Bitcoin sets new all-time high… well, sort of

Bitcoin hit a record price by some measures before dropping 9%.

It's been an eventful week for Bitcoin, and in true Bitcoin fashion, things just got even more eventful.

After hitting a new all-time high price in Australian dollars, euros and pound sterling this week, the leading cryptocurrency looked primed to race past it's previous record price in US dollars.

So did Bitcoin hit an all-time high?

Kinda. It depends on where you look.

Bitcoin is traded all around the world, at all times of the day, on many different exchanges and in many different currencies.

A key upshot of this is that it's hard to determine the "official" price of Bitcoin at any given moment.

The price on one exchange may be slightly different to the price on another exchange, and each of those exchanges will have its own record price.

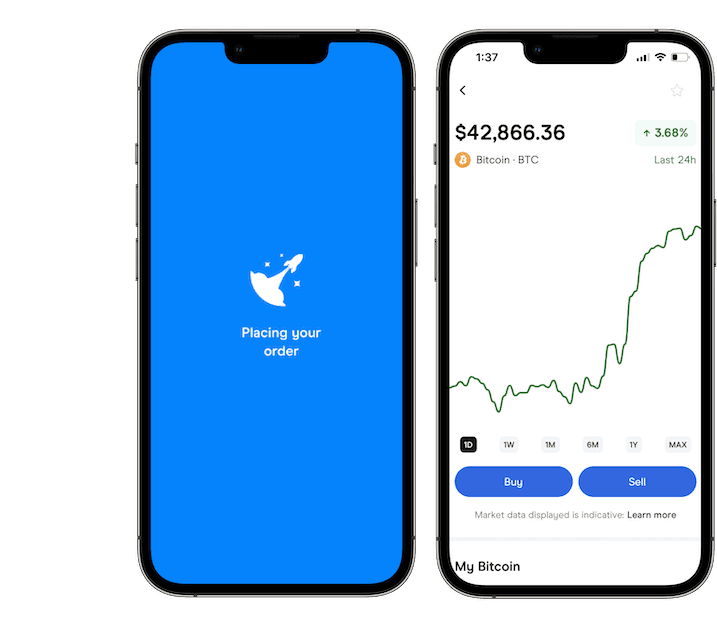

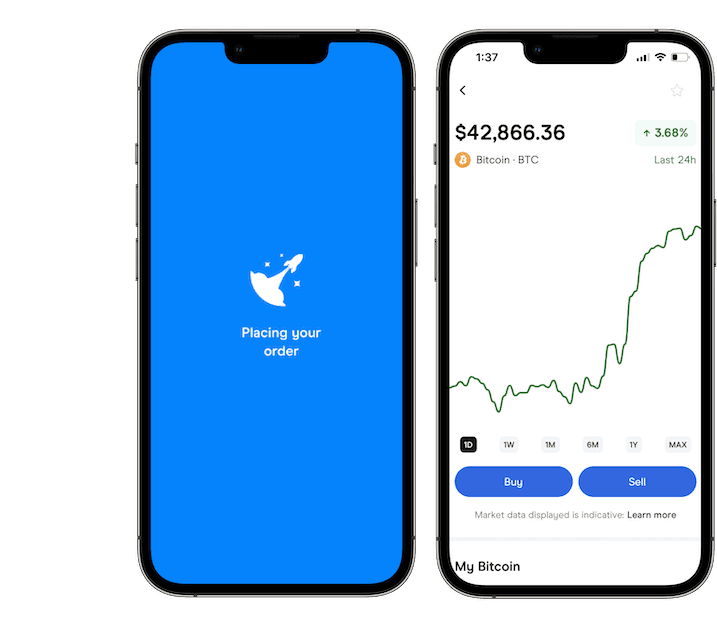

Take Coinbase for example.

According to Coinbase, the previous all-time high for Bitcoin was set in November 2021 when Bitcoin hit US$64,899.

This morning (AEDT time), Bitcoin surged to US$69,225 on Coinbase, shattering its previous all-time high.

But this won't be the case everywhere.

Some exchanges will have recorded a higher all-time high back in 2021 and may have yet to hit that price again.

Another measure is CF Benchmark, which tracks the price of Bitcoin across multiple exchanges.

"Bitcoin did, however briefly, achieve an all time high in USD terms overnight," said Jonathon Miller, managing director for Kraken Australia. "Utilising Kraken subsidiary CF Benchmark data, we can see the price reached US$69,209.84 on the CF CME Bitcoin Real Time Index (BRTI)."

"CF Benchmarks data is used by many Bitcoin ETF providers to track pricing data from various exchanges, so is the authoritative measure to use when it comes to tracking prices in crypto."

So did Bitcoin break it's all-time high?

Technically, yes.

What's undeniable is that Bitcoin has hit a new all-time high in market capitalisation, which is the total value of all Bitcoin in existence multiplied by the current price.

As new Bitcoin is "mined" all the time, there's now more Bitcoin than there was back in November 2021, which means the total value of all Bitcoin (the market capitalisation) is higher than it was back then.

What happened next?

Never one to cooperate, Bitcoin crashed almost immediately after flirting with a new all-time high.

It briefly dropped below US$60,000 on Coinbase within hours, before rebounding to around US$63,000 at the time of writing.

But the fact that Bitcoin managed to reach these prices during a period of high rates and high inflation speaks to its growing acceptance as a legitimate investment says Ben Rose, Binance general manager for Australia and New Zealand.

"Reaching an all-time USD high, even before the halving, speaks volumes to the growing acceptance and optimism towards crypto. While ETFs [exchange-traded funds] helped to break down entry barriers into crypto investing, more and more people are understanding the attractive characteristics of Bitcoin," Rose said.

"Unlike traditional fiat currencies which are inflationary and constantly expanding in supply, Bitcoin's algorithmically determined supply and its precoded halving event create a scarce and desirable asset that is free from inflationary debasement from a central party.

Right now we are seeing that investors are seeking certainty in volatile times, and with global debt increasing at record levels, Bitcoin and its set-in-stone halving event provides confidence that its scarcity will continue."

Will Bitcoin go even higher?

Historically, Bitcoin has performed extraordinarily well in the 12 or so months are hitting its previous all-time high, but that's no guarantee it will do the same this time.

While interest is surging back into Bitcoin and cryptocurrencies in general, it's yet to reach the heights seen in previous bull runs, said Dominic Gluchowski, chief marketing officer at CoinJar.

"We're witnessing trading volumes echoing the elevated activity of previous peak months, specifically May and November 2021. Yet, it's clear we're still in the early stages of this cycle. This week alone, we've seen a significant influx of new customers, though numbers still fall short of the peaks observed in the last bull market," said Gluchowski.

There's also been a shift away from the largest cryptocurrencies towards "memecoins", according to Gluchowski.

"Retail has been losing interest in the good old 'Popular Duo' [Bitcoin and Ethereum]. In the past month, our retail customers have been selling BTC, ETH, and XRP to buy Solana and memecoins, while our institutional clients and market makers have been buying BTC with AUD and selling BTC in the US for USD due to Bitcoin ETF demand," said Gluchowski.

But he still expects Bitcoin to perform well over the next 12-18 months, depending on wider macroeconomic issues.

"The market could peak in the next 8 to 18 months. It will likely be influenced by broader economic factors, including the US government's measures to inject liquidity into the stock market in anticipation of upcoming elections.

Moreover, given Bitcoin's classification as a high-risk asset and its recent foray into ETF markets, it remains susceptible to the vicissitudes of Wall Street."

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies

Join the crypto conversation – Follow us on X now

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Sources

Ask a question