Unattainable wealth aspirations: Average Aussie needs $330,000 to feel rich

The average Aussie says they would need to earn a far higher salary than the average wage to feel rich, according to new research from Finder.

A nationally representative survey of 1,013 respondents revealed 1 in 4 (25%) Australians wouldn't consider themselves affluent until they were earning at least $500,000.

The average Australian said they would need to earn a salary of $326,900 per annum – nearly 7 times greater than the median personal income of $49,805 – to feel rich.

Kate Browne, personal finance expert at Finder, said constantly longing for more money can be a dangerous game.

"A small percentage of high-income earners make average income statistics look impressive, but the reality is that the typical middle-class Australian is actually earning a $50,000 salary.

"If you are already fortunate enough to earn more than the median wage, it's a good reminder that you are already ahead. It can be tempting to keep striving for more, but it's also important to truly enjoy your work."

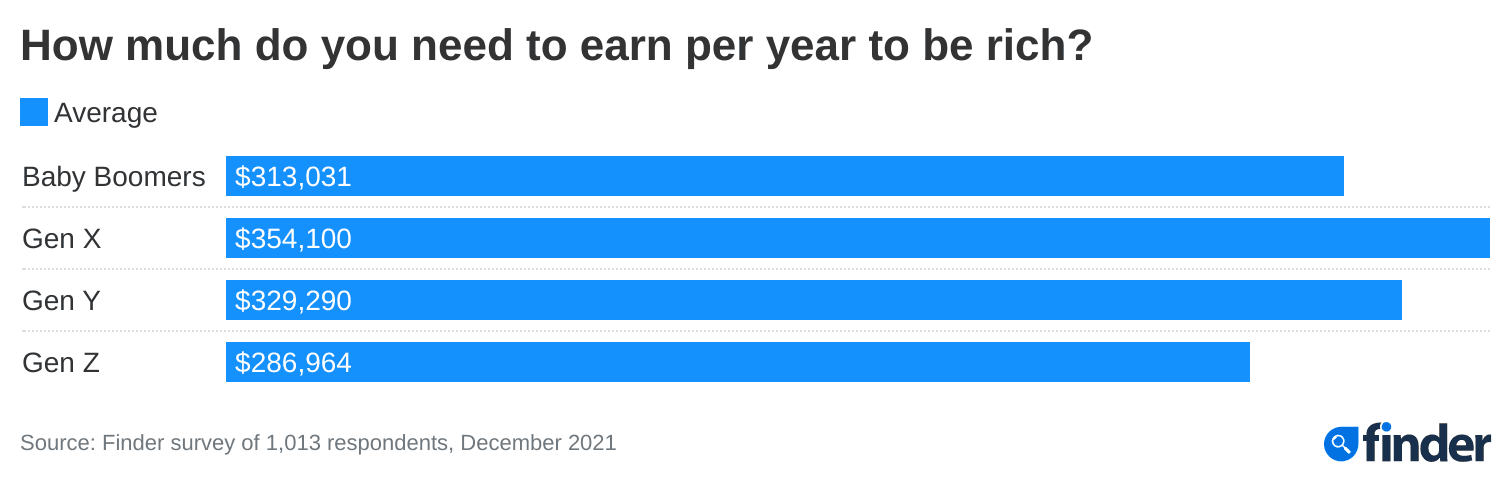

Finder's research found Generation X report needing the most money to feel rich ($354,100), while Generation Z need a little less ($286,964).

A US study by Credit Karma found almost half (48%) of millennials spent beyond their means to keep up with their friends in 2019, up from 39% in 2018.

Food (47%), clothes (41%) and travel (33%) are the main things millennials were found most likely to overspend on.

"Remember social media is a highlight reel, and while it can seem like everyone around you is hustling their way to the top, appearances can be deceiving.

"There's nothing wrong with striving to be financially comfortable, but endeavouring to compete with others is exhausting and expensive, and you'll never be satisfied with what you already have.

"It can also encourage you to overspend on items you can't afford."

Browne said there are many ways to build wealth outside of earning a competitive income.

"Working on habits like cutting back on spending where you can and saving a regular portion of what you earn is a great start.

"Aim to put at least 20% of your income every month into a savings account and let this grow. Having a savings goal to work towards – such as buying a house – will keep you motivated to keep going.

"Because interest rates are very low, you might also want to consider investing some of your money elsewhere for the future.

"Money management apps like the Finder app are a great way to keep track of your income and expenses. Seeing your spending broken down by category can help you set a realistic budget and manage your bills," Browne said.

Women ($333,010) report wanting slightly more than men ($318,952) to feel wealthy.

Want to learn how to effectively manage your money? Check out Finder's guide to Budgeting 101.

Ask a question