Bitcoin breaks all-time high in USD

Bitcoin goes past $US70,000 for the first time as demand soars.

Bitcoin (BTC) is back in the record books after setting a new all-time high over the weekend, almost 2 and a half years since it last hit a record high.

While it technically hit a new all-time high on 6 March, this time it's definitive.

In what was already shaping up as an historic year in Bitcoin's relatively young life, the leading cryptocurrency continues to confound both believers and detractors.

While there's no official way to track the all-time high of Bitcoin (given that it's traded on many different exchanges all across the world), the BTC price hit US$70,000 on multiple leading exchanges for the first time ever early on Saturday (AEDT).

It has since gone past US$72,500 at the time of writing, according to the CME CF Bitcoin Real Time Index (BRTI), a subsidiary of Kraken that tracks the aggregate price of Bitcoin across major exchanges.

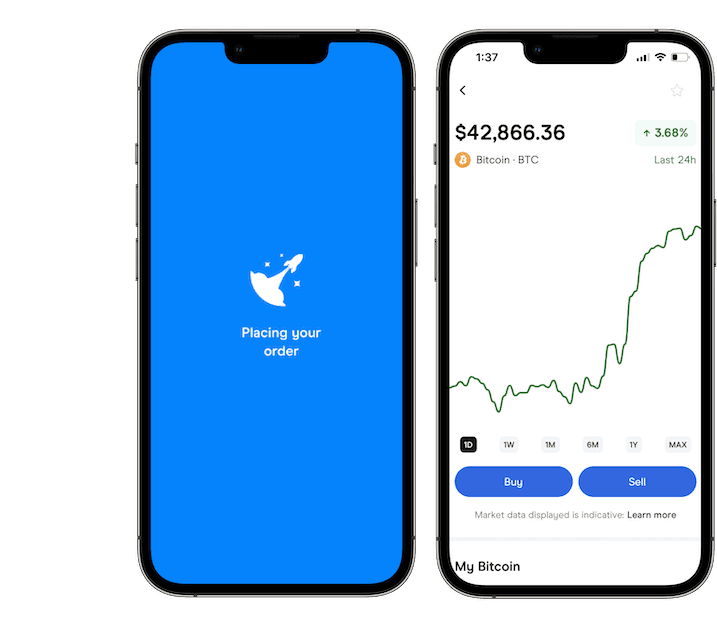

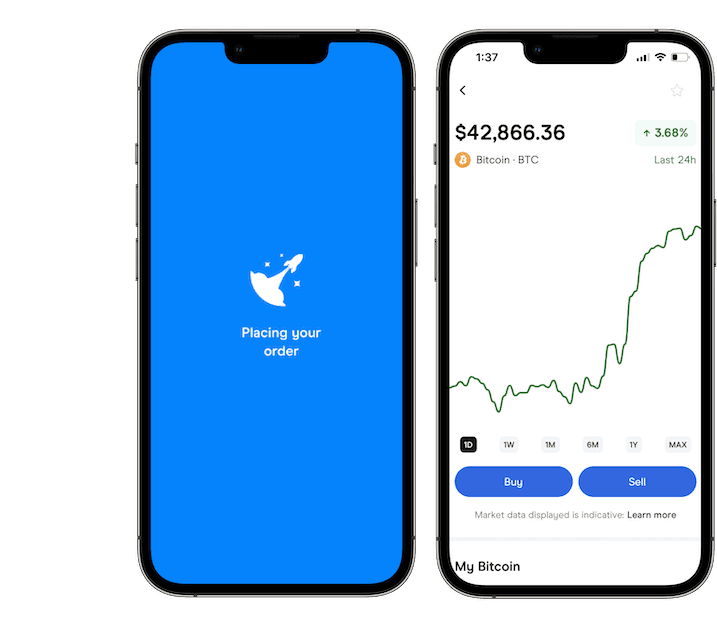

See how to buy Bitcoin in Australia.

Why is Bitcoin doing so well?

There's a couple of reasons for Bitcoin's record-breaking run.

The approval of the first spot Bitcoin exchange-traded funds (ETFs) in January has caused a surge of demand from both retail and institutional investors.

The 11 ETFs have collectively seen more than US$7 billion in net inflows since launching on 11 January and demand hasn't let up since then.

But that's not the only factor.

Bitcoin is designed to have a fixed supply. There will only ever be 21 million Bitcoin in existence, with the last Bitcoin set to be "mined" in approximately 2140.

This is in contrast to "fiat" currencies like the US dollar and Australian dollar where the monetary supply is continually increased over time.

With record-breaking demand for the spot Bitcoin ETFs as well as the upcoming Bitcoin halving, it's likely the cryptocurrency will experience a "supply shock".

In simple terms, this means that the demand for buying Bitcoin will outstrip the amount of Bitcoin that's available to buy, which leads to the price going up.

Historically, Bitcoin's price has roughly followed a 4-year boom and bust cycle. A key date in this cycle is the Bitcoin halving, which occurs approximately every 4 years and sees the supply of new Bitcoin entering the market cut in two.

Bitcoin has traditionally performed extremely well in the 12-18 month period following a halving event.

With the next halving due in April, investors may be loading up in anticipation of a similarly-impressive run over the next year, which could also be contributing to it's recent rise.

Join the crypto conversation – Follow us on X now

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies

Sources

Ask a question