Aussies take control of their financial situation by understanding the amount of wiggle room in their home loan.

The Mortgage Stress Calculator is unique in that it not only shows users where a homeowner stands financially, but also how much of an interest rate rise they can cope with in the future.

Cooke said the free tool will help Aussies get an individual understanding of their financial situation.

"Two in five mortgage holders struggling is the highest figure we've seen in 4 years of asking, and more rate rises seem likely.

"We believe this tool will be a valuable resource for anyone looking to manage their home loan and take control of their financial future."

To use the calculator, users simply enter their mortgage details, including: annual household income, amount and years remaining on their home loan, current interest rate, and whether their loan is interest only or interest and principal.

Based on this information, the calculator will place users into one of five categories: in control, start saving, start cost cutting, in mortgage stress, or consider selling or moving.

The calculator will also tell users their maximum interest rate before they enter mortgage stress.

Mortgage stress is defined as when more than 30% of your income goes towards your mortgage.

Finder reveals home loan winners

Cooke said it was more important than ever that homeowners pick a home loan that would give them the best deal.

"We've just announced the winners for the Finder Home Loans Awards 2023 – given to the best home loans on the market.

"Our experts reviewed over 9,000 home loan products from over 200 lenders to determine the winners."

This year saw credit union The Capricornian win 4 of the 12 categories, including Best Owner Occupier Fixed Home Loan – 2 year, Best Owner Occupier Fixed Home Loan – 3 year, Best Investor Fixed Home Loan – 2 year, and Best Investor Fixed Home Loan – 3 year.

Tic:Toc also scooped up 4 wins, including Best Low Deposit Variable, Best Owner Occupier Refinance Variable, Best Owner Occupier Refinance Fixed, and Best Investor Variable Home Loan.

Australian Mutual Bank won top gong for Best First Home Buyer Home Loan, while Police Credit Union's home loan won this year's Best Owner Occupier Variable Home Loan award.

Best Owner Occupier Fixed Home Loan – 1 year was awarded to The Mutual Bank, while Best Investor Fixed Home Loan – 1 year went to Easy Street.

Ask a question