Crypto’s past, present and future: What are the risks?

Cryptocurrency is still the proverbial wild west but there are ways you can invest and sleep better at night.

In the past year, Bitcoin (BTC) has fallen as much 74%, Ethereum (ETH) 79% and Dogecoin (DOGE) 93%. Terra (formerly LUNA) peaked around US$118 and then dropped to US$0.0001.

The old LUNA is now LUNC and the original Terra has made way for Terra Classic. Only in the pure narrative world of crypto can the total destruction of US$41 billion of market capitalisation be "rebranded" as "classic".

So, what exactly happened in the crypto world and how can we protect crypto investments in the future?

Crypto market falls by 69%

Well, in many ways, what happened in crypto is not unique. It's just more extreme.

Total crypto market capitalisation peaked on 9 November 2021, at US$2.9 trillion. It dropped as low as US$0.9 trillion – a fall of 69% – in 2022 and is now around US$1.02 trillion.

The Nasdaq Composite peaked on 19 November 2021 and has fallen as much as 33%. The Russell 2000 peaked on 8 November 2021 and has since fallen as much as 32%.

Good to know

- The Nasdaq Composite is a stock market index that consists of the stocks that are listed on the Nasdaq stock exchange.

- The Russell 2000 is an index that tracks 2000 small-cap companies. It is often used as a benchmark to measure the performance of small-cap mutual funds.

November 2021 was the first time when we really started to see upside surprises in the Federal Reserve's favourite inflation indicator, the Personal Consumption Expenditures Price Index (PCEPI).

This number is reported monthly by the Bureau of Economic Analysis, a US government agency.

Once the markets started to get a whiff of inflation, the fear started to settle in that the Fed would have to take away the quantitative easing punchbowl.

Good to know

- Quantitative easing is similar to cuts in bank rates. It helps to lower interest rates on savings and loans.

- In monetary policy jargon, taking away the punchbowl refers to the central bank reducing the stimulus it's giving to the economy.

Market fears increase as pessimism grows

Successive months only strengthened this fear with uncomfortably high month-over-month increases in the PCEPI. Throw in Russia's invasion of Ukraine for good measure and we have seen a perfect storm for global economic contraction.

Is it really any huge surprise that cryptocurrencies have seen more dramatic declines in this cycle of fear and pessimism?

If we look back on the year leading up to the current declines (that is, from 1 November 2020 to 1 November 2021) we see that total crypto market capitalisation grew from US$400.1 billion to US$2.6 trillion. That's an increase of over 500%.

Over the same period, the Nasdaq Composite only increased 43%. If we look back from 1 November 2020 to around now, we see total crypto up around 107%, while the Nasdaq Composite has only gone up around 15%.

All of this is to illustrate the point that one of the biggest opportunities we have to protect our crypto investments in the future is to be clear-headed about the level of volatility we should be prepared to deal with.

Big risks of investing in crypto: Does it need regulation?

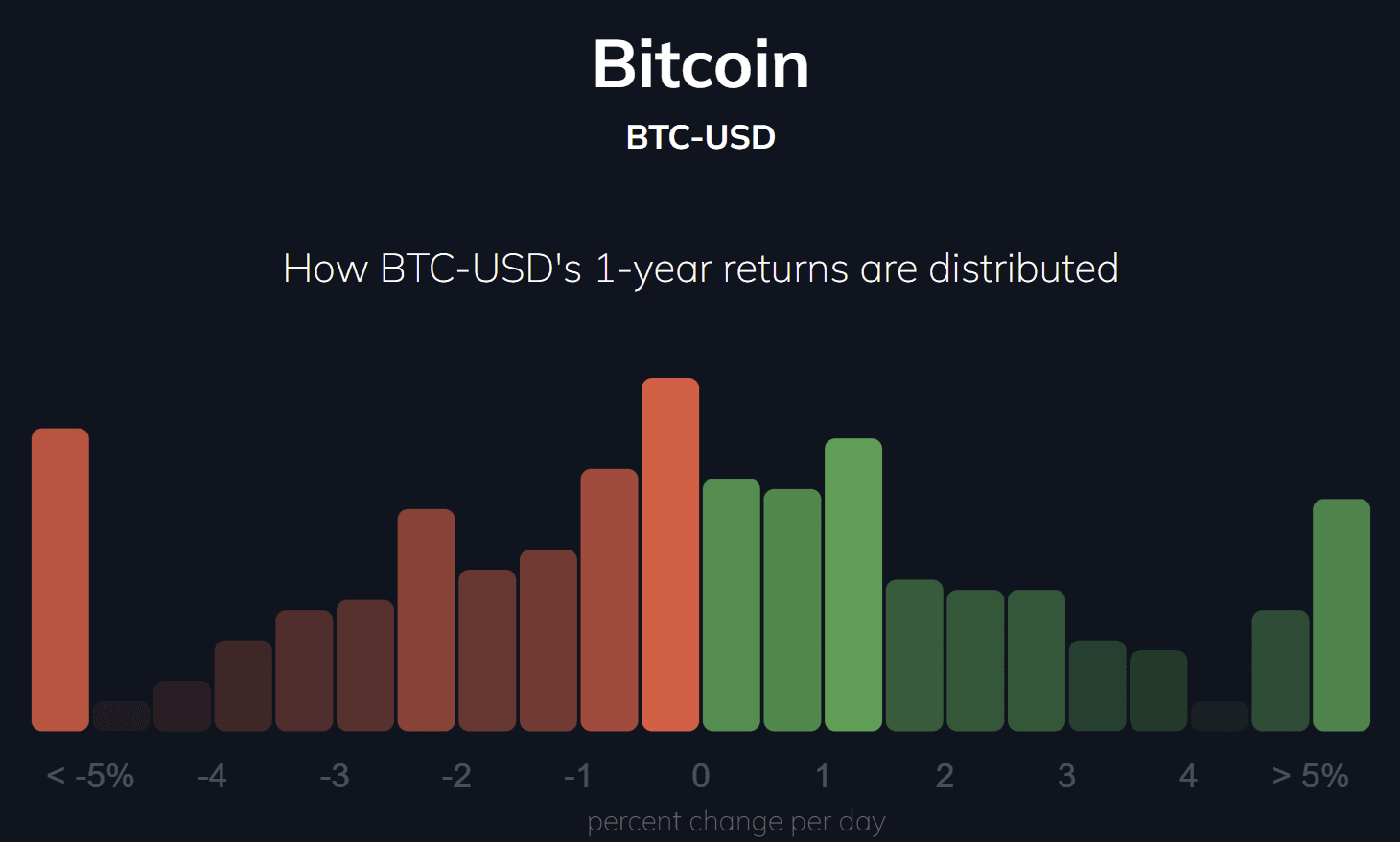

Bitcoin is more volatile than the Nasdaq Composite. It goes up faster and it goes down faster.

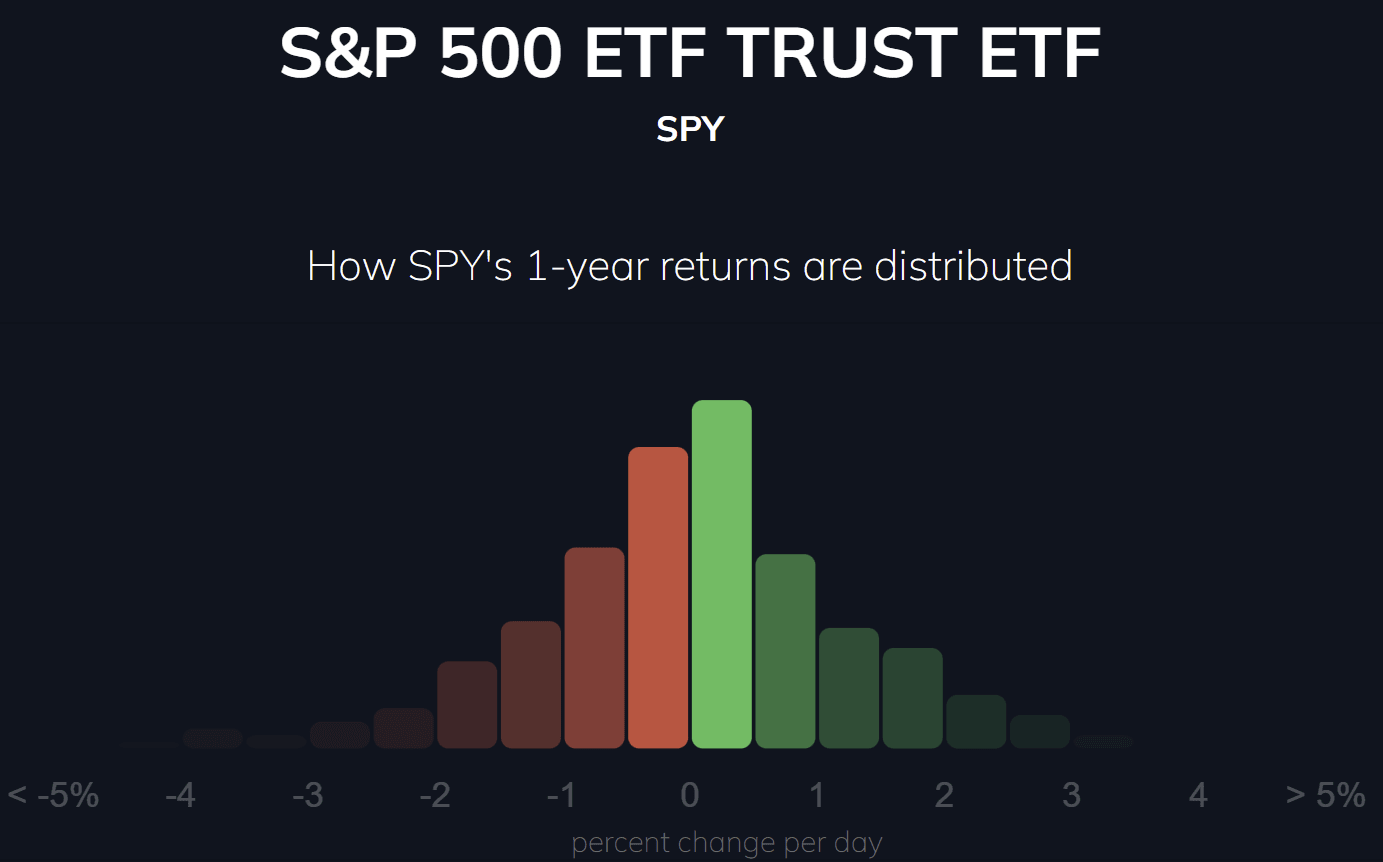

I like to look at histograms of daily returns that give me an idea of what I call the shape of risk.

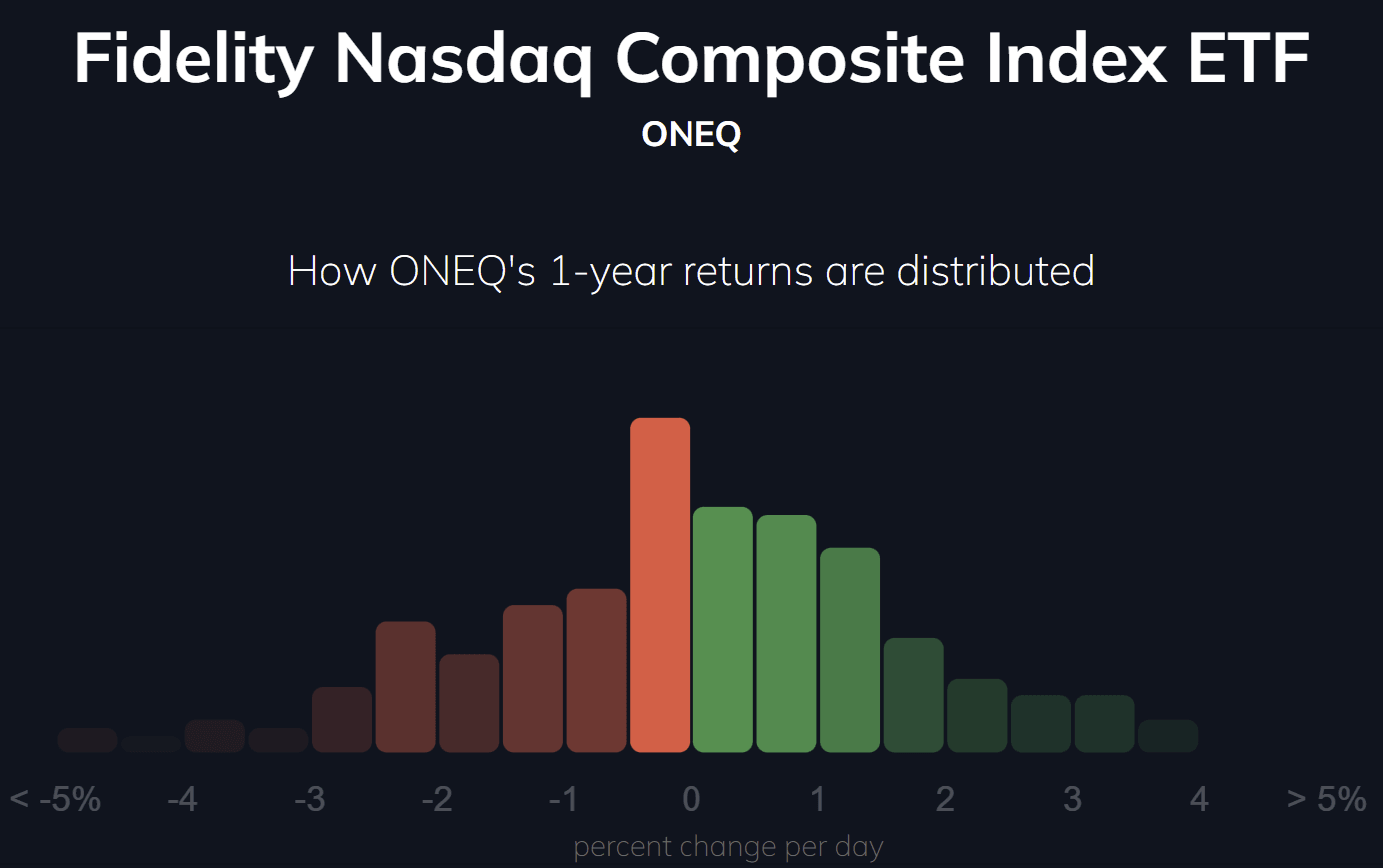

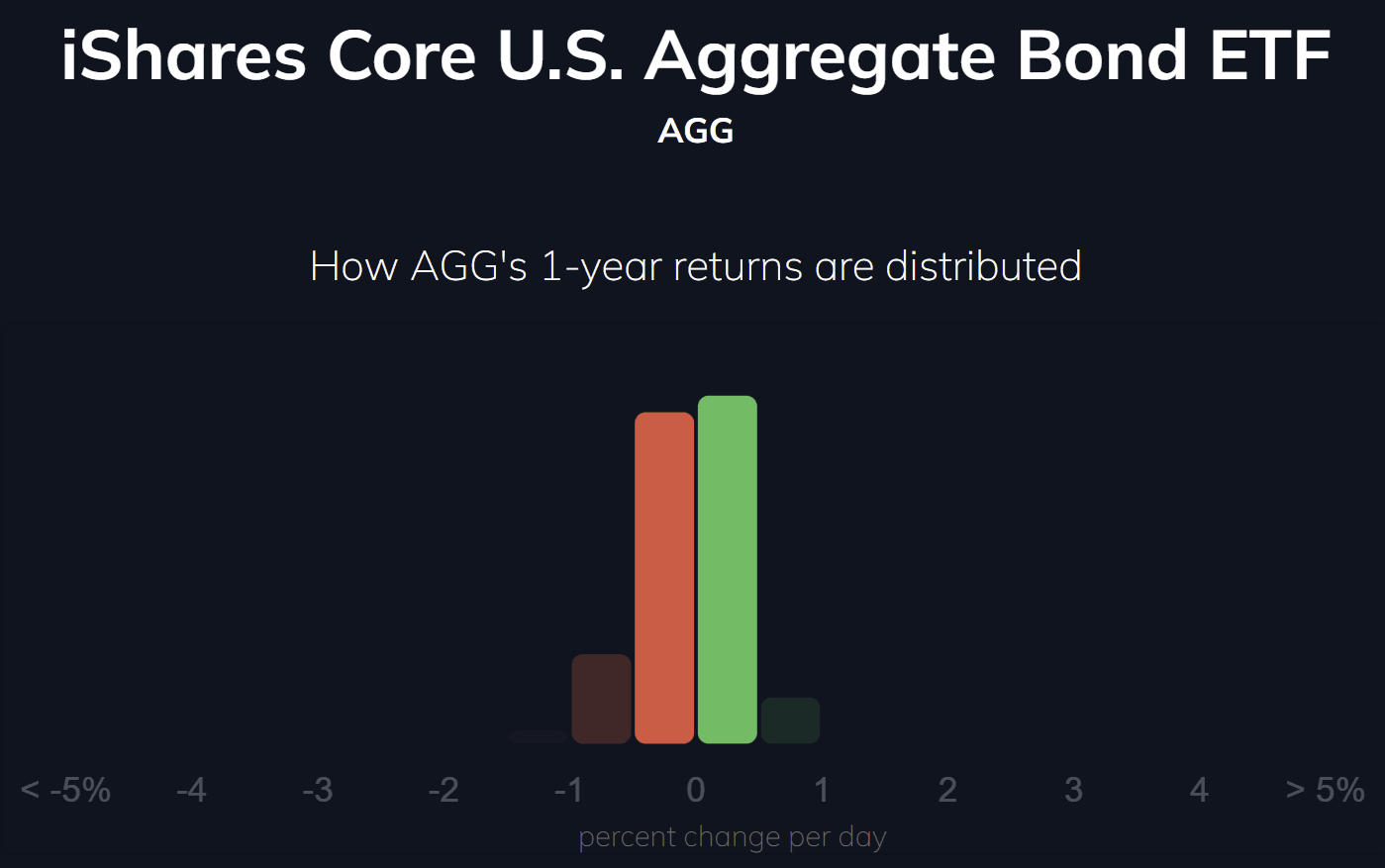

Here are a few sample histograms to help you get the idea.

As you look down the list, what you'll notice is that the shapes get wider and wider. The daily returns for a conservative bond fund like AGG are almost always between -1% and +1% per day.

Most of the daily returns are between -1/2% and +1/2%.

The S&P 500 on the other hand can see daily gains or losses of as much as +/- 3% and sometimes even more, but its histogram still has a pretty clean bell-shaped curve.

As we move into more volatile assets like the Nasdaq Composite, we see that sometimes the daily gains and losses can reach into the +/- 5% range. The Nasdaq Composite is more volatile.

And finally, when we get to Bitcoin, we see that daily gains and losses of more than 5% are a regular occurrence. Bitcoin has what are called "fat tails".

You can explore the histogram on Bitcoin here. There are multiple additional risk-based metrics for Bitcoin you can also review.

If you want to see other cryptocurrency pairs, just replace "btc-usd" in the URL with the crypto pair of your choice. For example: ETH-USD, ADA-USD, SOL-USD.

How to manage the stressful times

Once you are armed with a more intuitive understanding of volatility, you can then begin to manage your own stress better.

This can be done by putting less capital into your more volatile bets and more capital into your less volatile bets.

Want to buy, sell or trade in crypto? Find out Finder's picks of the best crypto exchanges in Australia.

Trust me, you'll sleep much better at night. That's true of any investment, but it's particularly true of more volatile investments like cryptocurrencies.

The other thing that we need to do to protect our cryptocurrency investments is realise that there are way more scams and frauds out there than there are legitimate opportunities.

Crypto is still the proverbial wild west and there isn't a sheriff in town yet. If it sounds too good to be true, then it most probably is too good to be true.

Just because a crypto-based investment has gone up a lot doesn't mean it's a legitimate enterprise.

Always remember that almost everything in crypto today is much more likely to fall to zero than to go to the moon.

Dr Richard Smith – Berkeley mathematician and PhD in system science – is a fintech entrepreneur, the CEO of The Foundation for the Study of Cycles and the author of The Risk Rituals newsletter.

Disclaimer: The views and opinions expressed in this article (which may be subject to change without notice) are solely those of the author and do not necessarily reflect those of Finder and its employees. The information contained in this article is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Neither the author nor Finder has taken into account your personal circumstances. You should seek professional advice before making any further decisions based on this information.

Images: Getty Images, Supplied

Ask a question