Finder’s RBA Survey: 94% of experts predict a hold

Aussie homeowners hoping for further reprieve will be left disappointed, according to a new poll.

In this month's Finder RBA Cash Rate Survey™, 34 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

Almost all (94%, 32/34) believe the RBA will hold the cash rate in April, keeping it at 4.10%.

Enthusiasm for a cut has waned since February when 1 in 5 (22%, 8/37) thought we would see the rate reduced at consecutive RBA meetings in 2025.

Graham Cooke, head of consumer research at Finder, said the second rate cut can't come soon enough for households burdened by rising mortgage payments.

"The February cut signalled a turning point for many cash-strapped borrowers – they hoped a couple more would be coming thick and fast.

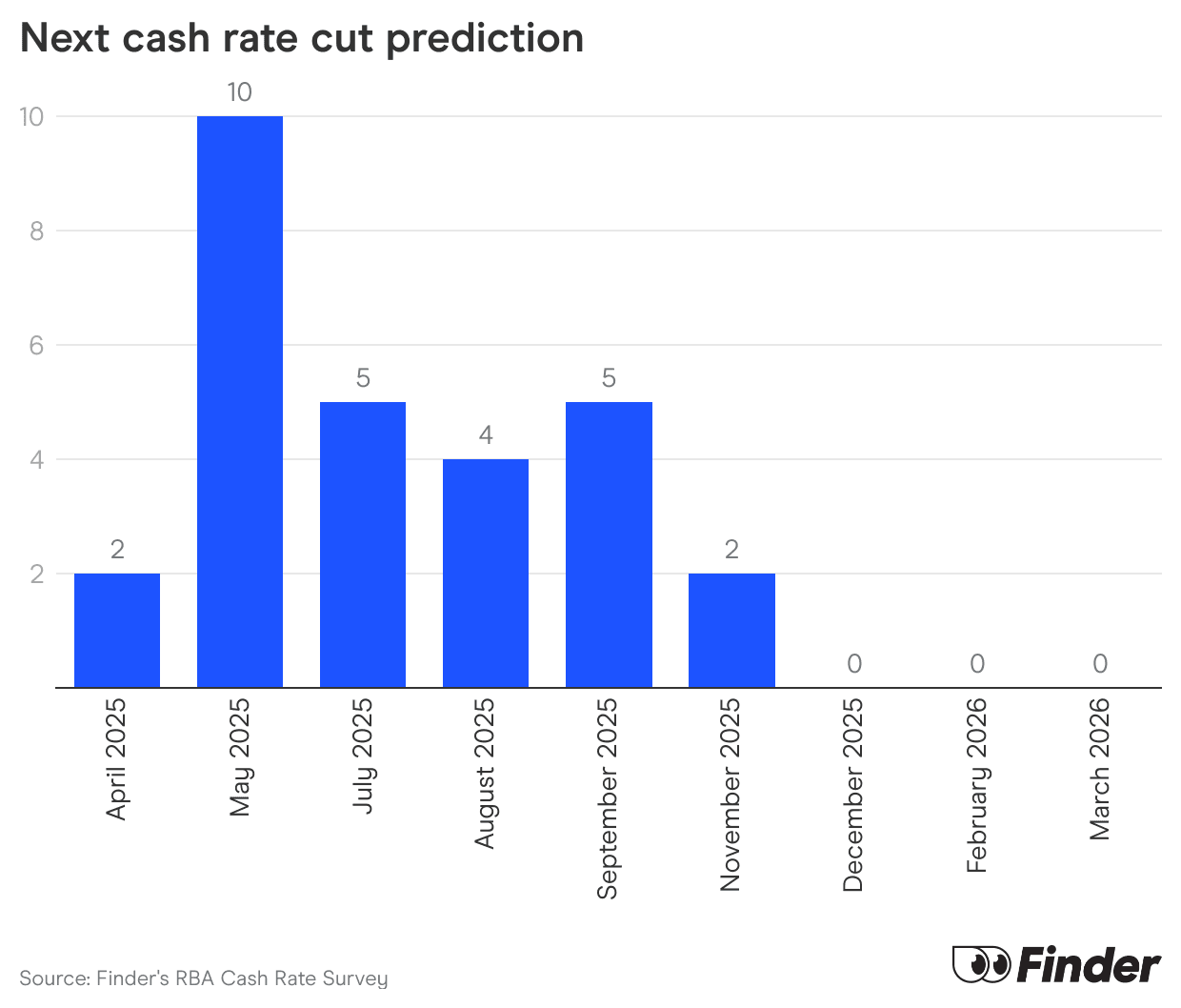

"New inflation figures show headline inflation is within target range, so while we're unlikely to see a second rate cut in April, we're anticipating further relief from May onwards," Cooke said.

Matthew Greenwood-Nimmo from University of Melbourne said the Board indicated that it would take a cautious approach to further rate cuts.

"Given that the economic data does not currently provide a strong case for further easing, it is likely that the cash rate will remain constant for now," Greenwood-Nimmo said.

Jeffrey Sheen from Macquarie University broke with the pack and said the RBA is marginally more likely to cut the cash rate again than to hold in April 2025.

"The headline inflation rate seems settled within the target range. While core or underlying inflation measured by the trimmed rate is just above the range, more sophisticated statistical measures (e.g. from dynamic factor modelling) indicate that it is in the range.

"With the escalating global tariff war and the likely weakening of global economic activity, the RBA should act now in anticipation.

"The Board will be torn between the risk that inflation is not fully under control and the risk of a future downturn and recession," Sheen said.

Despite near unanimous belief in a hold, just 79% (27/34) of experts believe the RBA should hold the rate in next week's decision, while 18% (6/34) believe they should cut the cash rate.

Leanne Pilkington from Laing+Simmons predicted a hold but thought a cut in April would be shrewd in light of recent jobs numbers.

"As well as sustained cost of living pressure and moderating inflation, the unexpected hit to employment figures has widened the window of opportunity for the RBA to cut rates, which it is expected to do in coming months anyway. It might be prudent to act now," Pilkington said.

Looking ahead, 2 in 3 experts who weighed in* (63%, 19/30) forecast between 2–3 more cuts this year, while 1 in 3 (33%, 10/30) anticipate only 1 more cut for the rest of 2025.

Majority of experts think the next cut will be passed on in full by lenders

So far, over 80 lenders have passed on the RBA's February cash rate cut, with almost every single one passing the full 25-basis-point-cut on to borrowers.

However, Finder analysis has shown that lenders usually don't pass on the full amount of the RBA cut to their customers.

The RBA's previous cutting cycle, from June 2019 to March 2020, saw a total reduction of 125 basis points (bps) across five cuts. However, the Big Four didn't all follow suit:

- ANZ passed on 97 bps (77.6% of the cuts), taking an average of 8.6 days

- NAB passed on 84 bps (67.2%), with an average 12-day wait

- Westpac passed on 80 bps (64%), averaging a 13-day delay

- CBA passed on 82 bps (65.6%), taking an average of 20 days

In stark contrast, throughout the May 2022 to early 2023 rate-hike phase, the Big Four passed on every single basis point of each increase in as little as 10–14 days.

Surprisingly, the vast majority of panellists (93%, 25/27) believe lenders will also pass on the next cut to the cash rate in full.

Cooke said it was refreshing to see most lenders pass on the full cut in February, but he didn't share the panel's optimism.

"This was the most surprising result from the survey for me – public pressure on lenders seems to still be so high that economists think banks will pass on another full cut next time.

"Personally, I'm not so sure, but this will be great news for borrowers if so.

"If your lender doesn't repeat this level of generosity following the next cut, it might be time to go home loan shopping."

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Matthew Greenwood-Nimmo, University of Melbourne (Hold): "In explaining its last decision, the Board indicated that it would take a cautious approach to further rate cuts. Given that the economic data does not currently provide a strong case for further easing, it is likely that the cash rate will remain constant for now."

Tomasz Wozniak, University of Melbourne (Hold): "Having correctly predicted the last cut, my forecasting system has settled on an uncontroversial HOLD prediction for the RBA's April meeting. Regarding the interest rate's values for the next year's horizon, one needs to consider the world's political uncertainty and its impact on inflation and economic activity in Australia. Providing the mid-term cash rate trajectory will not be possible before another two or three rate cuts. My forecasts are available at: https://forecasting-cash-rate.github.io/"

Mala Raghavan, University of Tasmania (Hold): "The Reserve Bank of Australia (RBA) may decide to keep the cash rate unchanged in April, taking a wait-and-see approach as it evaluates the effects of the recent fiscal policy measures announced by the Australian Federal Treasurer. These targeted expansionary fiscal policies are designed to alleviate financial pressures on households but could also lead to inflationary spending. Therefore, by maintaining the current interest rate, the RBA can better assess the impact of these fiscal measures."

Evgenia Dechter, University of New South Wales (Hold): "The RBA will continue lowering the cash rate in 2025 but at a gradual pace, with the next rate cut more likely in May."

Anthony Waldron, Mortgage Choice (Hold): "I'm predicting that at its April meeting, the Reserve Bank Board will vote to hold the cash rate. It takes some time to see cash rate changes reflected in the economy, and the RBA will want to see the impact of the February rate cut flow through before delivering further relief."

David Robertson, Bendigo Bank (Hold): "The RBA are likely to keep rates on hold in April despite further evidence of moderating inflation, and wait for the quarterly CPI data (due April 30th) to confirm the next cut on May 20."

Sean Langcake, Oxford Economics Australia (Hold): "The RBA gave the market a clear signal in February that hopes for more rate cuts in the near future need to be tempered. We think that advice can be taken at face value."

Nalini Prasad, UNSW Sydney (Hold): "I think that the RBA will take a wait and see approach after the previous cut in the cash rate. I think they want to be more confident that inflation is falling before making another cut."

Leanne Pilkington, Laing+Simmons (Hold): "As well as sustained cost of living pressure and moderating inflation, the unexpected hit to employment figures has widened the window of opportunity for the RBA to cut rates, which it is expected to do in coming months anyway. It might be prudent to act now."

Stella Huangfu, University of Sydney (Hold): "Inflation is easing but not quite done yet: headline CPI fell to 2.4%, and trimmed mean is at 2.7%—both now within the RBA's 2–3% target band. But the RBA has said it wants confidence that inflation will stay there sustainably. Some sticky services inflation may make them cautious about cutting too soon."

Geoffrey Kingston, Macquarie University Business School (Hold): "Another rate cut coming soon but not just yet—it's not urgent, & the Bank will want to keep a low profile during the election campaign. By the same token, February's significant fall in full-time employment heralds downward pressure on inflation. Likewise, February's inflation print was lower than expected."

Stephen Miller, GSFM (Hold): "No new information on inflation to warrant a follow up rate cut after March's "lineball" decision."

Nicholas Gruen, Lateral Economics (Hold): "Because they like to convey the impression of 'steady as she goes.'"

Cameron Murray, Fresh Economic Thinking (Hold): "Honestly, it's a guess. My general view is that we follow global trends and there is little urgency in lower rates."

Adj Prof Noel Whittaker, QUT (Hold): "The rate cut that finally came was a reluctant one and there is still no evidence that inflation pressures are coming down strongly. It would be a brave Reserve Bank that dropped rates once again with an election a few weeks away at most."

Brodie Haupt, WLTH (Hold): "Recent US policies and their impact on global economies, including Australia have yet to be seen."

Tim Nelson, Griffith University (Hold): "Following the cut last month, RBA is likely to wait for further data."

Mark Crosby, Monash University (Hold): "The economy is showing signs of weakness, but inflation remains a challenge."

A/Prof Mark Melatos, School of Economics, University of Sydney (Hold): "Monthly inflation readings have fallen precipitously and the Dec quarter CPI report showed headline inflation within the RBA's target range. While underlying inflation is still slightly above the target range, the trend since Dec quarter 2022 has been a consistent decline. Any temptation to further reduce the cash rate will be tempered by any upward pressure on house prices, continued full employment and any geo-political inflation shocks. The RBA will likely only move to cut rates further once convinced that underlying inflation has settled in the 2-3% range. With an upcoming federal election, the RBA is probably done easing for now."

Adelaide Timbrell, ANZ (Hold): "The RBA easing cycle is likely to be cautious and shallow. There has not been enough time or data since February to justify an April rate cut."

James Morley, University of Sydney (Hold): "The somewhat faster drop in underlying inflation compared to the RBA forecast was the main justification for a drop in the cash rate by 25 basis points. There is no obvious new information to suggest an immediate need to cut again at this meeting. The labour market remains tight, while the very high level of global uncertainty around trade policies and inflation would argue for waiting and seeing what data materialise to support further cuts or not."

Garry Barrett, University of Sydney (Hold): "Trends with CPI alongside labour market and trade uncertainty."

Mathew Tiller, LJ Hooker Group (Hold): "I expect the RBA to hold the cash rate steady in April, with inflation easing and employment still solid, though softening. In property markets, the last rate cut lifted buyer confidence and auction clearance rates, but the sugar hit is now starting to moderate."

Craig Emerson, Emerson Economics Pty Ltd (Hold): "Inbuilt RBA inertia."

Nicholas Frappell, ABC Refinery (Hold): "The RBA may decide to wait and judge on the impact of the Feb cash rate cut before moving again, and will also be assessing the fiscal environment in the run-up to the election."

Peter Boehm, Pathfinder Consulting (Hold): "The RBA's decision to reduce rates last time around was premature. Domestic inflation is still a problem; the government has signalled inflationary spending to help it win re-election; the artificial reduction in electricity prices due to government subsidies will be less impactful; and the tariff war with the US will likely add inflationary pressures."

Kyle Rodda, Capital.com (Hold): "The RBA will wait for the official quarterly CPI data before potentially cutting again in May."

Jakob Madsen, University of Western Australia (Hold): "The inflation rate has stabilised in the acceptable range."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "The new MPC will be waiting for more data on the extent to which inflation and in particular its preferred measure of 'underlying' inflation has continued to fall."

Matt Turner, GSC Finance Solutions (Hold): "I am not convinced a cut was warranted in the last meeting, as the economic data doesn't really suggest it was required. However, with the macroeconomic climate, never say never on anything."

Michael Yardney, Metropole Property Strategists Pty Ltd (Hold): "Given the current economic landscape, it seems highly likely that the Reserve Bank will choose to hold interest rates steady at their next meeting. The decision to maintain rates is often driven by a need to assess the lagging impact of previous rate changes on the economy. The bank will be keen to observe how the recent rate drop filters through various sectors, including housing, retail, and manufacturing, before making further adjustments."

Richard Holden, UNSW Sydney (Hold): "Inflation is not under control."

Jeffrey Sheen, Macquarie University (Decrease): "The headline inflation rate seems settled within the target range. While core or underlying inflation measured by the trimmed rate is just above the range, more sophisticated statistical measures (e.g. from dynamic factor modelling) indicate that it is in the range. With the escalating global tariff war and the likely weakening of global economic activity, the RBA should act now in anticipation. The Board will be torn between the risk that inflation is not fully under control and the risk of a future downturn and recession. The RBA is marginally more likely to cut the cash rate again than to hold in April 2025."

Tim Reardon, Housing Industry Association (Decrease): "A further cut is warranted. It will either be this month or next."

Ask a question