Keeping up with credit: Australian credit scores defy cost of living crunch

Australian credit scores are on the rise, according to new research by Finder.

Finder analysis of 59,016 credit reports in 2022 shows the average Aussie has a credit score of 735, which falls in the "very good" category.

That's a distinct improvement from 2021 when the average Australian had a credit score of 711.

A credit score is a number that determines how credit-worthy you are. It's one of the factors that lenders use when deciding whether to lend you money. It's usually a number between 0 and 1,000.

A score below 550 can be problematic while an excellent score of around 800 or above can help borrowers get better interest rates and loan terms.

Amy Bradney-George, credit card expert at Finder, said it was encouraging to see that credit scores are improving.

"Despite the rising cost of living, many Aussies are keeping on top of their financial responsibilities.

"Remember your credit score isn't just a number – it's a measure of how well you're looking after your finances.

"A good credit score can make a big difference to your chance of approval for credit cards and loans."

Credit scores are improving, but millions are still unaware of what theirs is.

A new Finder survey of 1,059 respondents revealed 69% of Australians – equivalent to 13.8 million people – don't know their credit score.

The research shows almost half (43%) of Australians have never checked their credit score, 7% are too scared to check and 6% don't know what a credit score is.

Bradney-George said knowing your credit score was vital.

"When you're planning a big purchase, such as a car or a home, your credit score is an important part of negotiating the best interest rate and loan terms.

"Banks and lenders check your credit score and history when you apply, so it's better to know where you stand beforehand, rather than right when you need to access cash.

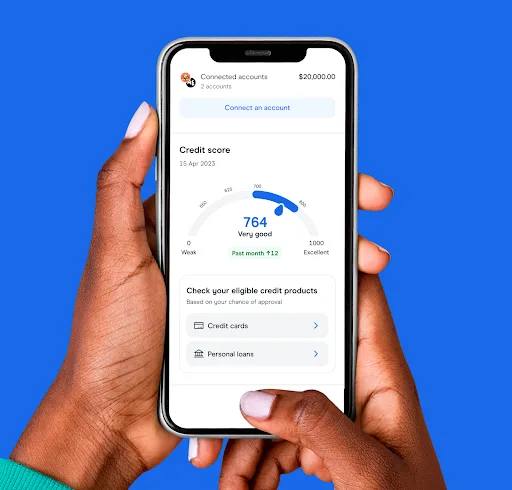

"The good news is it's easier than ever to check your credit score. You can check it for free in the Finder app in about 3 minutes."

| Do you know your credit score? | |

|---|---|

| No, I've never checked | 43% |

| No, I don't know how to check | 13% |

| No, I'm too scared to check | 7% |

| I don't know what a credit score is | 6% |

| Yes, but I only have a rough idea | 23% |

| Yes, I know my credit score | 8% |

Source: Finder survey of 1,059 respondents, February 2023.

The Aussie credit score "hot spots"

Cockatoo, a town just south-east of Melbourne's CBD, has taken out the top spot, with the average credit score of an impressive 870.

Cottage Point just north of Sydney in New South Wales took the second spot, with an average score of 857.

Aussie postcodes with the highest credit scores

| Postcode | Suburb | State | Average score |

|---|---|---|---|

| 3781 | Cockatoo | VIC | 870 |

| 2084 | Cottage Point | NSW | 857 |

| 5238 | Angas Valley | SA | 849 |

| 2548 | Berrambool | NSW | 843 |

| 5157 | Cherry Gardens | SA | 838 |

| 2085 | Belrose | NSW | 837 |

| 2710 | Booroorban | NSW | 834 |

| 5066 | Beaumont | SA | 834 |

| 2074 | North Turramurra | NSW | 833 |

| 6020 | Marmion | WA | 832 |

Source: Finder analysis of 59,016 credit reports in 2022. Suburbs needed a minimum of 10 reports to qualify.

When it comes to the states, Aussies in the ACT have the highest credit score (763). People in South Australia come in second-best with an average credit score of 753.

Western Australians have the lowest credit score at 716, with Queenslanders the second-worst at 720.

Among the capital cities, Canberrans enjoy the highest credit score of 765, with Melbournians and Sydneysiders not far behind at 758 and 757.

Those in Brisbane and Perth have the lowest credit score of 735.

Unsurprisingly, baby boomers have the highest average credit score at 846 while millennials have the lowest at 713.

The average gen Z has a credit score of 741 compared to 760 for gen X.

Credit scores by state in 2021 vs 2022

| State | 2021 | 2022 | Difference |

|---|---|---|---|

| ACT | 736 | 763 | 27 |

| SA | 738 | 753 | 15 |

| VIC | 740 | 745 | 5 |

| NT | 705 | 744 | 39 |

| NSW | 723 | 741 | 18 |

| TAS | 742 | 729 | -13 |

| QLD | 714 | 720 | 6 |

| WA | 721 | 716 | -5 |

Source: Finder analysis of 59,016 credit reports in 2022.

Get your credit score for free in 2 minutes through the Finder app.

Ask a question

Comment peut on faire pour avoir de crédit

Bonjour!

Je ne sais pas si vous voulez votre cote de crédit ou vous voulez un prêt, mais pour savoir votre cote de crédit vous pouvez visiter ici. Ou pour chercher pour un prêt vous pouvez aller ici. Vous aurez besoin de savoir votre cote de crédit avant vous demandez un prêt.

Merci,

Rebecca